Obama Will Focus on Wealth Inequality—Not Just Income

The president's plan to raise capital gains taxes brings a long-standing economic issue back to the limelight.

When President Obama addresses the nation in the State of the Union address on Tuesday, he is likely to boast about the health of the economy, which last year created jobs at its fastest clip since 1999. But the president isn't about to let the economy go on cruise control. Obama is also expected to announce a series of proposals aimed at reducing inequality, which has emerged as a major economic concern among American liberals.

The proposal likely to attract the most attention is Obama's plan to raise the capital-gains tax for Americans earning $500,000 or more from 23.8 to 28 percent. In addition, the president wants to close a loophole allowing Americans to dodge paying taxes on inherited money. These two proposals—alongside a separate plan to tax companies with assets over $50 billion—are expected to raise $320 billion in revenue of the next decade.

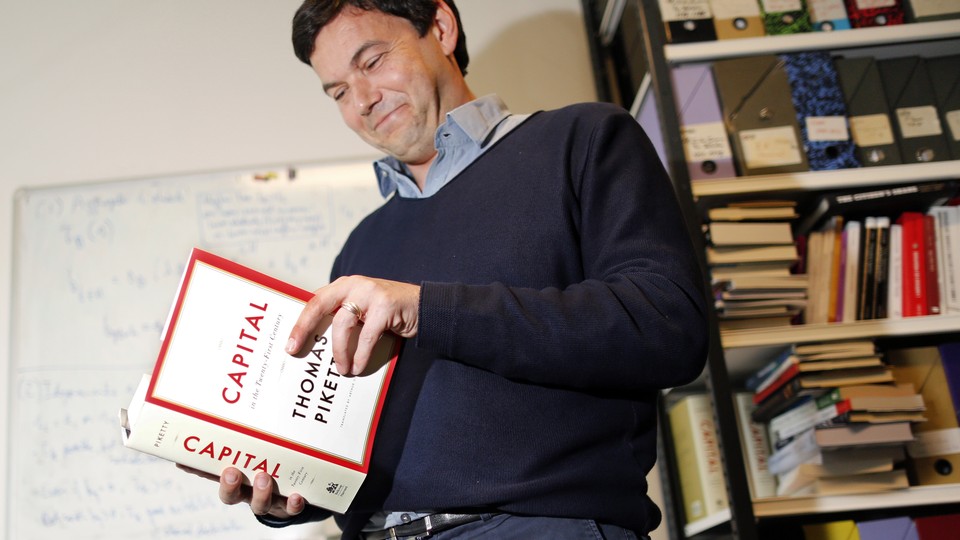

Capital gains tax reform has been a Democratic Party goal for years. But its inclusion at the center of Obama's economic agenda signals renewed attention on wealth, rather than income, inequality. And for that, the American president owes a tip of the cap to a person who isn't even American: the French economist Thomas Piketty.

In his 2014 book Capital in the Twenty-First Century, released amid great fanfare last year, the economist argued that inequality isn't just about income. It's also about wealth. Applying data gathered across several decades throughout the world, Piketty argued that when income derived from capital exceeds income derived from work, inequality necessarily widens. Or, in non-economics speak: The easiest way to get rich isn't to make a lot of money. It's to have a lot of assets in the first place. Better yet to inherit it.

The solution Piketty proposes for this problem is a global tax on wealth. This, to put it mildly, isn't feasible—something the economist himself concedes. But Obama's more modest plan to raise capital gains taxes—something he has already accomplished in his presidency—could have a significant effect.

Under current tax laws, America's highest earners pay income tax of 39.6 percent. Capital-gains taxes, even after Obama's shift, cannot exceed 23.8 percent. The Center for American Progress characterizes this difference as a government subsidy for investment income, and an expensive one at that. The Congressional Budget Office estimates that this subsidy amounts to $1.34 trillion over the next ten years. Sixty-eight percent of that went to the top one percent. Given this situation, it comes as no surprise that the country's 400 top earners, or 0.0003 percent of the taxpaying population, earned 12 percent of capital gains benefitting from lower rates.

If implemented, Obama's plan will strive to narrow this gap. Will it work? Opponents argue that higher capital gains taxes provide an incentive for the wealthy to not sell their assets, thus hurting the economy as a whole. But evidence produced by the Center for American Progress shows that since legislation to reduce capital gains taxes were passed under Presidents Bill Clinton and George W. Bush, government revenues have not correspondingly increased.

Given Republican opposition in Congress, the odds that Obama's proposal will become law are slim. But by placing capital gains at the center of his new economic agenda, the president has signaled that wealth inequality—not just income—will now have a higher profile.