/cdn.vox-cdn.com/uploads/chorus_image/image/36170462/6864741457_cca1e934f2_b.0.jpg)

It's still only a tiny fraction of Americans who actually own electric cars. But that number is growing fast.

So far this year, roughly 54,973 plug-in electric and battery-electric vehicles have been sold in the United States.

That sounds negligible at first — it's a scant 0.67 percent of the 8.1 million vehicles sold in 2014. But it also represents a 35 percent jump over last year. And both May and June were record sales months.

So how quickly are electric cars catching on? And can they ever be more than just a niche product? The Energy Policy Information Center recently posted a couple of interesting charts on the electric-car trend, and I've added a few more:

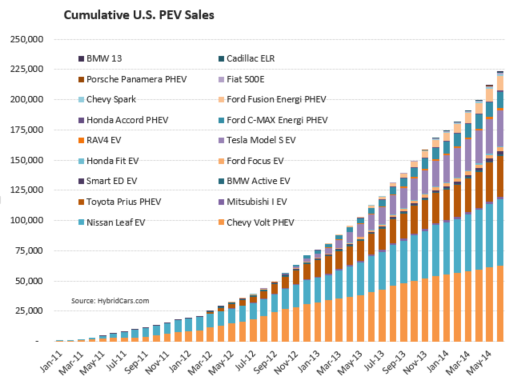

1) Plug-in electric vehicle sales are hitting record highs

Energy Policy Information Center

This chart shows US sales of plug-in electric vehicles — that is, cars that can be charged by getting plugged into an electrical outlet. (It doesn't include hybrids like the Prius C, whose electric systems are powered mainly by the gasoline engine or braking. We'll get to those in a sec.)

Back in 2011, when the Chevrolet Volt and Nissan Leaf first came out, virtually no one was buying electric vehicles and there was plenty of hand-wringing about sluggish sales. Since then, however, sales have risen nearly fivefold. May and June were record months. Electric cars still represent just 0.67 percent of all US car sales this year. But that fraction is steadily growing.

2) The plug-in market is dominated by just four vehicles

Energy Policy Information Center

The chart above shows cumulative sales in the United States since January 2011 — more than 220,000 plug-in vehicles have been sold in all.

The striking thing here is that the market has been utterly dominated by just four car models so far: GM's Chevy Volt, Nissan's Leaf, Tesla's Model S, and the plug-in version of Toyota's Prius. Together those vehicles have made up roughly 80 percent of all sales since 2011.

That's slowly starting to change, though. In June 2014, Ford's Fusion Energi outsold both the Volt and the plug-in Prius, and is slowly catching up.

3) Hybrids are still far more popular than plug-ins

A Toyota Prius drives in a residential neighborhood on November 30, 2010 in San Anselmo, California. Justin Sullivan/Getty Images

So far this year, automakers have also sold 232,788 hybrid vehicles. These are cars like the traditional Prius that have both a gasoline-powered combustion engine and an electric propulsion system to boost fuel economy. Typically the battery is recharged by either the engine or by harnessing the energy from braking.

Right now, car companies sell nearly five times as many hybrids as they do plug-in vehicles. That's not too shocking. Conventional hybrids, after all, are more convenient — you don't need to charge them in an outlet and you don't need to hunt around for an electric-charging station.

Even so, hybrids are also just a small fraction of vehicles sold in the United States — around 3 percent this year.

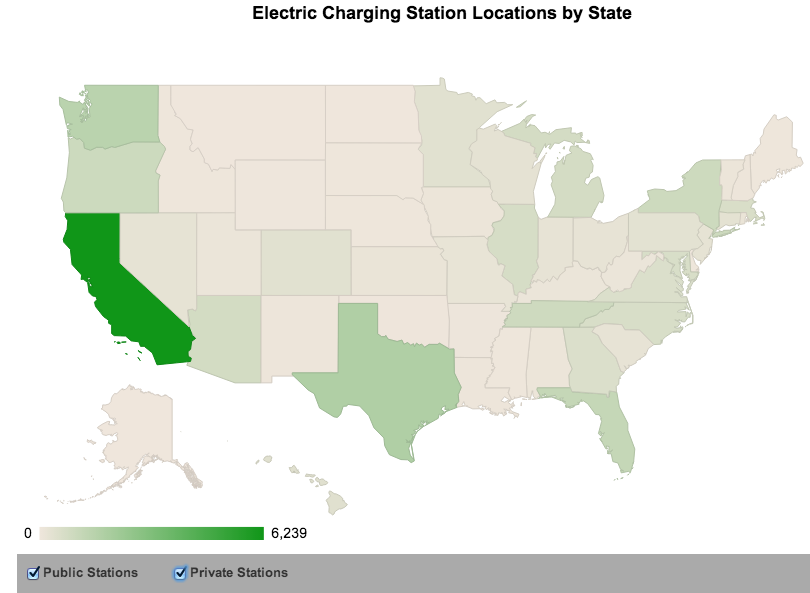

4) California has the most charging stations

Department of Energy Alternative Fuels Data Center

One reason that the rapid rise in electric vehicles matters — even if it's from a very small base — is that there are network effects here. If more people buy electric vehicles, then companies are more likely to build charging stations. That, in turn, makes electric vehicles more useful, which again helps boost sales at the margins.

California leads the way in this regard, with some 6,239 public and private charging stations. That's six times as many as New York and more than three times as many as Texas.

The overall number of charging stations in the United States is growing fast — there were just 3,300 in 2011, and that rose to more than 19,000 by the end of 2013. (We don't yet have data for 2014.)

5) Electric car sales often follow spikes in gas prices

Energy Policy Information Center

Plug-in electric vehicles are often significantly more expensive than conventional cars. So why would people buy them?

One possible reason is that they help save on gasoline costs. The chart above, from the Energy Policy Information Center, looks at month-over-month changes in gas prices and vehicle sales. The relationship is… suggestive but not really conclusive.

Sometimes spikes in gas prices go hand-in-hand with spikes in plug-in sales. But the correlation isn't perfect, and the center notes that there are other possible factors at play here — "cyclical sales of all automobiles, consumer confidence, and more."

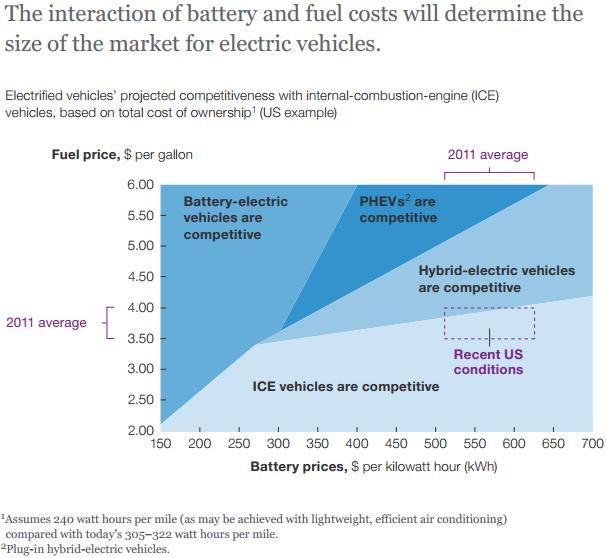

6) Battery costs will be a huge factor in how quickly electric cars catch on

McKinsey & Co.

One major reason why electric cars are a niche market is that batteries are still hugely expensive — usually around $12,000 to $15,000, or one-third the price of the vehicle — and can provide only limited range. And, for now, those costs are still much higher than the savings from reduced gasoline use.

If batteries ever get significantly cheaper, that could change. The chart above, from a 2012 McKinsey & Co. report, offers an illustration here. Right now, battery prices are estimated to cost around $500 per kilowatt hour and gasoline prices are hovering around $3.50 per gallon. Under those conditions, hybrid vehicles sort of make economic sense. But plug-in vehicles don't.

On the flip side, if battery prices fell by two-thirds, then plug-in electric vehicles would make a lot of economic sense for most people. And the McKinsey researchers, at least, think that's possible in the next decade, thanks to economies of scale in production, the reduced cost of components, and advances in things like cathodes.

On the other hand, not everyone's so optimistic that batteries can improve so fast. In a 2013 essay for the Proceedings of the National Academies of Sciences, Fred Schlacter argued that advances in battery technology have been slow going — and "significant improvement in battery capacity can only be made by changing to a different chemistry." While lithium-ion batteries have been slowly improving, and there's some hope for new lithium-air or lithium-sulfur batteries, he notes, scientists are no longer optimistic about huge gains.

We'll see whether optimism or pessimism is warranted here. But how batteries improve is likely to be a major factor in how quickly electric vehicles catch on.

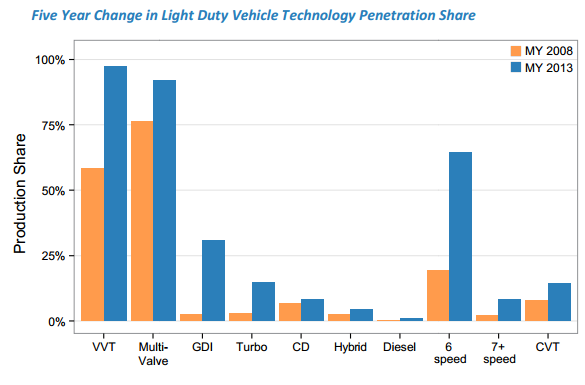

7) Electric cars are only one reason US fuel economy is improving

"VVT" = variable valve timing. "Multi-valve" = multi-valve engines. "GDI" = gasoline direct injection. "Turbo" = turbocharged or supercharged technology. "CD" = cylinder deactivation. "CVT" = continuously variable transmission. EPA

In recent years, US fuel economy has been rising — but hybrids and electric cars have only played a small role here. The chart above, from the Environmental Protection Agency, shows how various efficiency technologies that have become more prevalent since 2008.

As it turns out, improvements to the existing combustion engine have been a huge source of innovation over the last five years. There's gasoline direct injection, which is a more efficient technique for delivering fuel to the engine. Or there's cylinder deactivation to save fuel. These get less attention than electric cars, but they're key advances.

In the future, however, electric, hybrid, and "micro-hybrid" technology are expected to deliver even bigger gains — especially since new cars will need to average more than 35 miles per gallon on the road by 2025.

Further reading: Five reasons cars in the US are more efficient than ever