Investment banking giant Citigroup has hailed the start of the “age of renewables” in the United States, the world’s biggest electricity market, saying that solar and wind energy are becoming competitive with natural gas peaking and baseload plants.

In a major new analysis released last week, Citi says the big decision-makers within the U.S. power industry are focused on securing low-cost power, fuel diversity and stable cash flows, and this is drawing them to the increasingly attractive economics of solar and wind.

Citi’s report notes that gas prices are rising and becoming more volatile. This has made wind, solar and other renewable energy sources more attractive because they are not sensitive to fuel price volatility.

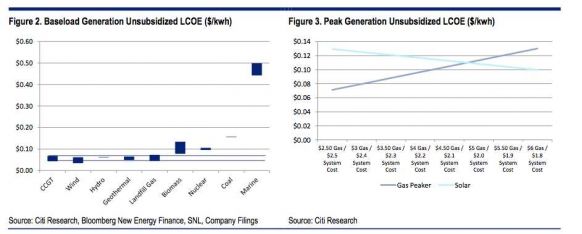

Citi says solar is already becoming more attractive than gas-fired peaking plants, both from a cost perspective and a fuel diversity perspective. And in baseload generation, wind, biomass, geothermal, and hydro are becoming more economically attractive than baseload gas.

The report notes that nuclear and coal are structurally disadvantaged because both technologies are viewed as uncompetitive on cost. Environmental regulations are making coal even pricier, and the aging nuclear fleet in the U.S. is facing plant shutdowns due to the challenging economics.

“We predict that solar, wind, and biomass continue to gain market share from coal and nuclear into the future,” the Citi analysts write.

Citi says the key metric in comparing power sources will be the levelized cost of energy (LCOE). “As solar, wind, biomass, and other power sources gain market share from coal, nukes, and gas, the LCOE metric increasingly becomes important to the new build power generation decision-making,” it says.

Citi defines LCOE as the average cost of producing a unit of electricity over the lifetime of the generating source. It takes into account the amount produced by the source, the costs that went into establishing the source over its lifetime, including the original capital expenditure, ongoing maintenance costs, the cost of fuel and any carbon costs. It also includes financing costs and ensuring that the project generates a reasonable internal rate of return (IRR) for the equity providers.

Below is the key graph on the current state of play, with baseload generation and its renewable competitors to the left, and peaking gas and solar to the right.

On baseload, all renewables except marine beat coal and nuclear. Combined cycle gas just hangs on.

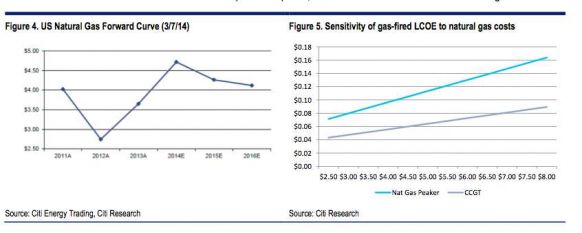

As for peaking plants, it depends on the gas prices, but these are rising, and in some regions, prices are now back above their pre-GFC and fracking boom levels. The move to export LNG will likely cause a further increase in prices.

The following charts provide more details on those gas prices. As can be seen, natural gas prices have nearly doubled in the past two years, and these have a direct correlation to the price of gas-fired electricity.

At a natural gas price of $4.00/mmbtu, the LCOE of a gas peaker is $0.10/kWh and that of a CCGT (combined cycle or baseload plant) is $0.06/kWh. If Citi’s commodities team’s long-term gas price forecast of $5.50 is used, the implied LCOE is $0.12/kWh for natural gas peaker or $0.07/kWh for a CCGT plant.

“These numbers,” Citi says, “set the bar for alternative energy.

“Given the large expected increase in demand for gas, offset by production gains, gas prices are expected to rise over the long term. As a result, the bar for renewables and other fuel sources to cross continues to rise, thus making it easier for alternatives to gain market share.”

Financiers in particular are conscious about the volatility in U.S. gas prices and the likelihood that they will rise. These factors are influencing where they are putting their money, and new YieldCo financing facilities for solar and wind energy are making these technologies both cheaper and more attractive.

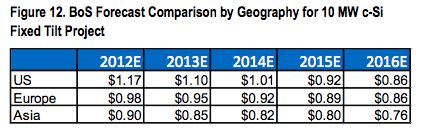

As for solar, costs are coming down. Citi says the base-case LCOE for solar is 13 cents/kWh, the near-term upside is 11 cents/kWh and the long-term upside (2016) is 10 cents/kWh. (This is despite the fact that some power purchase contracts are being written as low as 4 cents/kWh or 5 cents/kWh, but those figures are helped by various tax rebates.)

Citi says the outlook for solar LCOE is favorable, but the devil lies in the details. System costs comprise module costs plus balance-of-systems costs, and these vary based on end user, location, and other factors. As the table above shows, BOS costs are likely to fall sharply in the near term.

With a lower cost of capital, solar becomes much less expensive to finance and develop. In general, the growing financing market for solar has begun to recognize the strong cash flow and low risk profile that characterize solar projects.

“Solar is still early in the growth cycle, and in many countries -- Germany, Spain, Portugal, Australia, and the Southwest U.S. -- residential-scale solar has already competed with average residential electricity prices,” Citi writes. “In 2013, solar was the second-largest source of new generation capacity behind natural gas -- its prospects look bright in 2014 and beyond as costs continue to decline and improve the LCOE picture."

As for wind, it continues to reduce costs, but the most interesting development is the reduction in financing costs, thanks again to the YieldCo phenomenon.

“While LCOE may decline, the outlook for wind is also dependent on the wind levels in the areas it will be built and the cost of baseload alternatives. With gas prices forecasted to rise, the LCOE of wind is becoming more competitive with CCGT alternatives. Despite this, many of the most attractive wind sites are [already] in use and government incentives come into play, which reduces the outlook for wind,” according to the report.

Citi, however, is not as optimistic about hydro, geothermal, and marine energy sources because of physical limitations. “While hydro and geothermal are competitive from an LCOE basis, they require unique geological conditions and as a result, many of the remaining potential new sites have less attractive LCOEs,” the report notes. Marine technologies appear to still be early in their development cycles with an uncertain roadmap.

Coal, it says, is basically priced out of the market. Environmental regulations mean that the LCOE for new coal is around 15.6 cents/kWh, and the report notes that coal only accounts for 2 percent of the generation projects under development.

On nuclear, Citi says cost overruns at the Vogtle plant under construction in Georgia -- now slated to cost $15 billion, way above expectations -- mean that nuclear is pricing itself out of the market. Citi puts nuclear's LCOE at 11 cents/kWh, which it said is relatively expensive, versus combined cycle gas plants and solar and wind. And it notes that while financing costs are inexpensive in the current monetary environment, this situation will not last.

“Financing costs are likely to rise, which would hurt the LCOE attractiveness of a high-construction-cost generating source like nuclear,” Citi says. “As a result, we do not expect nuclear to effectively compete on economic merits. Despite this LCOE dynamic, there is merit to increasing fuel diversity and supporting lower carbon generation."

***

Editor's note: This article is reposted from RenewEconomy. Author credit goes to Giles Parkinson.