You have to be quick....

The EURUSD is trading is ripping higher and lower as Draghi says "markets must get used to periods of higher volatility". I guess he meant it.

The EURUSD has moved to a low of 1.1093 to a high of 1.1140, and back to a low of 1.1078. The 1.1078 low was just above the 100 day MA at the 1.1077 level today. Traders had to have their fingers on the trading button to catch that level as the price quickly shot back up - trading to new NY session highs. Action is volatile and choppy.

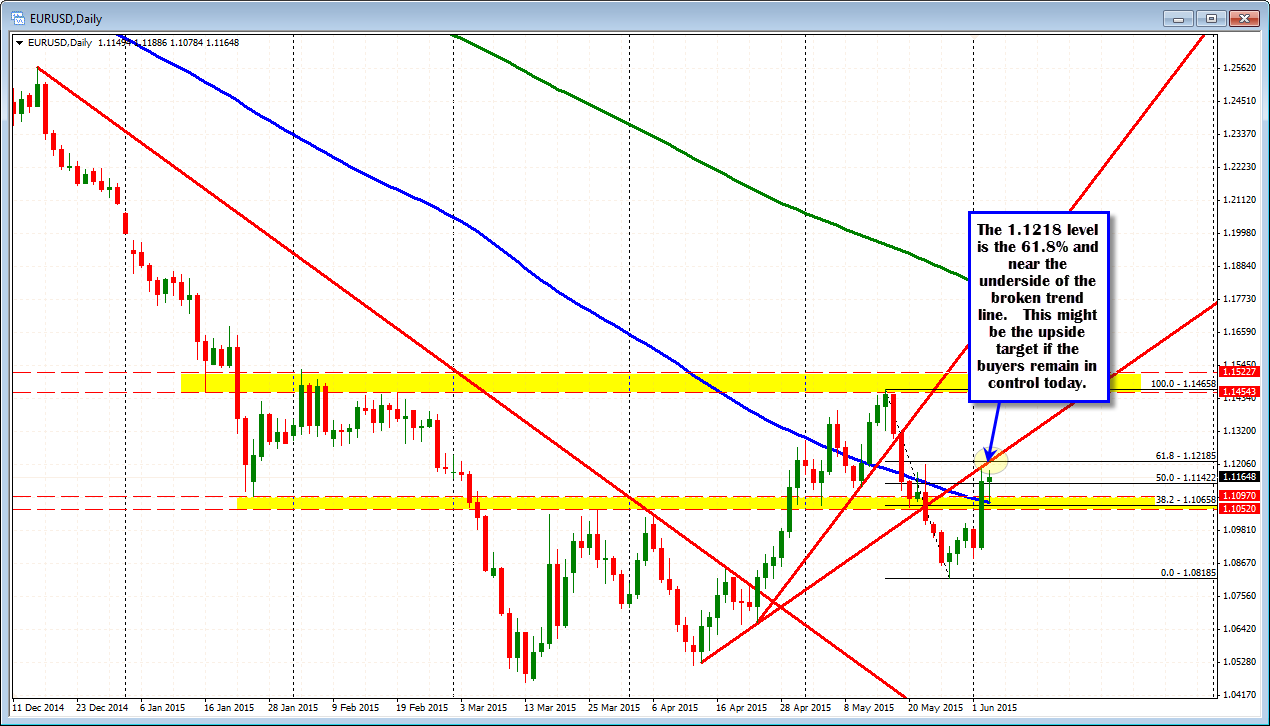

The 1.1142 level is the 50% midpoint of the move down from the May high to the May low. The high near the 1.1200 level has couple highs over the last few days. The midpoint of the Draghi move higher currently comes in at 1.11209.

Do I have a lot of confidence with the levels? Not really. However, what I do know is that the market broke the 100 day MA yesterday and raced higher. The price went right down to the level today and raced higher. So the buyers were waiting and bought at the precise right time.

ON the topside, the highs from yesterday and today will the the first targets, then the 1.1218 level will be another level to target (if the buyers can remain in control). That level is the 61.8% of the move down from May and the underside of a broken trend line (see daily chart below).