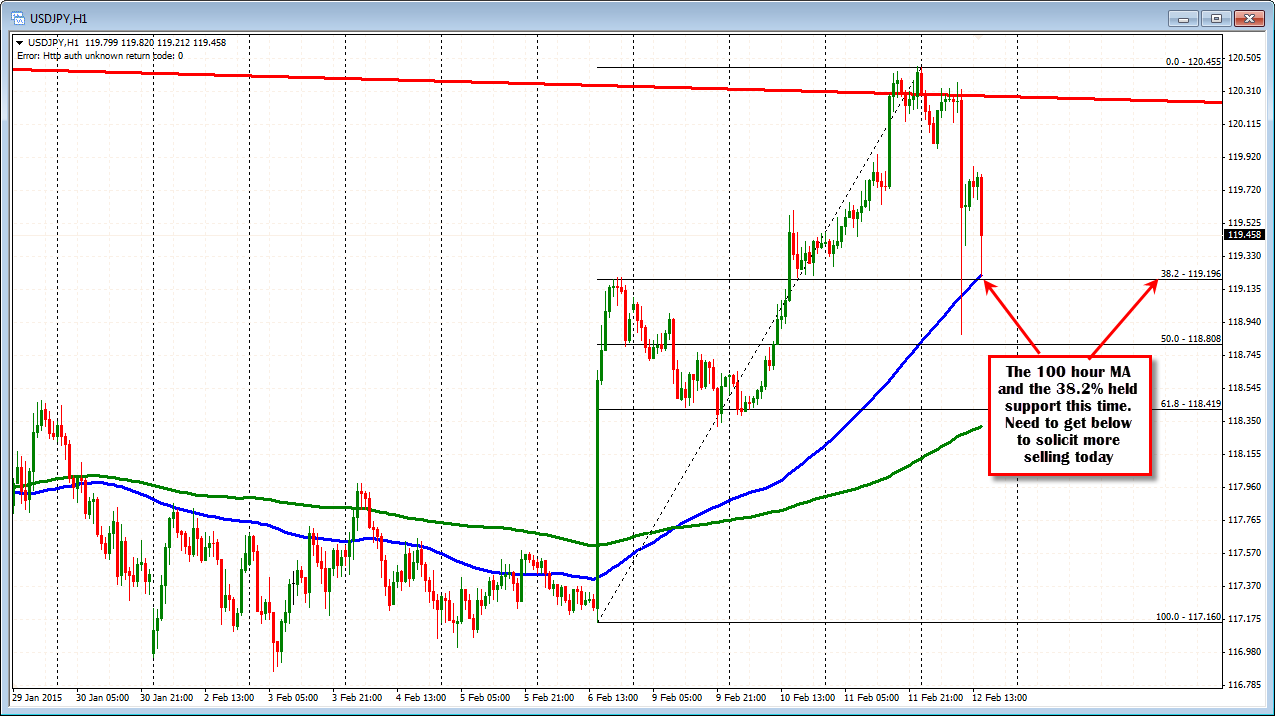

100 hour moving average and 38.2% retracement slow the slide

The USDJPY has fallen on the back of the weaker than expected US data.

The pair has found initial support against the 100 hour moving average at 119.215 and the 38.2% retracement at 119.196 (see chart below). The low has come in at 119.212. Earlier today the price fell below these levels on the back of concerns that Bank of Japan officials may not want to see a weaker yen. However, the pair quickly rebounded.

If the USDJPY is to continue the bearish move, a break and staying below the 119.196 level is now needed.

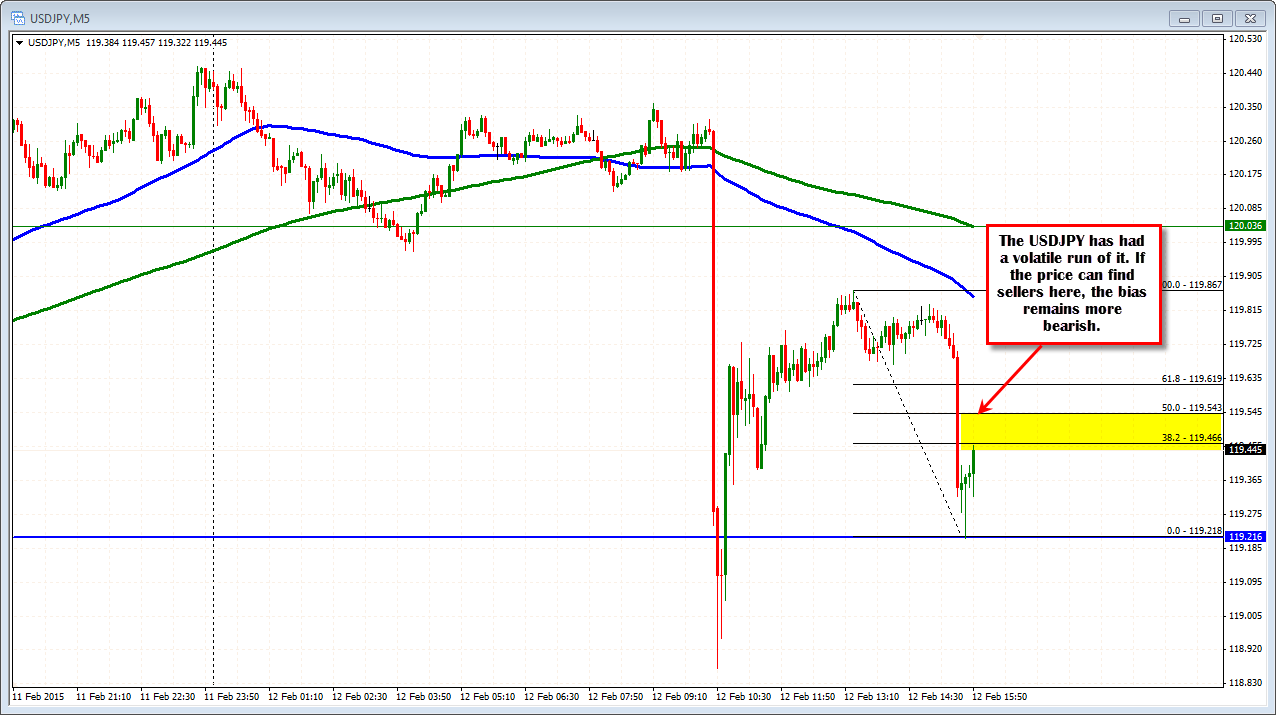

Looking at the 5 minute chart, the corrective move off the 100 hour moving average, has stalled short of the 38.2% retracement of the last move down (see chart below). That level comes in at 119.466. The 50% retracement of that same move comes in at 119.543. This is now risk for shorts/sellers in trading today. Stay below and I will give the benefit of the doubt to the short side. A move above and the waters get a little muddy.

Needless to say, the action in the USDJPY has been volatile and choppy. So traders should take that into consideration when trading this pair.