100 hour MA getting closer

The EURUSD is trading near the highs for the day as NY traders enter the mix for the week.

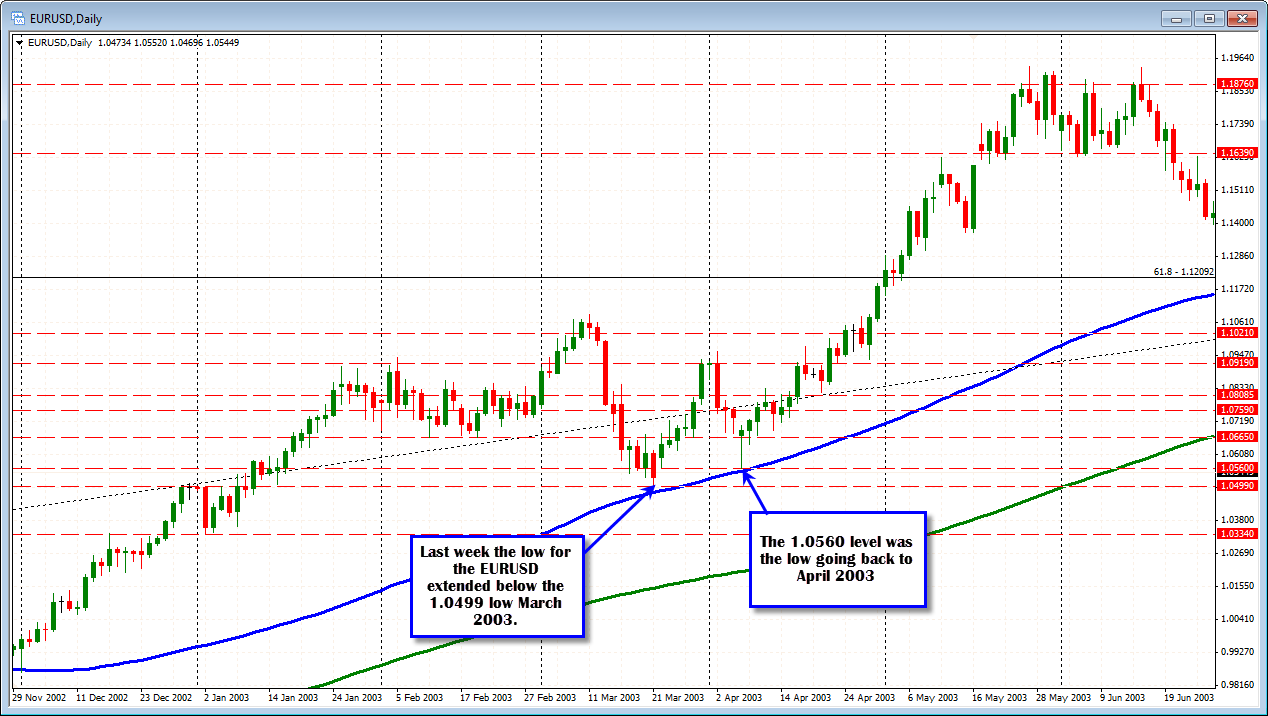

The high in the London morning session came in at 1.0552. The market price is just a few pips away from there at the moment. A move above the high would still need to get above the 1.0560 level (and this may be the reluctance to go higher). The 1.0560 level was the high going back to April 2003 (see chart below). Last week, that level was broken twice. The first look below the level found support at the 1.0500 low (March 2003 low). The second break came on Friday.

Can the price stay below?

That will be the first real test for the week. If the buyers cannot push the price above this level, they are not taking control. The lid we are currently seeing are traders leaning against the level. We will likely some stops on a move above.

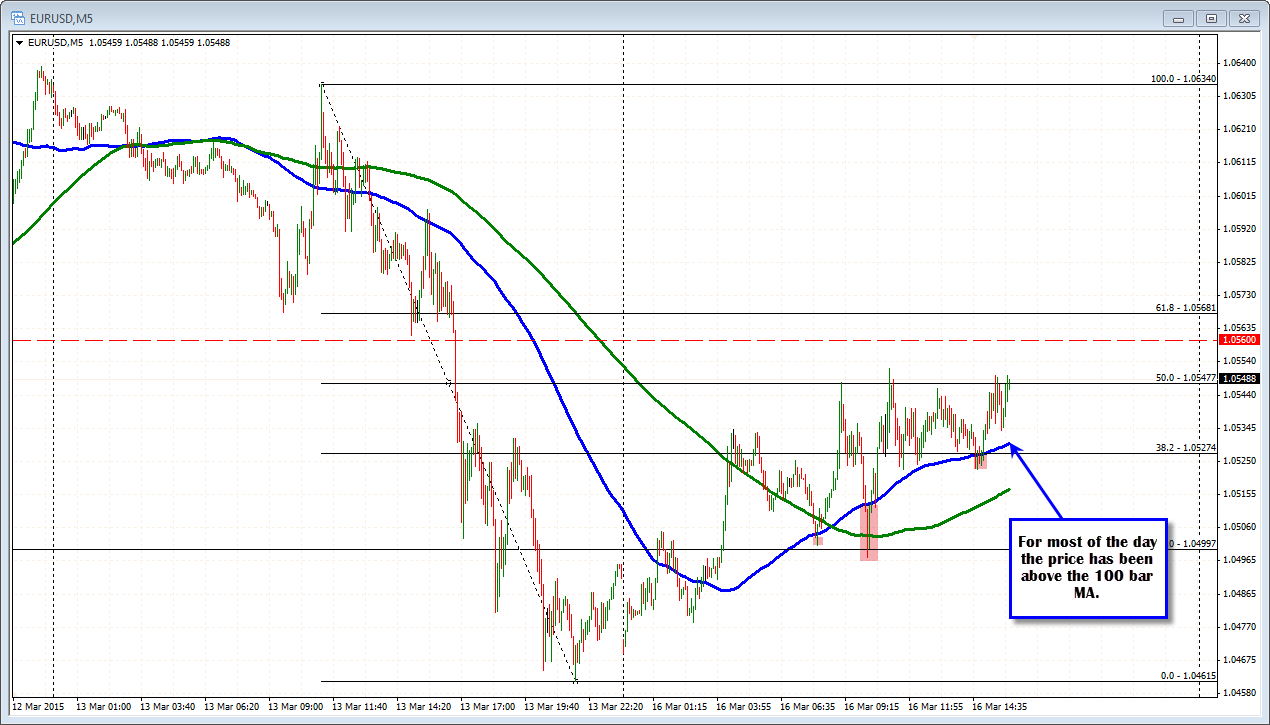

The other key level to watch this week is the 100 hour MA (blue line in the chart above). The price for the EURUSD has not traded above the 100 hour moving average since February 26, 2015 (it is currently at 1.0597 and moving lower). Since that day, the EURUSD has trended lower by over 900 pips.

If there is is to be a meaningful correction in the EURUSD, getting above the 1.0560 level and then the 100 hour moving average is a must.

Looking at the 5 minute chart below, the market is wobbly in up and down trading. However, it is trying to hold above the 100 and 200 bar MAs (lets say most of the volume has been above one or both of those MAs). If the price can stay above these lines in trading today, the intraday players, are still more bullish and potential for further upside is possible.