Palo Alto, California's municipal utility already has low electricity prices -- local recreation center Oshman Family JCC reported paying about 9 cents per kilowatt-hour at certain rate tiers. But THiNKnrg, an energy project developer, was able to provide the center with a 50 percent discount and close a deal with a twenty-year solar PPA price at 4 cents per kilowatt-hour.

This is a relatively small project -- it comprises 398 kilowatts spread across twelve rooftops. And although that doesn't compare in scale to, say, Austin's 5-cent-per-kWh, 150-megawatt PPA, the JCC project distinguishes itself by creatively financing a small project while keeping soft costs down.

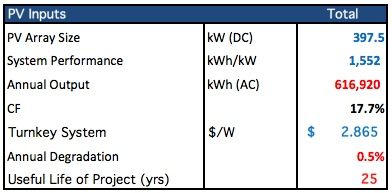

The JCC's solar installation is a 397.5-kilowatt system powered by 1,840 Trina PV panels that have been factory-integrated with Tigo power optimizers and connected to KACO inverters. Mark Holtzman, CFO of the Oshman Center, said the PPA would save about $30,000 per year in electricity bills and an estimated $1.5 million in energy savings over the twenty-year contract.

"This is one of the more innovative deals we have done," said Zach Rubin, CEO of THiNKnrg. The PPA takes advantage of the usual 30 percent investment tax credit, plus a generous five-year, 29-cent-per-kilowatt-hour performance-based incentive (PBI).

Rubin acknowledged that an aggressive PBI made the deal work at 4 cents -- but suggested that absent the PBI, this project could still compete with the fossil-fuel-based power from most utilities. (Austin Energy's net sub-five-cent price does not include any state PTC and works out to a non-subsidized price that still can compete with fossil fuels in the 13 or 14 cents per kWh range.)

Rubin said that Palo Alto had been "great with permitting" despite the city's self-described "reputation as being a very difficult place to get approval and pass inspections for solar panel installations." In fact, the city has overhauled its permitting process and driven down time to permit issuance from 122 days to three days. The utility also claims to have halved the frequency at which plans are returned with corrections. These are the kind of soft-cost savings that can make or break a project.

Another source of soft-cost savings, according to the project developer, was in the use of a standard template for the various tax appetite entities that "didn't require a lot of back-and-forth," according to the CEO, who added, "Closing costs and transaction costs can kill a deal." (Join the developer of this project, Zach Rubin -- along with Vikram Aggarwal, CEO of EnergySage, and Kristen Ardani, Solar Markets and Policy Analyst at NREL -- for "Cracking the Code on Soft Costs" at the Solar Summit in Phoenix next month. I will be moderating that panel and hope to see you there.)

A distinguishing financial feature of this project is the fact that Conergy, with its owner Kawa Capital Management, a private equity firm, accessed the tax equity appetites of a small pool of individuals, according to the CEO. Conergy "closed one of the first leveraged tax equity partnership structures with individual investors who could utilize the investment tax credits," said John Marciano, Partner at Chadbourne and Park and tax counsel for Conergy and Kawa, in a release about the project. He continued, “This is a landmark transaction, one of the first leveraged partnership structures to successfully close with individual investors."

Rubin revealed that the project sold for $2.87 per watt and had a sub-$2.50-per-watt installed cost. The developer makes a margin and "JCC gets a discount to their electric rate and a reduction in demand charges."

Technologically, the site stands out as Trina's largest installation using the integrated Tigo optimizers. Rubin said that Tigo optimizers were an easy decision to make on economic terms. "In a PBI-based system, you want to extract every kilowatt-hour."

Here are some vital statistics on the project:

Eduardo Manzur of THiNKnrg was kind enough to provide this flow chart of the moving parts that go into a project of this nature:

Palo Alto Mayor Nancy Shepherd noted the complexity of this public-private-nonprofit partnership and restated her goal for Palo Alto to be the greenest city in the world. Located in Northern California, Palo Alto is the home of Stanford University, Packard's garage, a high concentration of venture capitalists, and a crop of high-tech startups that occasionally build useful things. The city estimates that meeting its goal of being 100 percent carbon-neutral will cost the average ratepayer about $3 per year.

Does a 4-cent-per-kilowatt-hour PPA price accurately reflect the true cost of solar?

It does in this deal.

Every PPA, whether or not it is based on a renewable source, relies on its own ecosystem of subsidies, tax breaks and financial engineering to make it work -- which makes 4-cent-per-kilowatt-hour solar as real as this project in Palo Alto.