5G to IoT: 3 Long-Term Growth Stocks in the Tech Sector

The tech industry is still in the early stages of rolling out 5G networks, but according to a Bank of America report, the 5G semiconductors market is expected to boom from $593 million in 2018 to $19 billion by 2022.

The market has already begun pricing in gains for the most popular stocks associated with 5G technology, such as smartphone producers Apple (NASDAQ:AAPL) and wireless communication giants such as Verizon (NYSE:VZ) and AT&T (NYSE:T). However, these are far from the only companies that are poised to benefit from the massive communications restructuring and expansion that 5G demands. Other companies that will be heavily involved will include those conducting test/measurement and front-haul, laying fiber optic cables, developing chips and building towers.

As the world becomes increasingly connected on the foundation of 5G, companies whose products are geared towards the so-called Internet of Things (IoT) are more likely to see stronger growth than their competitors. Smartphones won't be the next big thing forever, so if you are looking for long-term 5G growth potential, smartphone stocks may not necessarily be your best bet (though their potential in the short term is undeniable). Instead, the companies that will be involved in the 5G rollout and also stand to benefit from IoT technology might be better investments.

Skyworks Solutions

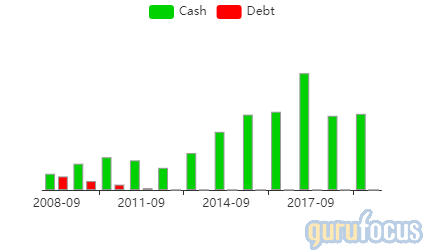

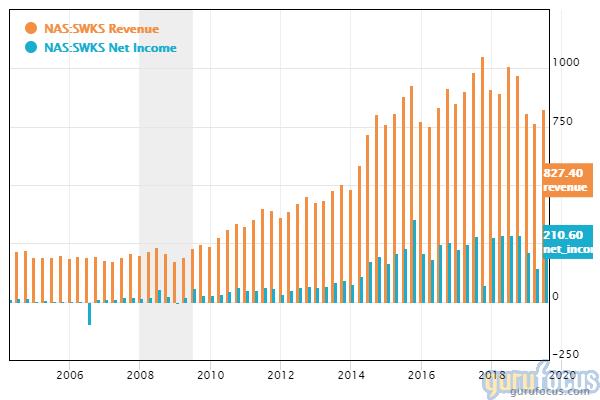

Skyworks Solutions (NASDAQ:SWKS) is a semiconductor company based in Woburn, Massachusetts. It primarily manufactures semiconductor modules for radio frequency and mobile communications systems. As of Jan. 23, it has a market cap of 23.81 billion, a price-earnings ratio of 26.24 and no debt.

Over the past three years, Skyworks has grown its revenue at a rate of 8.1% per year and its earnings per share without non-recurring items by 6.9% per year. Year to date, the share price has grown approximately 70% to a high of $124.90.

Over the past year, Skyworks' income has taken a hit due to an industry-wide downturn in demand for semiconductors. The memory market experienced a 31.5% decline in 2019, while the winding down of 4G growth and the trade war between the U.S. and China also cut into profits.

As 5G networks are built out, Skyworks' 5G solutions will be in increasing demand. The company's 5G developments include a unifying platform and small cell and multiple-input, multiple-output (MIMO) technology, which facilitate end-to-end 5G connectivity.

"Leveraging decades of experience, manufacturing scale and vertical integration capabilities, our highly advanced Sky5 platform is fueling market adoption of 5G across a broadening customer set," President and CEO Liam K. Griffin said in the earnings report for the quarter ended Dec. 31, 2019. "With an expansive suite of applications - from smartphones to wireless infrastructure, industrial robotics, autonomous vehicles, smart homes and virtual assistants - our solutions provide the critical connection, ensuring peak performance for 5G and IoT usage cases."

As both a builder of key radio components for the distribution of 5G signals and a developer of chips for the IoT market, Skyworks has strong potential to grow its earnings for years to come.

Taiwan Semiconductor Manufacturing

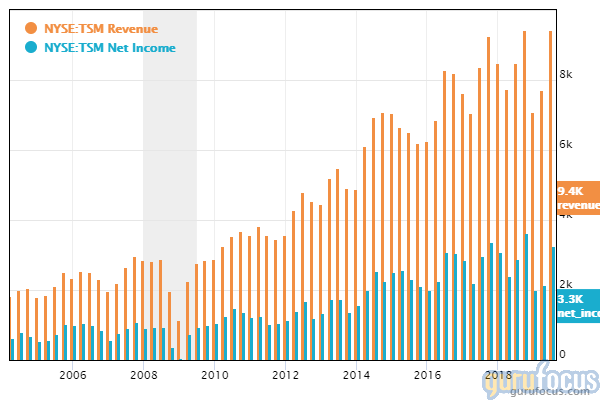

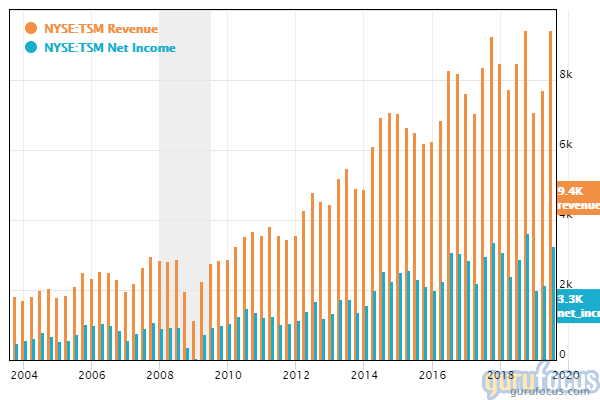

Another semiconductor company to keep an eye out for is Taiwan Semiconductor (NYSE:TSM), which is based in Hsinchu, Taiwan. It is the largest independent semiconductor foundry in the world, and it focuses primarily on base components such as diodes, transistors, bridge rectifiers and photocouplers. As of Jan. 23, it has a market cap of $297.84 billion, a price-earnings ratio of 24.93 and a cash-debt ratio of 4.79.

Over the past three years, Taiwan Semiconductor has grown its revenue at a rate of 6.9% per year and its EPS without NRI at a rate of 6.2% per year. Year-to-date, the share price has grown approximately 67% to trade at $58.39 per share.

Compared to some competitors, Taiwan Semiconductor did not lose as much revenue during 2019, as pure memory chip components do not make up as much of its revenue. For full-year 2019, 49% of revenues came from smartphone components, followed by 30% from high-performance computing and 8% from IoT. The highest growth rate came from the IoT (33%) and smartphone (12%) departments.

With its strong position in the smartphone components market, the semiconductor manufacturer is set to see high profits from 5G, while its growing IoT division provides an additional route for increasing revenues. The company's comprehensive IoT platform and ultra-low power technology are geared towards integrating and maximizing the efficiency of systems that combine IoT, 5G and artificial intelligence.

American Tower Corp

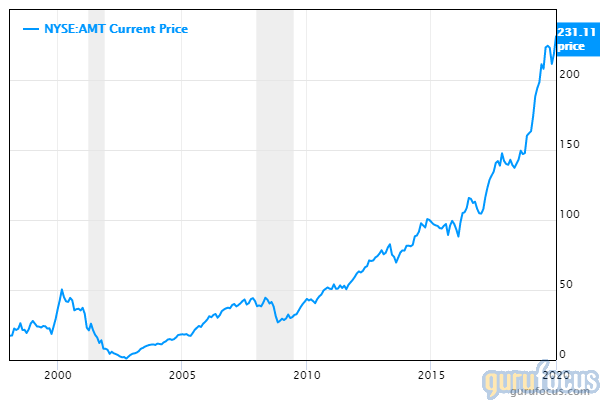

While American Tower (NYSE:AMT) does not manufacture semiconductors, it will play a key role in increasing the world's connectivity. Operating officially as a real estate investment trust headquartered in Boston, American Tower owns and operates wireless and broadcast communications infrastructure in several countries around the world. As of Jan. 23, it has a market cap of $105.16 billion, a price-earnings ratio of 66.05 and a cash-debt ratio of 0.05.

Over the past three years, American Tower has grown its revenue at an annual rate of 14.2% and its EPS without NRI at an annual rate of 25.2%. Share prices have increased approximately 53% year over year to trade at $231.11.

American Tower's business model is to buy communications infrastructure, primarily wireless towers. Due to regulations surrounding the building of such structures, this basically gives the company a monopoly over the areas that its towers provide service to, as service providers must pay to use the towers.

Other communications companies will be dealing with American Tower a lot when expanding 5G networks, as the REIT owns many of the locations that they will need to build equipment and send signals from. The company's scale also gives it an important role to play in IoT, as access to its networks will be crucial to both smart city and rural applications.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful analysis or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.