TORONTO – So you just had a baby. Hey, congratulations. While you bask in the glow of parenthood, here’s a scary thought: By the time your baby heads off to college or university, they could be forced to shell out upwards of $100,000 for an education.

In 2013 and 2014, the average price tag for a year’s tuition at a Canadian university was $5,772.

And those costs are expected to rise, according to the Financial Consumer Agency of Canada. Last year, for example, the average tuition was 3.3 per cent more than the year before.

Factoring in books, course materials and living expenses, it’s enough to make any parent break into a cold sweat.

According to the Canadian Federation of Students, students in Ontario and the Maritimes (the provinces with the highest debt loads) hold more than $28,000 in debt on average.

But all these numbers aren’t meant to scare you and your kids away from higher education – still widely considered to be a sound investment in your child’s future.

Data from Statistics Canada shows that the higher level of education achieved, typically the higher the rate of employment.

In 2009, for example, 82 per cent of Canadians ages 25 to 64 with post-secondary education were employed. Compare that to just 55 per cent employed for those with less than high school education. In 2008, university grads earned 70 per cent more on average than high school graduates.

So with all that in mind, here are some tips for parents and students saving for post-secondary education.

Decide where to put your money

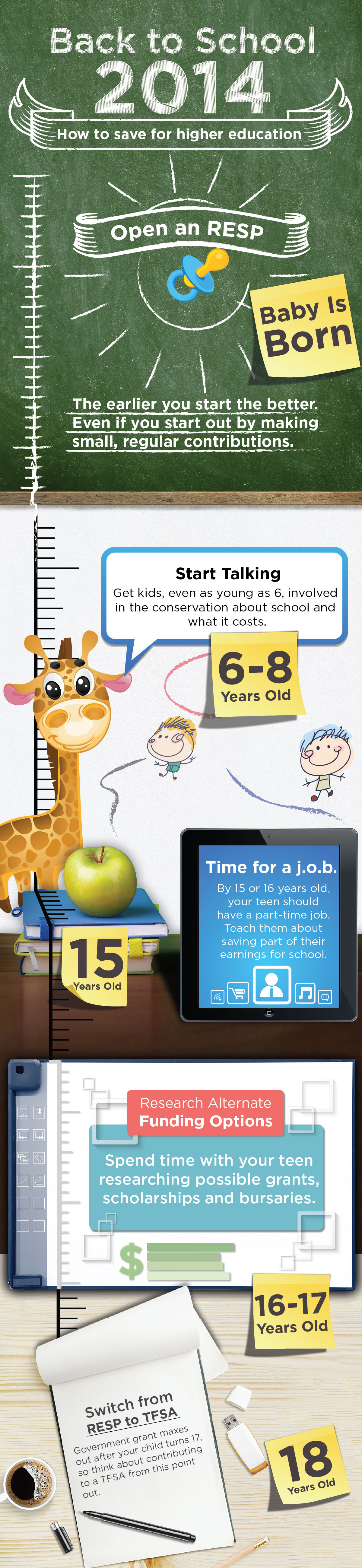

Parents, grandparents, relatives and friends are all able to open a Registered Education Savings Plan (RESP) for a future student. There are different RESPs to choose from, but to get started all you need is a Social Insurance Number for the child – meaning you can start saving when the child is very young.

Individuals then make regular contributions to the RESP, and once the child is ready to attend a qualifying post-secondary education program money is withdrawn from the RESP to help cover the costs of school.

RESPs have a few significant advantages, namely that the federal government will match contributions made through the Canada Educations Savings Grant, contributing an extra 20 per cent up to a maximum of $500 per year.

The grant is available until the child is 17 years old.

If you’ve opened an RESP, you may also be eligible for the Canada Learning Bond, which could add up to $2,000 in government funds to your child’s RESP.

The bond is available to children born after Dec. 31, 2003 whose family receives the National Child Benefit Supplement (find out if you’re eligible here).

There are also non-registered options for education savings, including high-interest savings accounts, bonds and GICs.

Non-registered savings plans are preferred by some since they don’t have a contribution limit and don’t come with the same education-specific restrictions.

Money can be withdrawn at any time for any reason – but holders of non-registered accounts must resist the temptation to use the education funds for something else.

Tax-free savings accounts (TFSA) are also an option. Savings grow tax-free and money can easily be withdrawn to help pay for a child’s education down the road.

The earlier you start saving, the better

It goes without saying that the earlier you start saving, the more funds you’ll have by the time your child enrolls in a post-secondary program.

If, for example, you began saving $100 per month in an RESP (earning three per cent annually) from the time your child is born, you will have saved more than $30,000 by the time they turn 18. Start saving once your child is 10, and the same monthly contribution only gets you around $12,000.

Use online tools to figure out how much you’ll need to save

You can get an idea of how much you’ll need to save in an RESP using online calculators like this one.

The calculator allows you to choose the province of study (there ‘s a big difference in tuition fees across the country), how many years you think your kid will be in school for, if they’ll live at home or not and so on.

Other online calculators give you an idea of how much money it will cost to attend specific schools and programs.

Start the conversation early

Not only is it better to start saving early, starting the conversation with your child about the cost of education is also recommended.

“You really want to be proactive and involve them at an early age,” said Scott Hannah, CEO of the Credit Counselling Society.

Hannah recommends that as early as six years old, start talking to your kids about going to school and how it is going to cost money.

Explain to kids that when they come into extra money (like gifts from grandparents) they could put it into their RESP to give it a boost, said Hannah.

As they near the end of their high school career, start talking to them about potential student loans, grants and scholarships that may be available.

If your child is taking out a student loan, make sure you talk to them about debt.

“Kids don’t understand debt,” said Hannah. “They think of student loans as money,” using it for things such as going on spring vacations.

Make sure your kid has a McJob

Ideally, once a child turns 15 or 16, they are working in a part-time job. Money earned can be put toward education savings. Beyond that, having a job teaches kids about money management and how to balance priorities – important life skills as they head out to college.

“Kids need to have skin in the game when they go to school,” said Hannah, adding that because they have paid for the courses, they’ll be more likely to show up to class and put more effort into their studies.

One tip from Hannah is that, when financially possible, parents have their children pay for school courses themselves. Money saved in their RESP can then be transferred to a high-interest savings account, so they’ll have savings when they come out of school.

He doesn’t, however, recommend doing this if it means the student will have to take out a loan or incur debt – in those cases, use the funds saved in the RESP to cover the costs.

“Student debt really puts you behind the eight-ball,” said Hannah.

Comments