To all the college grads out there, sighing over their student loan payments, the Federal Reserve Bank of New York has a message: it was all worth it.

If you regret spending all that money on a college education, you are not alone. About 31% of millennials regret paying for college instead of trying to get a job out of high school, according to Wells Fargo.

Yet thanks to that expensive education, over the course of their lives college graduates are bound to recoup all the money they spent getting their degree – and much more, says the New York Fed.

“Over the past four decades, those with bachelor’s degree have tended to earn 56% more than high school graduates while those with an associate’s degree have tended to earn 21% more than high school graduates,” found the report.

In their lifetime, college graduates are likely to earn about $1m more, the Fed said. Those with an associate degree earn about $325,000 more in their lifetime than high school graduates.

There is a caveat here: the real cost of college education, according to the New York Fed, is the net cost of tuition and the opportunity cost of lost wages – meaning the money students give up by not working full-time during their college years.

And while these numbers sound great in the long term, leaving college to search for work in the current market is not easy, and requires resilience and patience.

Especially if, like most US students, you graduate with about $30,000 in loans.

Strangely, student loan debt, which amounts to about $1tn in the US, is something the New York Fed report authors chose not to incorporate into their analysis on the rate of return of an education.

There are a few other factors in the cost of an education that the authors omitted.

Not only did the report not incorporate student debt, but the tuition estimates used in the analysis are the net tuition costs, which don't include room and board.

The report estimates the total cost of four-year tuition to be $26,000, arguing that the net price of a bachelor's degree is $6,550 a year – well below the annual $14,750 sticker price. At many private colleges, particularly elite ones such as those in the Ivy League, the sticker price is above $50,000.

And the cost of the associate degree, according to the Fed? $0. In fact, less than zero. "[T]he actual cost of an associate's degree was more than fully subsidized by various tax benefits and other form of aid," noted the report.

Opportunity cost

The opportunity cost of going to college – missing out on two or four years of full-time wages – is not that high, found the New York Fed.

The wages that American students miss out on, should they not enter the labor market after high school, totals $96,000 for those pursuing a four-year bachelor’s degree, and $46,000 for those pursuing an associate degree. College graduates are likely to make up for those lost wages within a few years, thanks to the higher pay ensured by their degrees.

What about the debt?

Despite the fact that everyone, from President Obama to Starbucks CEO Howard Schultz, is worried about the student debt crisis that plagues US college graduates, the New York Fed believes that student loans are cheap subsidies.

The authors write:

In exchange for paying interest, people can take out student loans to delay paying their college expenses. Thus, it is not necessary to incorporate such financing options into our rate of return analysis. In face, because interest rates on student loans are often subsidized at below-market rates, student loans generally allow people to earn higher returns than our results would indicate."

While it's true that federal loans are often subsidized at below-market rates and hover at less than 6% interest rates, not all students are eligible for such loans.

As a result, a number of students rely on private loans, which come with interest rates as high as 18%. As of 2012, there were $150bn in private student loans. Even if the New York Fed didn't deem these loans and interest rates important enough to consider when evaluating the worth of one's education, the students who took out those loans are keenly aware of their costs.

A newly released study by the Brookings Institution came to the conclusion that US households with extreme student debt burdens are not the norm, but are "exceptional cases".

Working off of Federal Reserve Bank's Survey of Consumer Finance, the report found that 58% of those households have less than $10,000 in debt and 18% have debt between $10,000 to $20,000.

The problem is that this assessment looks at all households with student debt, including those who have been paying off their burden for years.

Therefore, the debt analyzed in the study is not the original debt taken out, but what remains after years of payments.

Buried in the Brookings study is the one thing that really matters to recent graduates and to younger Americans still debating whether college is worth it: the fact that, on average, "bachelor’s degree recipients in 2011-12 who took out student loans accumulated an average debt load of approximately $26,000 ($25,000 at public institutions, and $29,900 at private, nonprofit institutions)."

That means that new generation of college graduates are dealing with much greater burden of debt than those who came before them.

A degree is no longer the quickest, surest way to a well-paid job

It has been the burden of student loan debt, in fact, that has caused college graduates to question the point of a college degree. The current unemployment rate for college graduates might be 3.2% but that still translates into more than 1.5m unemployed Americans who have bachelor’s degree or higher. When so many people have a college degree, it is no longer a guarantee that one will get a job.

Then there are those students who found jobs where their college degree hasn't improved their prospects. The current underemployment rate for recent college graduates is 18.8%.

And while employment prospects get better with time, it does not apply to everyone, admits the report.

[T]he likelihood of being underemployed declines significantly with age, and more college graduates work their way into college-level jobs by the time they reach their thirties. Nonetheless, about a third of those who obtain a college degree do spend much of their careers in jobs that typically do not require a bachelor’s degree.”

Interestingly, the report found that even though college graduates are increasingly working jobs that do not require a high of a level of education, they are still getting something out of their degree.

“Employers are willing to pay a premium for college graduates relative to those with just a high school diploma, even in jobs that are not typically considered college-level positions,” notes the report.

According to the Economic Policy Institute, the average wage for college graduates is $16.60, as compared to just $9.48 for high school graduates. So while college graduates might not be working the jobs they imagined they would be based on their level of education, they are still making more than those who did not attend college.

Degrees as stocks

In order to drive home the point of why higher education is still worth time and money, the report's authors presented degrees as stocks, pointing out that they actually have a great rate of return.

“To put these findings in perspective, consider that investing in stocks has yielded an annual return of 7% and investing in bonds an annual return of 3% since 1950,” notes the report. “A return of at least 7% is clearly a good investment because it exceeds the historical return on stocks; a return below 3% would be a poor investment since one could do better by investing in bonds.”

The return on a bachelor degree, which averaged about 9% during the 1970s, reached peak return of about 16% in 2001. It has since remained within the 14% to 15% range. Similarly, the return for associates degree ranges between 13% to 15%.

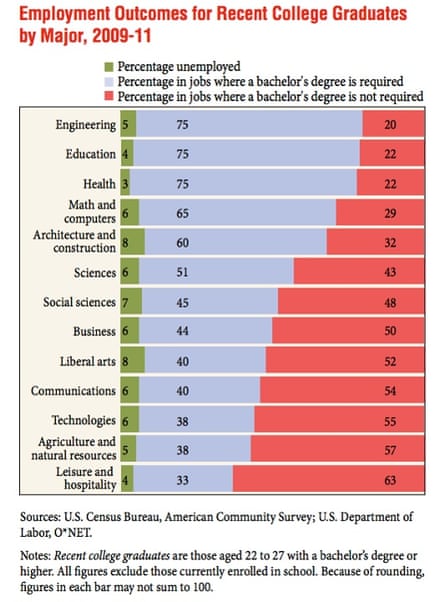

Yet just like stocks, not all degrees are created equal. Some will perform better than others.

For example, technical training degrees are likely to have a higher rate of return. The report found that engineering majors and math and computer majors had rates of return 21% and 18%, respectively.

On the other end of the spectrum are degrees in majors like liberal arts, hospitality and leisure, which the report says have “below-average returns”. Even those low returns are still worth it, however, as “each major has a rate of return exceeding 9%”.

Another report from the New York Fed, released in January of this year, found that the graduates with these under-performing degrees most often find themselves underemployed, working lower-paid jobs that sometimes don’t even require a college degree.

As difficult as things might seem for college graduates, they could always be worse. Just think about those Americans who never went to college, says the New York Fed.

"Despite the recent struggles of college graduates, investing in a college degree may be more important than ever before because those who fail to do so are falling further and further behind."

Comments (…)

Sign in or create your Guardian account to join the discussion