The Commonwealth Bank has told its shareholders to expect its support of the coal industry to decline as it helps finance the transition to a low-carbon economy, indicating the bank is unlikely to lend to new large coal projects.

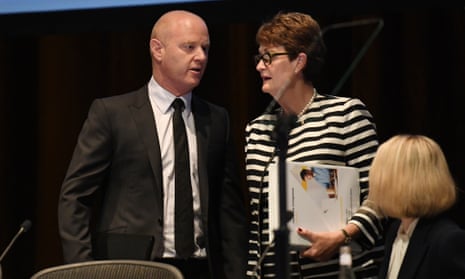

Ahead of its AGM on Thursday, the bank posted the speech of its chairwoman, Catherine Livingstone, to the ASX. In it she said climate change poses both a business risk and a responsibility for the bank.

Livingstone said that the bank’s funding of coal was “small and has been trending down for some time”.

Of particular significance, Livingston said: “We expect that trend to continue over time as we help finance the transition to a low-carbon economy.”

Environmental groups jumped on the statement, some arguing it meant the bank was ruling out any future investments in coal.

“By ruling out future investments in coal they have shown they are willing to literally put their money where their mouth is on fossil fuel investment,” said Jonathan Moylan, a campaigner with Greenpeace. The bank today “set a new standard for financial investment in Australia”.

Julien Vincent, from financial activist group Market Forces, said the comments were significant because they were part of a market disclosure, meaning the bank could be held accountable to the statement.

Vincent said the bank was telling shareholders what to expect – that financing of coal would decline, meaning it was in effect exiting coal.

“Commbank’s exit is one of the starkest indicators yet that coal has no future,” said Vincent.

Vincent pointed out that the bank had not funded any new coal projects since November 2015.

Rob Henderson, former chief economist at National Australia Bank, told Guardian Australia the statement by Commonwealth Bank did not rule out any future funding of coal but it did appear to rule out funding of any new large coal projects, or assisting the opening up of new coal regions.

“It doesn’t rule out a small expansion of a Newcastle coalmine, for example,” Henderson said. “This is a statement to shareholders saying ‘You can expect that we will not continue to invest in that at the same rate as in the last decade in coal. You can expect that we will be changing the mix of our lending book away from coal and towards a low-carbon economy.’”

Vincent said a significant test for the bank’s adherence to the statement would come when Adani’s Abbot Point coal terminal came up for refinancing. The Commonwealth Bank has said it would not be funding Adani’s Carmichael coalmine, but it remains the most exposed Australian bank to Abbot Point.

“Now the bank needs to exit from Abbot Point, which would not only uphold the commitment made today but ensure it no longer has any part in Adani’s dirty coal export plans.”

The chief executive of 350.org, Blair Palese, said the announcement was a big step “for the bank that has struggled to lead on climate change”.

“For four years we have worked with the bank, protested and worked with thousands of people around Australia to divest from the bank and demand leadership. Today we saw leadership and we say thank you,” Palese said.

While the bank’s moves in relation to coal have been welcomed by environmental groups, its continued support for other fossil fuel sectors has frustrated them. Market Forces analysis has found the bank has lent $6bn to fossil fuel projects since it committed to support keeping warming to less than 2C in 2015 – four times what it has lent to renewable energy in that time.

“Publicly stating its exit from coal is a welcome move,” concluded Vincent. “However, lending to all new fossil fuels must be phased out in order to meet its 2C goals.”

The Australian financial regulator, Australian Prudential Regulation Authority (Apra) has put the finance industry on notice on the issue of climate change, saying it could be forced to complete climate risk scenario testing.

In August, two Commonwealth Bank shareholders began a class action against the bank for inadequately disclosing the risks associated with climate change. After it was revealed the bank acknowledged that climate change posed a significant risk, and announced it would be conducted a climate scenario risk analysis, the class action was dropped.

Comments (…)

Sign in or create your Guardian account to join the discussion