Supply Chain Transformation Driving Up Prime Global Hub Logistics Rents

As e-commerce growth and demand goes, so goes the increased need for e-commerce fulfillment and distribution centers, according to the debut issue of the Global Prime Logistics Rents report recently issued by CBRE Research.

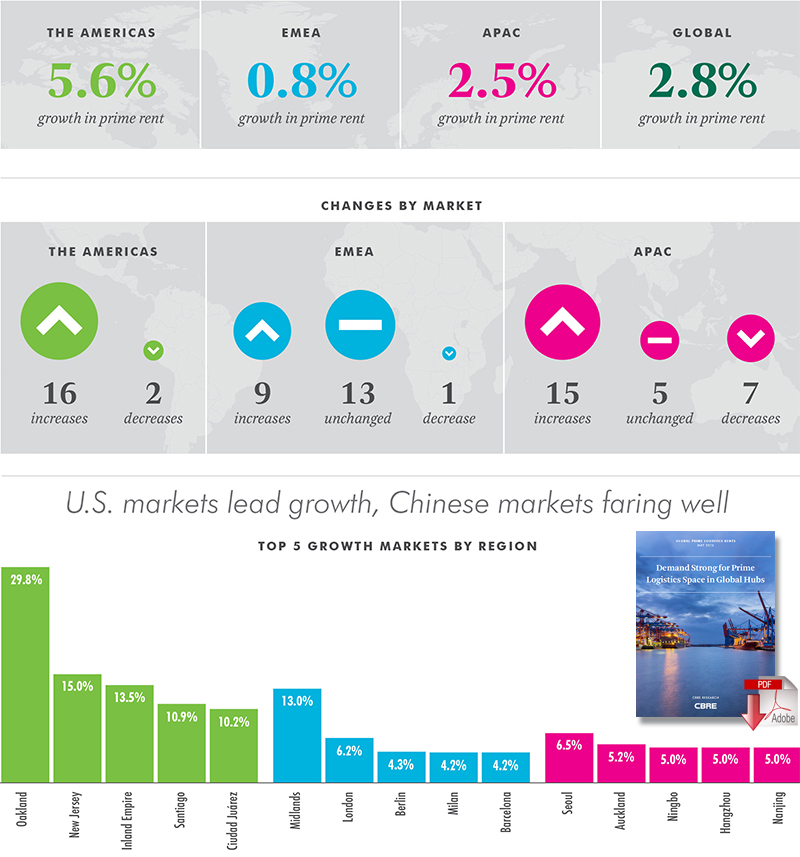

According to the CBRE report, the ongoing demand for e-commerce fulfillment and distribution centers facilities led to a 2.8 percent in prime global logistics rents, with double-digit percentage growth in United States coastal markets, including Oakland, New Jersey, and the Inland Empire in the top three.

What’s more, CBRE’s research noted that growth in prime logistics rents in the Americas led the global pack in 2015, with a 5.6 percent increase, topping Asia’s 2.5 percent, and Europe, the Middle East and Africa (EMEA) at 0.8 percent. CBRE defines prime rents as the highest achievable rents for a logistics facility of the highest quality and specification.

But while United States-based logistics markets saw the highest growth in rents, CBRE observed they are not the most expensive, with the top three markets - based on U.S. dollar per square-foot - being Hong Kong at $28.94; Tokyo at $16.74; and London at $16.36. The most expensive U.S. market was Los Angeles-Orange Beach at 12th globally at $8.04.

“Global consumer demand is strong, and an ever-increasing share of retail sales are taking place online,” said Richard Barkham, CBRE’s global chief economist, in a statement.

“That is prompting traditional retailers, e-commerce companies and third-party logistics firms to seek out advanced ‘prime’ logistics warehouses to modernize their supply chains and thus facilitate the rapid delivery of goods.”

And David Egan, CBRE’s head of industrial and logistics research in the Americas, explained in an interview that e-commerce continues to grow and evolve as the new “behavior” consumers have largely become accustomed to and has subsequently forced retailers and suppliers to re-examine their supply chain.

“This all happens at the back end in tandem with consumer behavior and expectations continue to grow and change very sharply, and anyone trying to compete in that marketplace has to get their systems in place ASAP,” he said. “It basically has to be done yesterday.”

This what is driving demand for industrial space of all types across the U.S., with a focus on the prime hubs and a lion’s share of the demand and focus on these markets and beyond, he said.

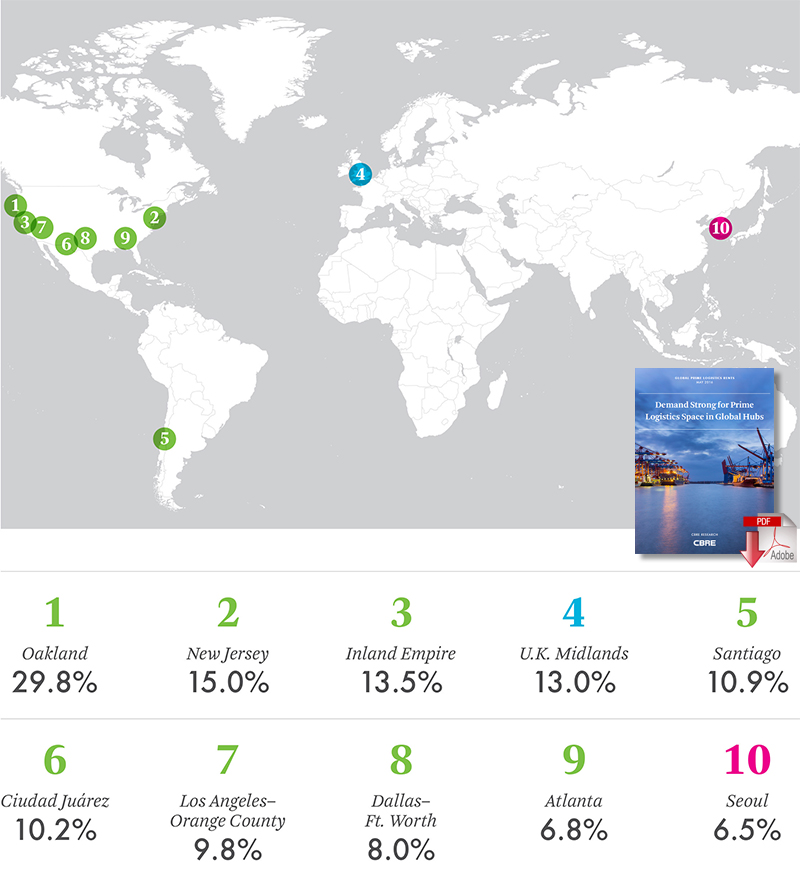

The 10 Fastest Growing Markets

(Annual percent change in prime logistics rents as of Q4 2015)

Source: CBRE Research, Q4 2015

“Anywhere there is some sort of combination of e-commerce and consumers, there is a growing concentration of supply chain demand, and the issue is the old paradigm of supply chain which was where you have a couple of regional locations to serve each portion of the country in three or four days and was sufficient does not work anymore as three or four days is way too long.”

As for how this translates into the type of space that is needed, Egan said there is a huge market in the U.S. but the type of space that is needed in many cases is a very particular type of space and there is not as much of it available.

“The reason rents are high is that demand for that space continues to outpace supply, even with developers trying to build as quickly as they can to meet the demand there is still way more leasing and occupier demand for that kind of space than there is available supply”

“At that point it is a basic economics problem with demand outpacing supply leading to costs going up,” he said.

According to CBRE data using net absorption as an indicator for demand, there have been 23 straight quarters of more net absorption than supply, going back to the beginning of the recovery cycle in 2010.

Looking ahead, while demand continues to outstrip supply, Egan explained that the market is not immune to cycles, but in the short term all indications point to demand continuing to outpace supply and are not likely to change too soon.

“These e-commerce and consumer behaviors are not going to change, and I think there is going to be continuing pressure to investigate and rationalize supply chains, which will continue to generate demand,” he said.

“In some markets, the availability of sites to build to generate new supply is really short. Demand will continue to go up and down, but the new normal for demand is much higher than it used to be.”

Annual Change Breakdown Q4 2014-Q4 2015

Source: CBRE Research, Q4 2015

China is an emerging market with large increases in completions every year, and these new properties skew the spot rent. To prevent this, CBRE Research has made the appropriate adjustments to the % changes to reflect a “like-for-like” in rental growth.

Article Topics

CBRE News & Resources

CBRE report points to a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights the ever-growing role of holiday season reverse logistics operations Top 20 Warehouses 2023: Demand soars and mergers slow Top 20 Warehouses 2023: Demand soars, mergers slow CBRE report highlights mixed Q3 industrial real estate directions Q3 Commercial Construction Starts Fall 37% vs. Q2 More CBRELatest in Supply Chain

Ask an Expert: How Shippers Can Prep for Hurricane Season Apple Accused of Multiple Human Rights Violations South Korea Finally Overtakes China in Goods Exported to U.S. UPS Struggles in First Quarter With Steep Earnings Decline How Supply Chains Are Solving Severe Workplace Shortages SAP Unveils New AI-Driven Supply Chain Innovations How Much Extra Will Consumers Pay for Sustainable Packaging? More Supply ChainAbout the Author