Wind & Solar Best Sectors In Climate Stocks According To HSBC

Originally published on Renew Economy.

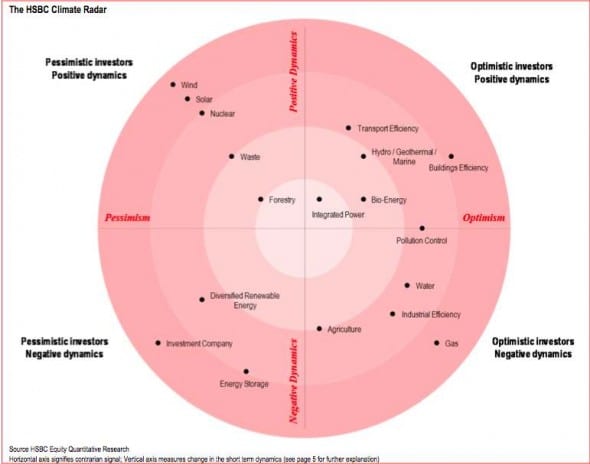

Investment bank HSBC says the wind and solar sectors offer the best opportunity for investors looking at climate themes, while industrial efficiency looks the least attractive.

In a report entitled Climate Radar, that it says is one of the first attempts to profile, quantitatively and systematically, investment opportunities within the climate space, HSBC estimates the wind sector offers upside of 68 per cent, while the solar sector offers an upside of 37 per cent.

It comes to this conclusion by analysing the prevailing short-term dynamics of the sector, and the long-term investor optimism. Wind and solar offer the greatest upside because the dynamics of the sector are positive, but the investors have not been – even though wind was the best performing climate theme in 2013, gaining 83 per cent over the year.

But it is still 73 per cent below its highs of 2008. Solar was the second best performer in 2013, gaining 65 per cent and adding a further 10 per cent in 2013, but it too is well below previous highs. The “price to book” relatives for wind and solar are also below their long term averages.

HSBC says the combination of pessimistic investors and positive sector dynamics is the most attractive quadrant for long investors to focus on, as themes in this quadrant represent potential ‘buys’.

“Often the challenge for investors is to differentiate between genuine value opportunities and value traps,” the analysts write.

“The Radar allows us to separate long-term influences from short-term effects as a means of identifying those themes which are well placed to be recognised and rewarded by the market, in the short term.”

“The Radar allows us to separate long-term influences from short-term effects as a means of identifying those themes which are well placed to be recognised and rewarded by the market, in the short term.”

As the graphs on the right and below show, industrial efficiency is ranked poorly because the sector has negative dynamics, but positive investors, suggesting that many of the price gains have already been locked in.

Curiously, energy storage has a combination of pessimistic investors and negative dynamics – haven’t quite reached that crucial technology cost target.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.