New Year – New Commitment to Risk Management

It’s a new year which means it is a new opportunity to take an in depth look at your insurance coverages and how well the current design and implementation of your customized program is working for you. More important, it is a time to asses with fresh eyes how you are protected your organization from loss via transfer of risk to your insurance policies. These insurance policies can be thought of as an asset. While it does not show up on your balance sheet as such, it is the lifeline that protects many companies when a claim arises and thus warrants protection as any other asset does.

In this case, protection starts with active risk management practices that complement an organization’s insurance program. Thus, in kicking off 2018 we challenge each organization to make a commitment to risk management. Further we are going to help you succeed in this challenge through the examination of some common risk issues that most companies face as well as provide you with a plan to handle them.

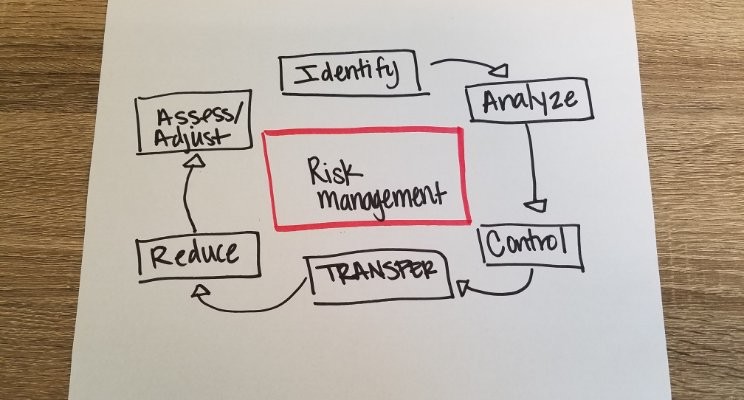

First, let’s start with the basics. Risk management, at its very core, is the process of preparing for the unknown events that have potential to create harm to the organization. It requires a forward looking leadership team to identify, assess, and prioritize potential hazards as well as your organization’s response to them. From there a strategy must be designed and executed which coordinates the application of resources. This proactive approach reduces the frequency and/or severity of losses and ensures that the company can maintain focus on its core operations.

In theory, as with most business ideals, risk management sounds like the smart, easier path to follow, but, many businesses find the process to be daunting. With this in mind, following these steps will see you well on your way:

- Appoint a safety committee to advance your risk management program. This should include as many people as possible from different departments and job functions as the clearer and broader the picture, the better you are able to frame it. It can also include the advice and counsel of outside parties with specialization in managing risks like yours.

- Conduct an in-depth study of potential risks. Again, your committee will need to look at as many facets of your organization as possible. Claims often come from the least expected circumstances.

- Assess and prioritize each potential risk. You will not be able to address each and every identified risk from the onset. Some risks will require resources that you do not yet have, others may require a change in your logistics, while still others are as easy as sending a memo to all staff. Tackle the items that can either be done quickly or pose a major threat. From there, use the momentum that is created to snowball into a more robust program.

- Check current policies/procedures with respect to addressing each risk and make changes where necessary. How long has it been since your policies and procedures have been reviewed? Do they include adherence to current states and federal guidelines? Take the time to inventory your current risk management program. From there you can map out the areas that need to be addressed.

- Train and implement changes to and/or new policies/procedures. A policy is only as good as its implementation. That implementation must include training of staff, if applicable, as well as providing for a system of review.

- Schedule periodic committee meetings to examine risks, plan/procedure, and losses. Is the plan working as anticipated? Are there adjustments that can be made? Does everyone know and use the plan as it was designed? Did we uncover factors that we hadn’t previously thought of? It is essential that once the work has been done to set the plan in motion, that the nonprofit continues their proactive risk management approach through subsequent analysis.

Dr. Michael Ong once said, “Good risk management fosters vigilance in time of calm and instills discipline in times of crisis”. The storms that are created by loss will come to your company; the question will be whether you have done the work in the calm times to allow you the discipline to survive the crisis?