EURUSD corrects after yesterday's tumble lower

The EURUSD tumbled in trading yesterday as trader's flocked back into the dollar. Today, the German inflation data just came in better than expected at 0.9% vs 0.6% estimate. The German states reported their numbers earlier in the day and they were better than expectations. So the release was not too much of a surprise. Nevertheless, the EURUSD has gotten a little boost in the last few minutes of trading and is pushing to new highs on the day.

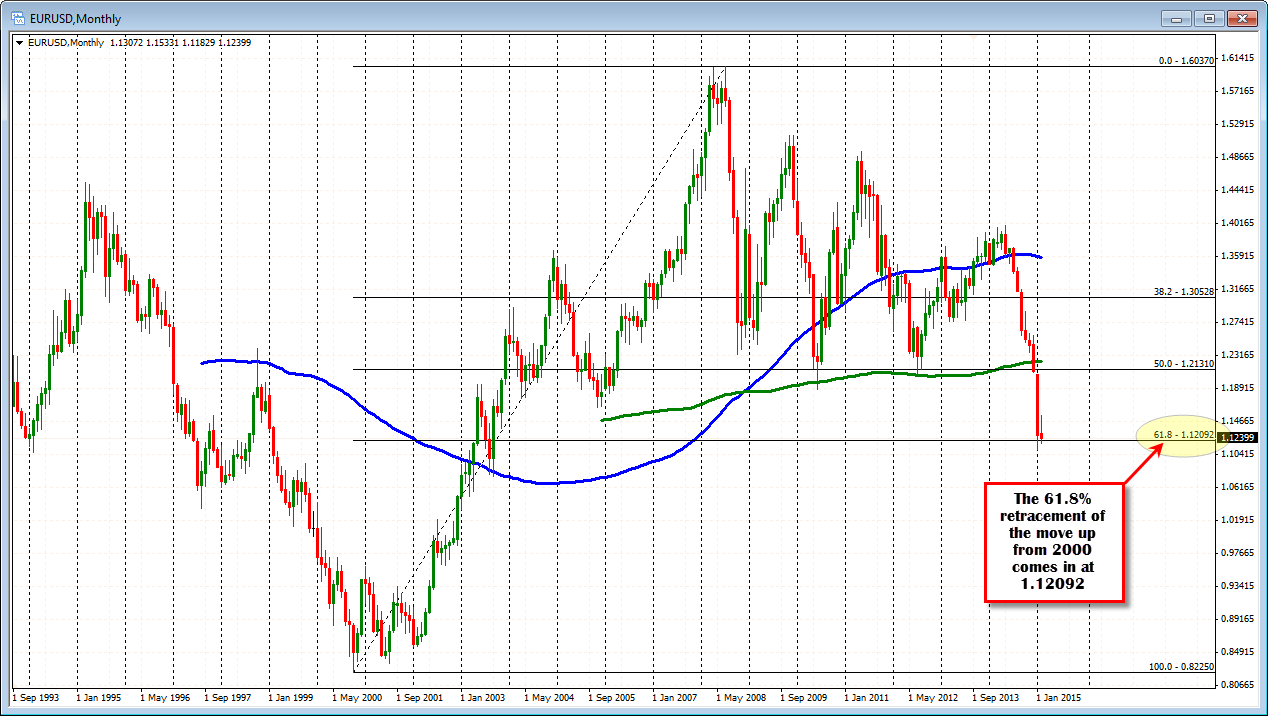

Technically, the pair in trading today has been able to get back above the 1.1209 level. This is the 61.8% retracement of the move up from the 2000 year low to the 2008 year high (see monthly chart below).

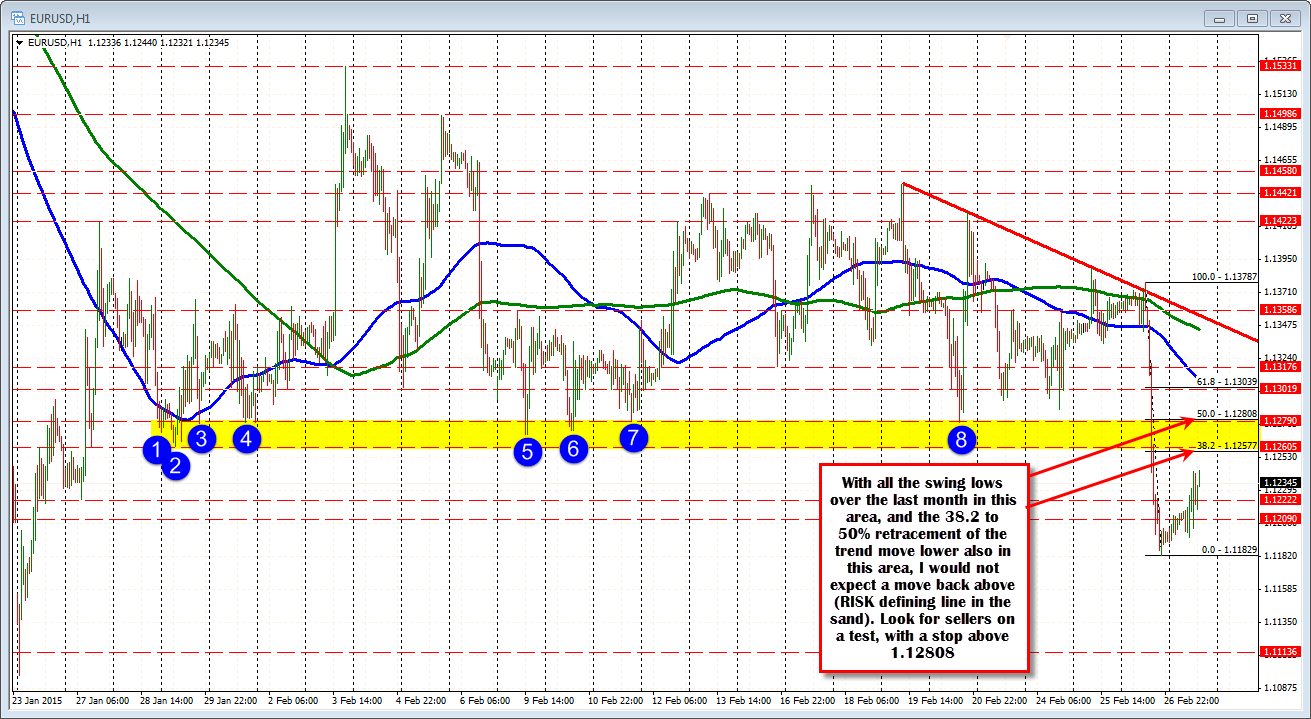

The pair is also back above the 1.12222 level. This was the low going back to January 27, 2015 (see chart above). The next key target on the topside comes in at the 1.12577- 1.12605 area. This represents the 38.2% retracement of the move down from yesterday's high to yesterday's low. It also is the low price going back to January 29.

I would expect that sellers would use this area (up to 1.1280 honestly) as a level to lean against from the short side. If the sellers loved the break below the month-long consolidation area, in yesterday's trade (see yellow area in the chart above), they should also love selling against it in trading today. This is a key line in the sand. The sellers should keep the price below it if the sellers are to remain in control.