South Africa finance minister won't submit to police

- Published

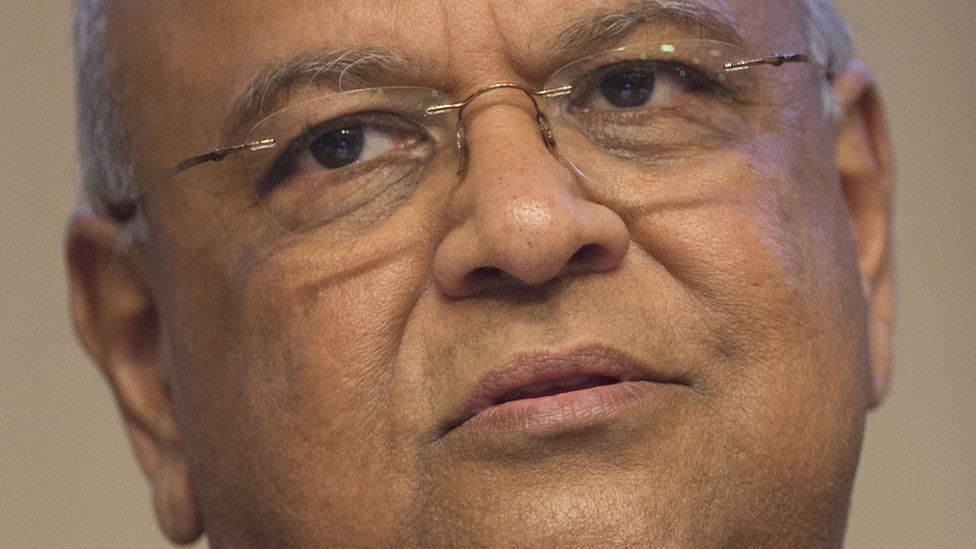

South Africa's finance minister has said he will not appear before the police despite a request to do so.

Pravin Gordhan says allegations against him related to his time as head of South Africa's tax agency are wholly unfounded.

Mr Gordhan says his legal team has advised him he is under no obligation to go to the police.

South Africa's currency, the rand, had earlier fallen on speculation Mr Gordhan may be arrested.

The Treasury confirmed Mr Gordhan had taken legal advice, having been contacted by the elite police unit, the Hawks.

Questions

By deciding to ignore its request to appear before it, Mr Gordhan is essentially telling the Hawks that he has already answered the questions they put to him.

Also, he points out that the Hawks themselves said a few months ago that he was not a suspect in this matter.

The rand had fallen more than 1% against the US dollar on Wednesday morning.

Domestic bonds also fell as the cost of insuring debts in the credit default swaps market surged.

Speculation has been rife that Mr Gordhan may be charged in connection with an alleged rogue spy unit that was set up at the tax collection agency when he headed it up between 1999 and 2009. Rumours of an arrest first emerged in local South African media back in May.

Investigators sent Mr Gordhan a list of questions earlier this year, but he has always said the unit's work was above board and that he was unaware of any illegality connected with it.

Downgrade risk

The ongoing developments have raised investors' concerns over the leadership at the finance ministry of Africa's largest and most developed economy.

In December last year, President Jacob Zuma sacked the then finance minister, Nhlanhla Nene, replacing him with a little-known MP, David van Rooyen. Financial markets and the currency tumbled following that decision and President Zuma was forced to remove Mr van Rooyen as finance minister and offer the job to Mr Gordhan.

It was the second time Mr Gordhan had accepted the job - he was the finance minister before Mr Nene.

South Africa's economy is teetering on the brink of recession, having recorded a contraction in the first quarter of this year. Figures for the second quarter are due out in early September. Should they also show a contraction, the economy will be technically in a recession.

The country narrowly avoided a downgrade to junk status recently and the ratings agencies are due to give another assessment by the end of the year.

Shadow finance minister David Maynier, of the opposition Democratic Alliance, says the arrest of Mr Gordhan would "shatter investor confidence, risk a sovereign ratings downgrade and be a disaster for the already fragile zero growth, zero jobs economy in South Africa".

Earlier this month, the performance of the ruling African National Congress in South Africa's local elections was its worst since the end of apartheid 22 years ago.

Nuclear deal

Many analysts are saying that these events are part of the political endgame by President Zuma to oust Mr Gordhan.

The reason seems to be the continuing tension between the Treasury and the Presidency over a Zuma-backed plan to build several nuclear power stations at a cost of some $60bn.

Mr Gordhan has not publicly opposed the deal, which Russian companies are favoured to win, but keeps re-iterating that South Africa will only sign deals it can afford.

It's thought that one of the main reasons Nhlanhla Nene was shown the door was that he refused to sign off on the nuclear deal.

If the goal is to replace Mr Gordhan with someone more amenable to signing the cheques for the nuclear deal, logically soon is the time to do it.

For the past six months, the rand had been gaining significantly against the US dollar (having slumped following Mr Nene's sacking last December). But the economic growth forecasts for this year remain bad - at best 1%, probably closer to zero - while unemployment remains stubborn high at more than 25%.

For many analysts, precious little has been achieved or is likely to be achieved by the end of the year, when the credit rating agencies may well downgrade South Africa's sovereign debt to junk status.

Firing Mr Gordhan, or making him step aside, will no doubt cause a good deal of market turmoil.

- Published14 December 2015