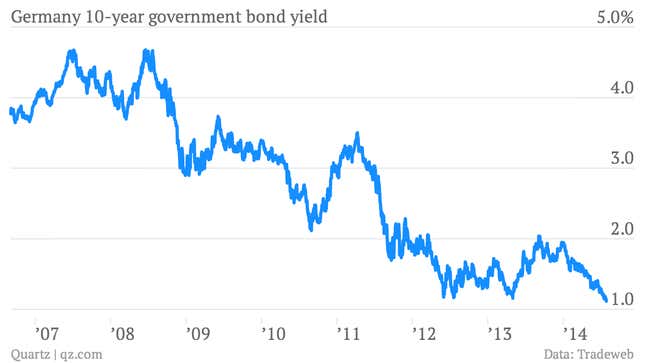

Any given day in the global bond market can be fairly snooze-worthy. Bond yields tick up by a few basis points, and down by a few basis points. Ho-hum. That’s the case today in the market for German government bonds (known as bunds). Yields on the 10-year bund declined by about four basis points, or 0.04 percentage points, to 1.12%. In other words, low.

But in my experience, the best way to make sense of the the bond markets is by looking at a long time series. That’s usually when the noise of a meandering market gives way to a clear signal. You can see that the recent run lower in bund yields—prompted by an easier-sounding European Central Bank, disinflation, and scary developments in Ukraine—has pushed yields down to their lowest level in recent history.

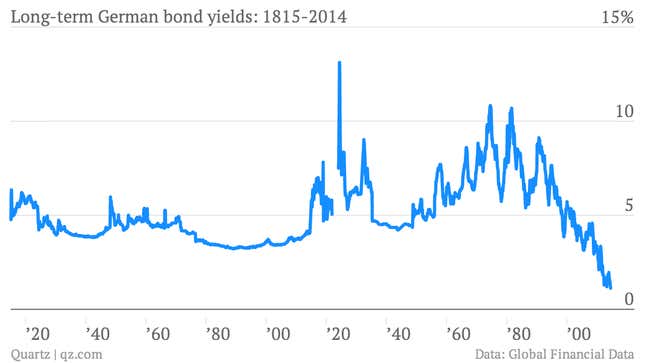

But there’s more. We grabbed estimates of long-term bund yields from data provider Global Financial Data. With the best numbers we have going back to 1815, these are the lowest German bond yields on record. Pretty remarkable.

Now, it’s best to think of these numbers as a broad estimates of interest rates. The benchmark 10-year bund that hit a low today didn’t exist 200 years ago, not least because Germany as we know it today didn’t exist 200 years ago.

Back in 1815, the dominant power in the confederation of German-speaking states, formed that year after the final defeat of Napoleon Bonaparte at Waterloo, was the province of Prussia. So the numbers that start in 1815 in the chart above are estimates based on the yield of Prussian government bonds. German Imperial government bonds were used from the 1870s. Government-backed mortgage bonds began in the 1920s. Bonds issued by Hitler’s Third Reich are the benchmarks for the 1930s and immediately after the war. Through the 1950s and 1960s, a mix of West German government bonds were used. Starting in 1980 the Bundesbank’s constant maturity 10-year bond is used, which is comparable with today’s bond yields.

At any rate, if you’re going to have long-term data series like this in the world of fixed income, a certain amount of stitching and pasting is required.

Also, cutting. You may have noticed the odd gap in the graph around 1920. That’s because I axed the yield data around the hyperinflation of 1922-23, which rendered Germany’s bonds worthless. And it’s not just me. The irreplaceable survey of interest-rate history, the appropriately titled A History of Interest Rates, also leaves those years out. “Unfortunately, no bond yields at all were computed by the sources quoted for the inflation years of 1922 and 1923, no doubt because of the chaotic state of the market and the currency,” the authors wrote. Rates stabilized a bit in 1924, where the series picks up.

The government held yields steady throughout the war years. After the war, yields on West German bonds rose, along with those of most advanced economies (although apples-to-apples comparisons are impossible because of various changes to how the bonds were taxed).

German yields most recently spiked in the 1990s around the time of reunification. But since then, it’s been pretty much a one-way ride to the record low levels we see today.