Down and up lap has messed up the technical picture today

Yesterday, the price at this time was looking toward the 1.5000 resistance area. Although the technicals were bullish, getting above that level was key and staying above intraday support was also required (see post outlining the technical roadmap).

Well, the resistance held, the support was broken and the pair reversed course.

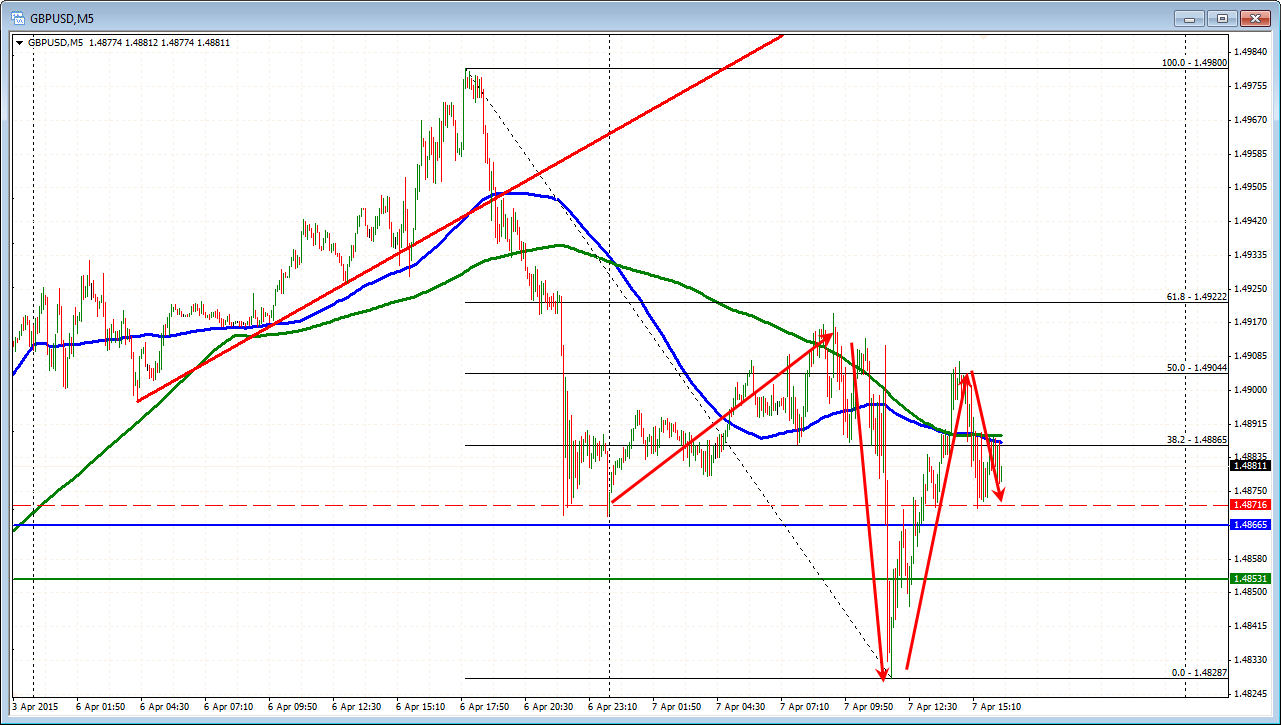

Today, the GBPUSD has seen some up and down action which has created a more confusing technical picture (see up and down in the chart above).

Can the technical picture be simplified?

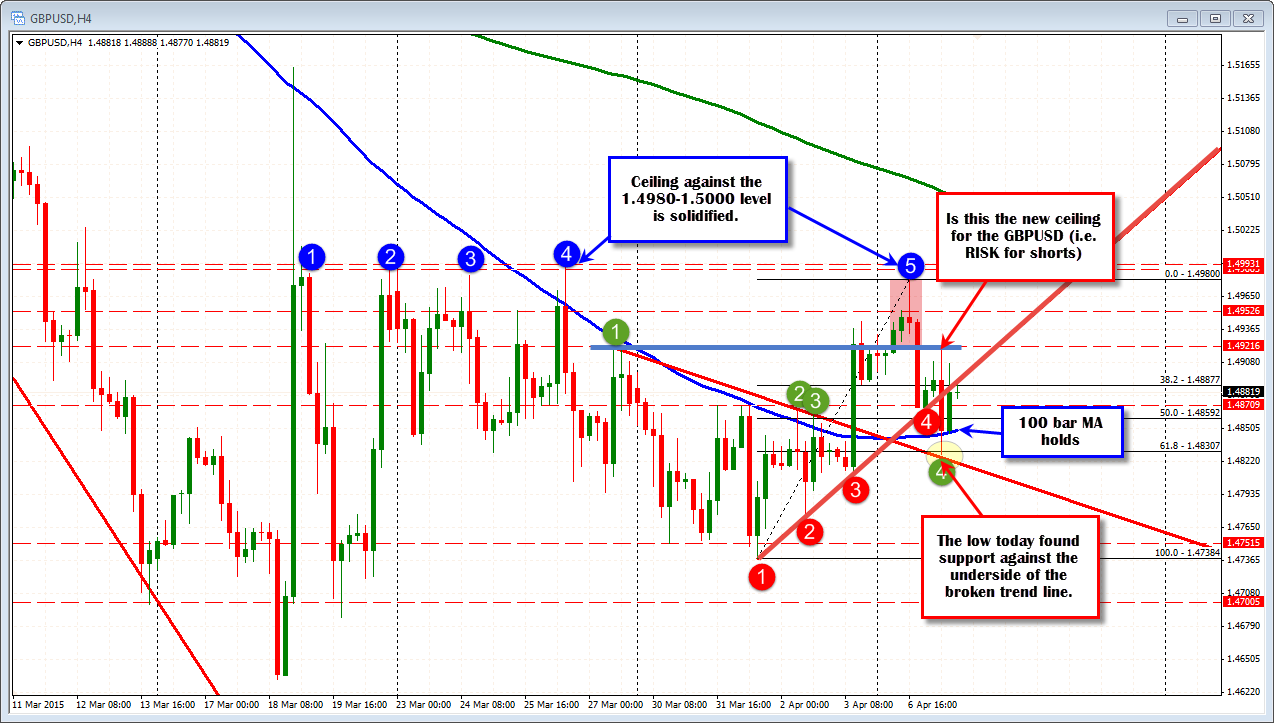

Looking at the 4 hour chart below, perhaps a broader view can clear up the picture. What do I see?

1. The high ceiling is solidified against the 1.4980-1.5000

2. The low today found support against the underside of a broken trend line (at 4 green circle).

The combination defines a broad-ish range for the pair. Is there something in between?

1. The high off the low today peaked at 1.4921. This was also a corrective high going back to March 27 (see blue horizontal line). Is this a new ceiling (risk level for shorts). Why not see by leaning against it? Resistance.

2. The 100 bar MA on the 4 hour chart (blue line in the chart above) comes in at 1.4849. The low on the last 4 hour bar comes in at the level. That says the market is paying attention to that technical level. Support

So the combination narrows the technical levels to 1.4849 below and 1.4921 above. Anything in between?

The 38.2-50% of the move up from the low last week to the high yesterday comes in at 1.4859 and 1.4888. The underside of the broken trend line comes in at 1.4890. Can the price find sellers against this area now?

If so,a lower ceiling is found. We will then need to see if ultimately the 1.4859 and 100 bar MA can be broken and go from there.

I am not sure the picture is much clearer (the price action is saying the market is not sure of any move), but levels and a road map can be followed.

Fundamentally, the picture is also not that clear. The market will likely struggle with politics (bearish) and the economy (Markt PMI was better than expected today) in the UK. In the US, the Fed uncertainty and data in the US is muddy and unclear. So it is time to be patient. Don't panic. Don't fall in love with positions and try to catch a mini trend from time to time OR stay away until the picture is more to your liking.