Trading is icing first and then your cake.

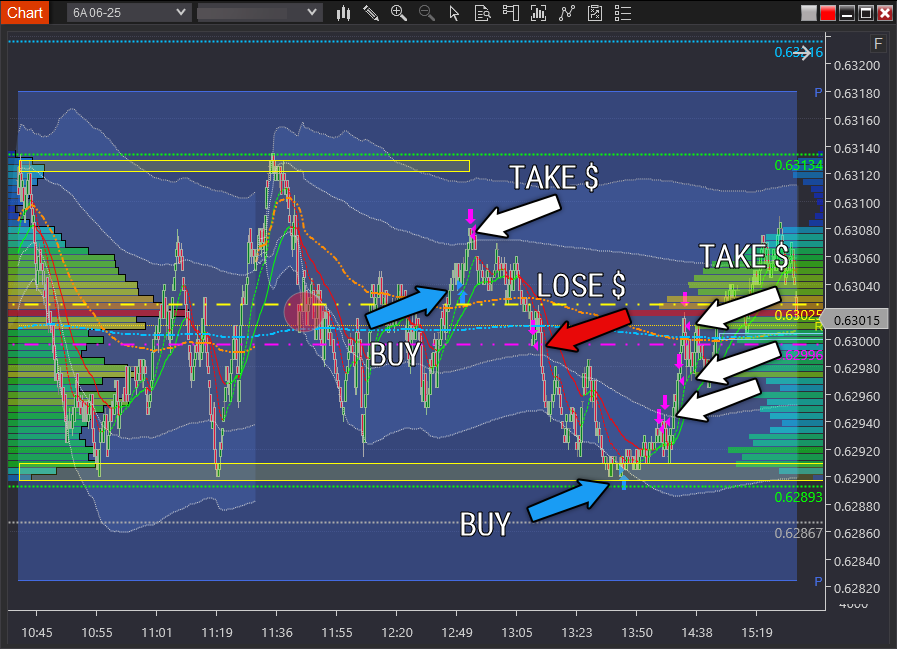

Look at Monday's trading. What stands out?

First trades:

Final trade sequence:

First it's several "nothing-to-write-home-about" trades.

Only then does the opportunity you solved for (in your game plan) show up fully.

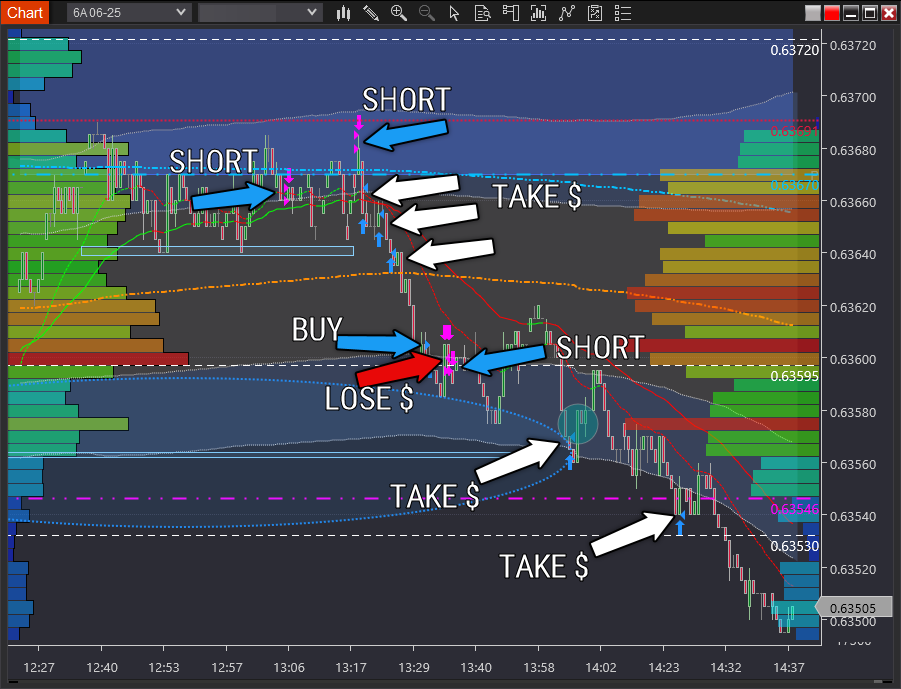

- Tuesday? Same.

- Wednesday? Same.

- Today? Again—same.

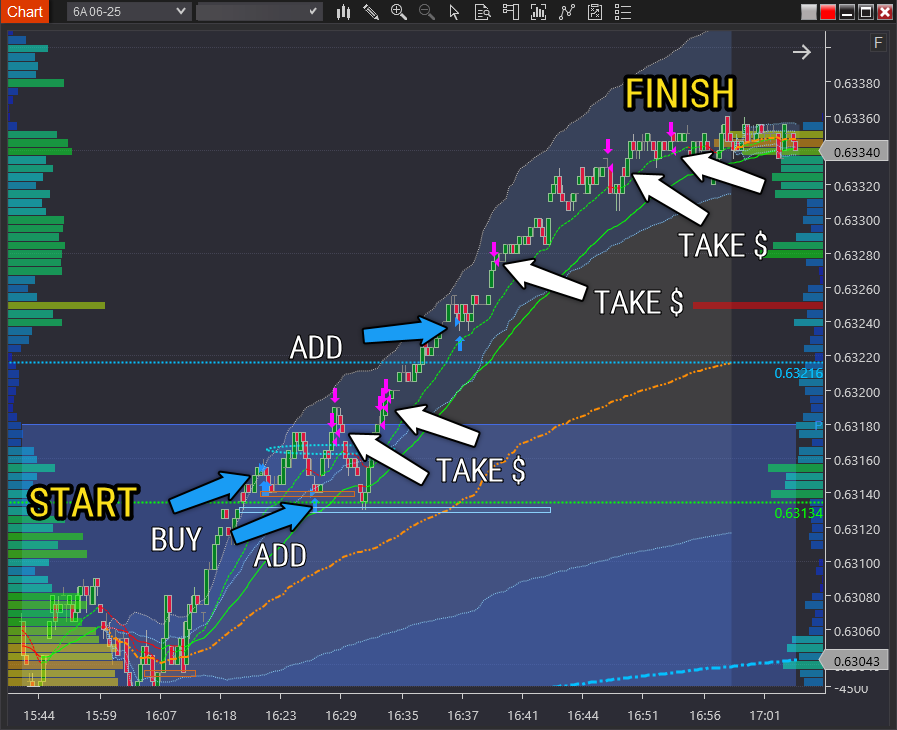

Look at today's trading.

First trades:

Final trade sequence:

What's happening?

When too many traders jump into the same opportunity, the market must clear the crowd.

Money always transfers from the majority to a select few who know how to play the game.

Your game plan (the opportunity for you to take money from the market) works—but at first, only a little. It's the icing.

The cake doesn't come until others:

-

Exit in frustration.

-

Bleed trying to force it.

-

Or better yet, flip their position in doubt.

And the long the delay between icing and cake—the bigger the cake when if finally comes.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD holds above 1.1250, looks to post small weekly losses

EUR/USD rebounds and stabilizes above 1.1250 following a two-day slide but remains on track to post small weekly losses. The pair draws support from a pause in the US Dollar buying as traders turn cautious ahead of US-China trade talks on Saturday.

GBP/USD extends daily recovery toward 1.3300

GBP/USD gathers recovery momentum and rises toward 1.3300 in the American session on Friday. The US Dollar stalls its upside as focus shift to the weekend's US-China trade talks. On Thursday, the BoE cut the policy rate but maintained its cautious stance on future easing.

Gold clings to gains above $3,300 on escalating geopolitical tensions

Gold price turns positive on the day above $3,300 following an intraday slide to the $3,275-3,274 area. Geopolitical risks stemming from the Russia-Ukraine war, the escalation of tensions in the Middle East, and the India-Pakistan border, attract safe-haven flows and support XAU/USD.

Week ahead – All eyes on US CPI and trade talks amid no end to tariff uncertainty

US CPI report takes centre stage to gauge tariff impact. Progress in trade negotiations will also be watched, especially with China. US Retail Sales, UK and Japanese GDP on the agenda too.

Why the UK-US trade deal won’t herald a wider tariff climbdown

For Britain, the UK-US deal secures lower tariffs without compromising forthcoming UK-EU talks. And for the US, it signals to investors that the administration is prepared to be flexible on tariffs. But we're sceptical that the deal will translate into a much wider de-escalation in US tariff policy.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.