What's going on in Beer World? Beer lovers of America might be forgiven if their grasp of the current brew-scape feels iffy. Alice herself would be at home in this Wonderland. It's a world in which up is down, little is big, and there's no Blue Moon on the horizon.

It's a world in which old standbys are faltering (case sales of Miller High Life were down almost 10 percent in 2013 from the prior year). Mexican labels are dominant (Corona, Modelo, and Dos Equis, account for three of the top four imported beers). And a craft-beer company founded only 20 years ago is coming on strong ("Bartender, pour me a Lagunitas").

The March 2014 issue of Beverage Industry offers us a through-the-looking-glass portrait of Beer World in the United States today. The magazine unleashed its writers on data gathered by Information Resources Inc. (IRI) of Chicago from supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains for the 52 weeks ending December 29, 2014. I made graphs and charts from their tabular data.

Before we delve into the particulars, let's remember the big picture: over the past twenty years, per-capita consumption of beer in the U.S. has been declining. Derek Thompson wrote about that here last August, citing this report. But twenty years is a long lens. Let's take a look at the state of Beer World in the last year.

Domestic Beer

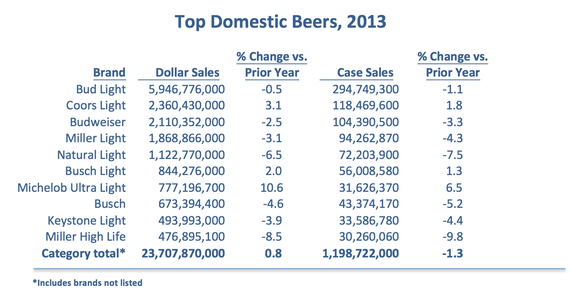

If you were to hazard a guess as to which domestic beers are the top sellers by volume, you'd probably manage to guess at least half of the top ten. These are the familiar, less-expensive brands, regular as well as light, that you see everywhere—Budweiser, Coors, Miller, etc. The table below tells the story about the top ten domestic beers in 2013.

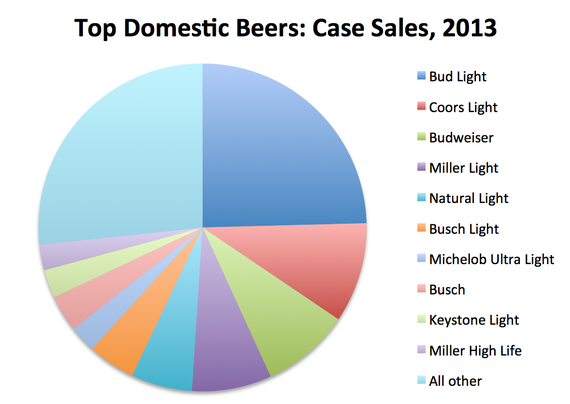

This pie chart makes it easier to visualize the relative size of these various domestic brews, as measured by annual case sales. Bud Light accounts for nearly as much market share as all the other non-top-10 domestic beers combined. Lumped together, the beers ranked six through 10 also account for a smaller market share than Bud Light.

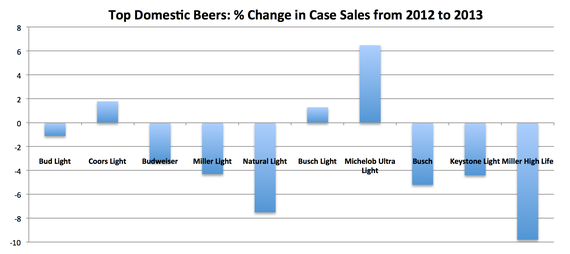

Stephanie Cernivec's report in Beverage Industry reveals a far more interesting picture emerging when we look at what kind of year each of these top 10 domestic beers had in 2013. The following chart shows the percent change in case sales that each of the top ten brands experienced from 2012 to 2013.

Michelob Ultra Light was the big winner among the top ten, with its case sales rising 6.5 percent. But seven of the top ten domestic beers suffered sales declines for the year. In the case of Natural Light and Miller High Life, the declines were steep—7.5 percent and 9.8 percent, respectively.

Imported Beer

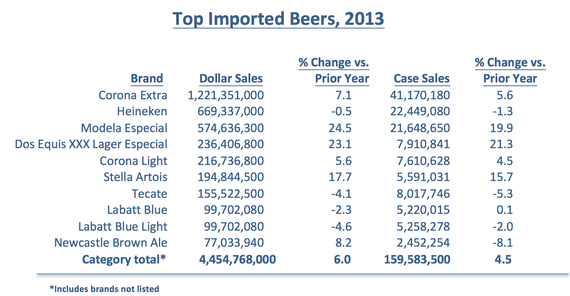

While the domestic-beer category is hurting, the imported-beer category is thriving, according to Jennifer Haderspeck's report in Beverage Industry. Imported beers grew in volume by 4.5 percent in 2013. The following table contains the particulars on the top ten imported beers:

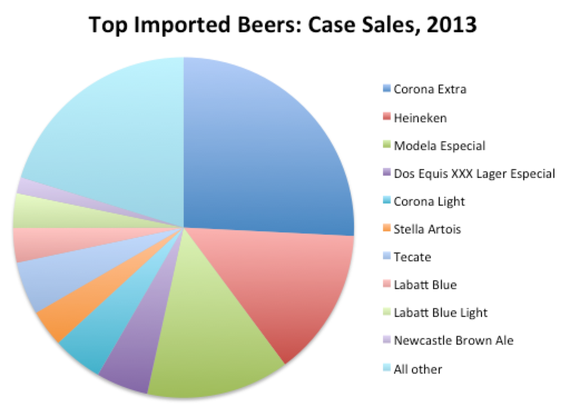

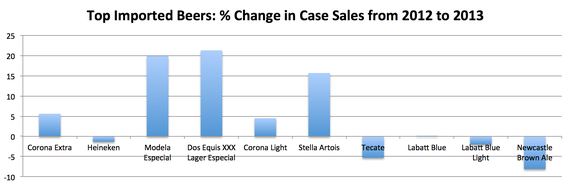

The pie chart to the left shows each of the top ten imports' relative share of this market segment, a category in which much of the growth is being propelled by Mexican beers. The Mexican brews grew in 2013 twice as fast as total imports (11.1 percent vs 5.3 percent). By comparison, Canadian imports as a group were down 6.5 percent last year, and European imports declined 2.1 percent. Experts attribute growth in the Mexican-beer segment to the growing Hispanic population in the United States, and aggressive marketing by these brands (think of the "Most Interesting Man in the World" commercials from Dos Equis, or the "Find Your Beach" campaign by Corona). The relative fortunes experienced in 2013 by the top ten imports are evident here:

Craft Beer

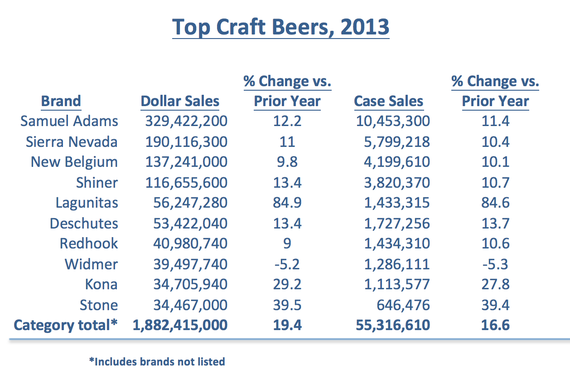

Although craft beers are popular, and this segment of the market is the one in which the most exciting things are happening, craft beers generally remain way behind the main domestic brews and imports in both case sales and revenue. Part of the explanation for this has to do with distribution. Reporting for Beverage Industry, Jessica Jacobsen cited one industry expert who noted that while craft beers have good distribution in grocery stores and liquor stores, they're less available in convenience stores and gas stations, which lack the space to accommodate a large variety. But that's changing as distribution through those latter outlets grows. And, overall, the growth rates for craft beers is much greater than for major domestics or imports. In a future post, I'll have more to say about the craft-brew industry. For now, here's the basic rundown on the top 10 brands in the craft-beer segment:

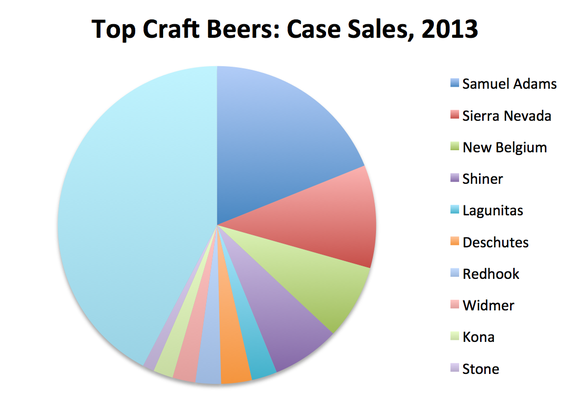

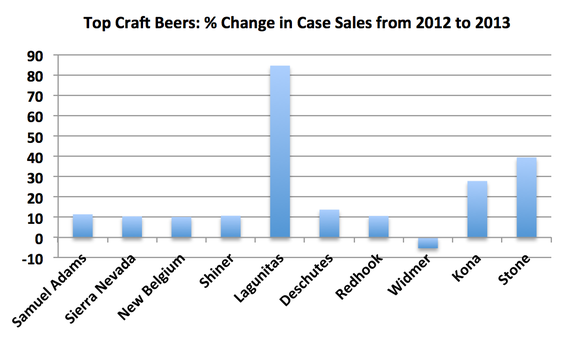

This pie chart offers a better visualization of the relative share held by each of the top ten craft beers. And the bar graph below shows how each brand fared over 2013. Can you say "Lagunitas"?

What about Blue Moon? Whether or not you consider the MillerCoors brand a craft beer (other producers in that segment certainly don't), you may wonder why it doesn't show up on any list. If so, your curiosity may stem from a map that was ubiquitous on the Web back in October. The map came from Blowfish (the makers of "the hangover cure"), which conducted a survey of 5,000 drinking-age adults around the United States. The map purported to show each state's top beer choice and also made the claim that Blue Moon is America's favorite beer, with Sam Adams coming in second.

Writing at the time about this map and its claims, The Atlantic's Jordan Weissmann offered his opinion about Blue Moon ("that bland excuse for a Belgian white ale brewed by MillerCoors"), and questioned the validity of the claims ("Something about these results smells a bit off."). On the basis of all the data examined above, I'd say there's plenty of reason to share Weissmann's skepticism.