Fears that Greece is close to defaulting on its debt swept European trading floors on Monday morning after talks between Athens and its creditors collapsed on Sunday.

The Greek stock market slumped by almost 7% in early trading, as traders showed alarm that a deal will not be reached before the country’s bailout programme expires on 30 June.

Despite growing pressure, the Greek prime minister, Alexis Tsipras, is refusing to accept new spending cuts and tax rises to achieve the budget surpluses demanded by Greece’s lenders.

“One can only see a political purposefulness in the insistence of creditors on new cuts in pensions after five years of looting under the bailouts,” Tsipras told Greek newspaper Efimerida Ton Syntakton on Monday morning.

“We will wait patiently until the institutions accede to realism,” he said. “We do not have the right to bury European democracy at the place where it was born.”

The war of words between the two sides continued, with Jens Weidmann, the head of Germany’s Bundesbank, saying time was running out for Greece.

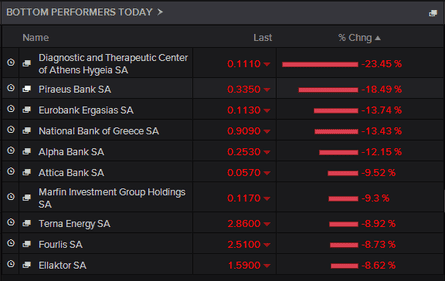

Greek financial shares were routed on Monday morning, with Piraeus Bank tumbling by 18% and Eurobanks down 15%, dragging the Athens market to its lowest point since mid-April.

The price of Greek two-year government bonds fell sharply, as investors raced to sell up in case Athens should default on its debts.

#Greece's 2yr yields jump to 28.3% as default risks rise after debt talks collapsed. pic.twitter.com/EXCdYd8WM1

— Holger Zschaepitz (@Schuldensuehner) June 15, 2015

Analysts warned that the collapse of negotiations on Sunday, after just 45 minutes, has pushed Greece closer to default and a potential exit from the single currency.

“Even if the parties involved do reach a deal in the near future it will likely be a short-term one only,” said Gary Jenkins of LNG Capital. “Indeed the lack of trust suggests that funds will be drip-fed to Greece and that a longer-term agreement will be very difficult to reach.”

According to local media Tsipras has called an emergency meeting with top ministers to discuss the situation, including chief negotiator Euclid Tsakalotos, the deputy prime minister, Yannis Dragasakis, and the state minister, Nikos Pappas.

Talks are now in limbo until Thursday, when eurozone finance ministers meet for their scheduled Eurogroup meeting.

That is probably the last chance for Greece to negotiate a deal to unlock the €7.2bn (£5.2bn) of bailout funds that have been frozen for months, says Peter Rosenstreich, head of market strategy at online bank Swissquote.

“We expect markets will feel the heat this week as the odds of a Greek default have increased considerably,” Rosenstreich added.

All the main European markets fell on Monday morning, with Germany’s DAX index down 1.1%. In London, the FTSE 100 index of blue-chip shares was down 37 points or 0.5% at 6746.

How the talks collapsed

On Sunday night, the European commission warned that: “While some progress was made, the talks did not succeed as there remains a significant gap between the plans of the Greek authorities and the joint requirements of the commission, European Central Bank and IMF.”

In fiscal terms, the differences amounted to €2bn a year in permanent budget savings.

The gulf between the sides prompted a call from the IMF’s chief economist for both sides to compromise further. Olivier Blanchard said Brussels should be prepared to delay more of Greece’s debt repayments, accept only limited reforms and cut the interest applied to debt-relief loans, while Tsipras should offer further pension reforms and accept that some VAT exemptions must be dropped.

“On the one hand, the Greek government has to offer truly credible measures to reach the lower target budget surplus and it has to show its commitment to the more limited set of reforms,” Blanchard wrote in his economic blog. “On the other hand, the European creditors would have to agree to significant additional financing and to debt relief sufficient to maintain debt sustainability.”

The intervention by Blanchard late on Sunday will be widely seen as supportive of the Greek position, though with the sting for Athens in his call for pension reform, which Yanis Varoufakis, the Greek finance minister, repeated on Saturday was a dealbreaker.

With the future of Greece in the eurozone on the line as never before – and time now of the essence if Athens is to honour a €1.6bn debt repayment to the IMF on 30 June – the magnitude of the moment was not lost on Greek officials or the prime minister’s radical-left Syriza party.

Dragasakis, who flew to Brussels to head talks, said Athens remained ready to conclude negotiations “with a mutually beneficial agreement”, suggesting there was still room for compromise.

Blaming foreign lenders for the breakdown in talks, he said the Greek government had submitted complementary proposals that “fully cover” the fiscal gap and the primary surplus – the two major sticking points between the two sides.

Creditors, he said, had insisted on pension cuts and increases in VAT both worth 1% of GDP – or €3.6bn – to close the projected gap, measures that Athens regards as untenable for a population already pauperised by five years of biting austerity. It was the second economic reform package to be proposed by the Greek government and rejected by creditors in June.

“Despite the presence of the Greek delegation in Brussels, there was no response on the part of the institutions [European commission, ECB and IMF] for discussions at the same [political] level or authorisations that would permit a solution to the issues that remain open,” Dragasakis said in a statement.

Tsakalotos said it was clear “the opposite side did not have a mandate to negotiate”. He told the Guardian in a text message: “We made huge efforts to meet them halfway but they insisted on both pension cuts and the increase in VAT on restaurants and would not accept closing the gap even partially via administrative measures to reduce tax evasion, even though this was a central plank of our electoral programme. Moreover, they told us bluntly they had no mandate to discuss a compromise! So much for negotiating.”

With developments taking such a dramatic turn, opposition parties urged Prokopis Pavlopoulos, the head of state, to call an emergency meeting of political leaders. “The country has to remain intact within Europe and this has to be understood by everyone,” said the centrist party, To Potami. “We await a responsible reaction from the political leadership of the country.”

Failure to keep Greece in the euro, after years of arduous negotiations and two emergency bailouts totalling €240bn, would send it lurching into the unknown and mark a historic blow to the EU’s most ambitious project.

Greek officials flew to Brussels after Tsipras signalled he would soften his stance and accept painful compromises in return for promises to alleviate the country’s staggering debt.

Government sources had indicated that Athens was “very close” to sealing a deal that would release more than €7bn in bailout funds the country now desperately needs to avoid defaulting on loans to the IMF and ECB over the summer. Creditors have refused to disburse financial assistance since August as both sides have wrangled over reforms.

A gesture on the ever-contentious issue of Greek debt would also allow Tsipras to sell a deal to hardliners in Syriza, which was catapulted into power in January on a pledge to end five gruelling years of “self-defeating” austerity, and to Greeks at large.

At more than €320bn, the equivalent of 180% of the country’s entire economic output, Greece has the highest debt-to-GDP ratio in the EU with economists far and wide agreeing it is unsustainable. Following the breakdown in talks, leftwing militants implored the government not to concede on any measures that would entail “the extinction of the Greek people”.

Fears now abound that Greece could be heading for a Cyprus-style denouement with the ECB pulling the plug on the emergency liquidity assistance (ELA) it has been drip-feeding Greek banks. The Frankfurt-based institution has come under growing pressure to make such a move in recent weeks.

Indicative of the growing tensions between Athens and Berlin, the biggest contributor of Greece’s bailout programme to date, Sigmar Gabriel, Germany’s vice-chancellor and head of the country’s Social Democratic party – who has long been seen as a friend of Greece – criticised the Greek government’s negotiating tactics in an article for Monday’s daily Bild newspaper.

“The game theorists of the Greek government are in the process of gambling away the future of their country,” he wrote in an excoriating critique of Varoufakis, whose academic expertise includes game theory. “Europe and Germany will not let themselves be blackmailed. And we will not let the exaggerated electoral pledges of a partly communist government be paid for by German workers and their families.”

Comments (…)

Sign in or create your Guardian account to join the discussion