Money

The Early Business Pursuits of Bezos, Buffett, and Other Legends

They say everyone has to start somewhere.

And for legends like Jeff Bezos, Warren Buffett, Estée Lauder, and Richard Branson – well, they got into the money-making game early.

From hawking golf balls to bootstrapping student magazines, many of these iconic entrepreneurs started their very first businesses in their childhood or teenage years. Not all of these enterprises fared well, but they did give these eventual magnates an early taste of the startup life.

Childhood Ambition

Today’s infographic comes to us from Colonial Life, and it showcases the early endeavors of ten successful business greats:

While some business greats weren’t afraid to get started later on, people like Warren Buffett and Jeff Bezos had an entrepreneurial drive at a very early age.

It likely drove their parents wild, but it seems that hitting the ground running ended up paying off in the long run.

Entrepreneurial Early Years

How did famous entrepreneurs get their feet wet in business? It generally falls into two categories.

1. Work With What You Have

People like Warren Buffett, Ingvar Kamprad, and Daymond John worked with what they had, finding the easiest route into business possible.

Buffett sold golf balls, built an ambitious newspaper route, and sold gum. Meanwhile, Ingvar Kamprad marked up wholesale matches to sell them to neighbors for a profit, while Daymond John personalized pencils in his school classes.

The lesson here? Sometimes the first opportunities you see are not glorious game-changers – instead, you need to apply hard work and creativity to a widely available opportunity and grind it out.

2. Early Passions Realized

On the other hand, entrepreneurs like Michael Dell, Max Levchin, Kevin Plank, and Estée Lauder realized their passions early, and these initial childhood ambitions were linked to their later careers.

Dell and Levchin were both involved in computers early – either building them or programming on them – and would both start renowned tech companies (Dell and Paypal) in their adult lives. Kevin Plank of Under Armour was in the apparel business early, selling t-shirts at local concerts, and Estée Lauder was selling cosmetics to her friends that were made by her chemist uncle.

Want other useful hints from the world’s best? Take a look at the Habits of Highly Successful Entrepreneurs.

Money

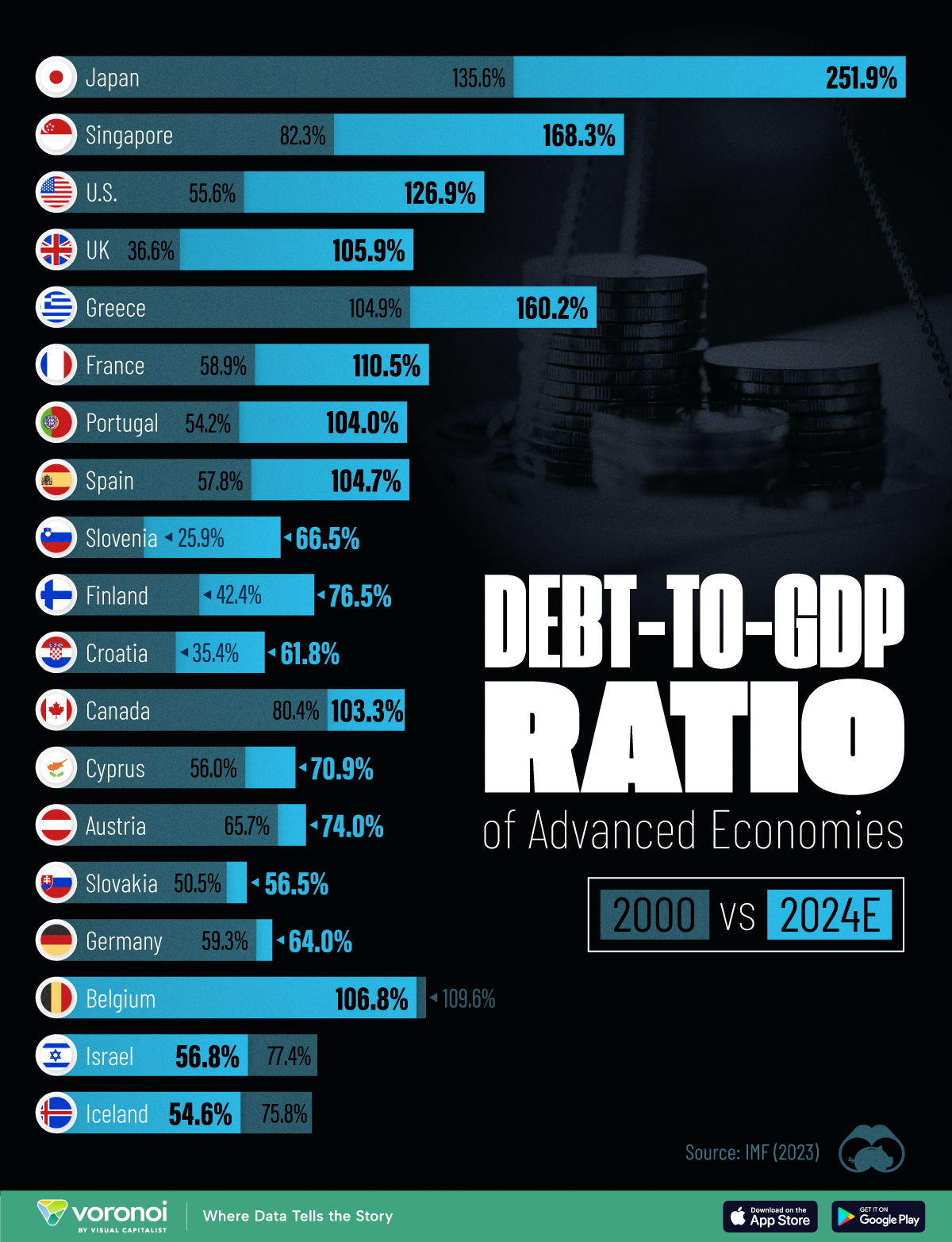

How Debt-to-GDP Ratios Have Changed Since 2000

See how much the debt-to-GDP ratios of advanced economies have grown (or shrank) since the year 2000.

How Debt-to-GDP Ratios Have Changed Since 2000

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, we’ve visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

| Country | 2000 (%) | 2024 (%) | Change (pp) |

|---|---|---|---|

| 🇯🇵 Japan | 135.6 | 251.9 | +116.3 |

| 🇸🇬 Singapore | 82.3 | 168.3 | +86.0 |

| 🇺🇸 United States | 55.6 | 126.9 | +71.3 |

| 🇬🇧 United Kingdom | 36.6 | 105.9 | +69.3 |

| 🇬🇷 Greece | 104.9 | 160.2 | +55.3 |

| 🇫🇷 France | 58.9 | 110.5 | +51.6 |

| 🇵🇹 Portugal | 54.2 | 104.0 | +49.8 |

| 🇪🇸 Spain | 57.8 | 104.7 | +46.9 |

| 🇸🇮 Slovenia | 25.9 | 66.5 | +40.6 |

| 🇫🇮 Finland | 42.4 | 76.5 | +34.1 |

| 🇭🇷 Croatia | 35.4 | 61.8 | +26.4 |

| 🇨🇦 Canada | 80.4 | 103.3 | +22.9 |

| 🇨🇾 Cyprus | 56.0 | 70.9 | +14.9 |

| 🇦🇹 Austria | 65.7 | 74.0 | +8.3 |

| 🇸🇰 Slovak Republic | 50.5 | 56.5 | +6.0 |

| 🇩🇪 Germany | 59.3 | 64.0 | +4.7 |

| 🇧🇪 Belgium | 109.6 | 106.8 | -2.8 |

| 🇮🇱 Israel | 77.4 | 56.8 | -20.6 |

| 🇮🇸 Iceland | 75.8 | 54.6 | -21.2 |

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

See More Debt Graphics from Visual Capitalist

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?