After a Data Breach

(Because protecting your customers after a data breach is important if you want to keep them)

FRSecure is a full-service information security management company that protects sensitive, confidential business information from unauthorized access.

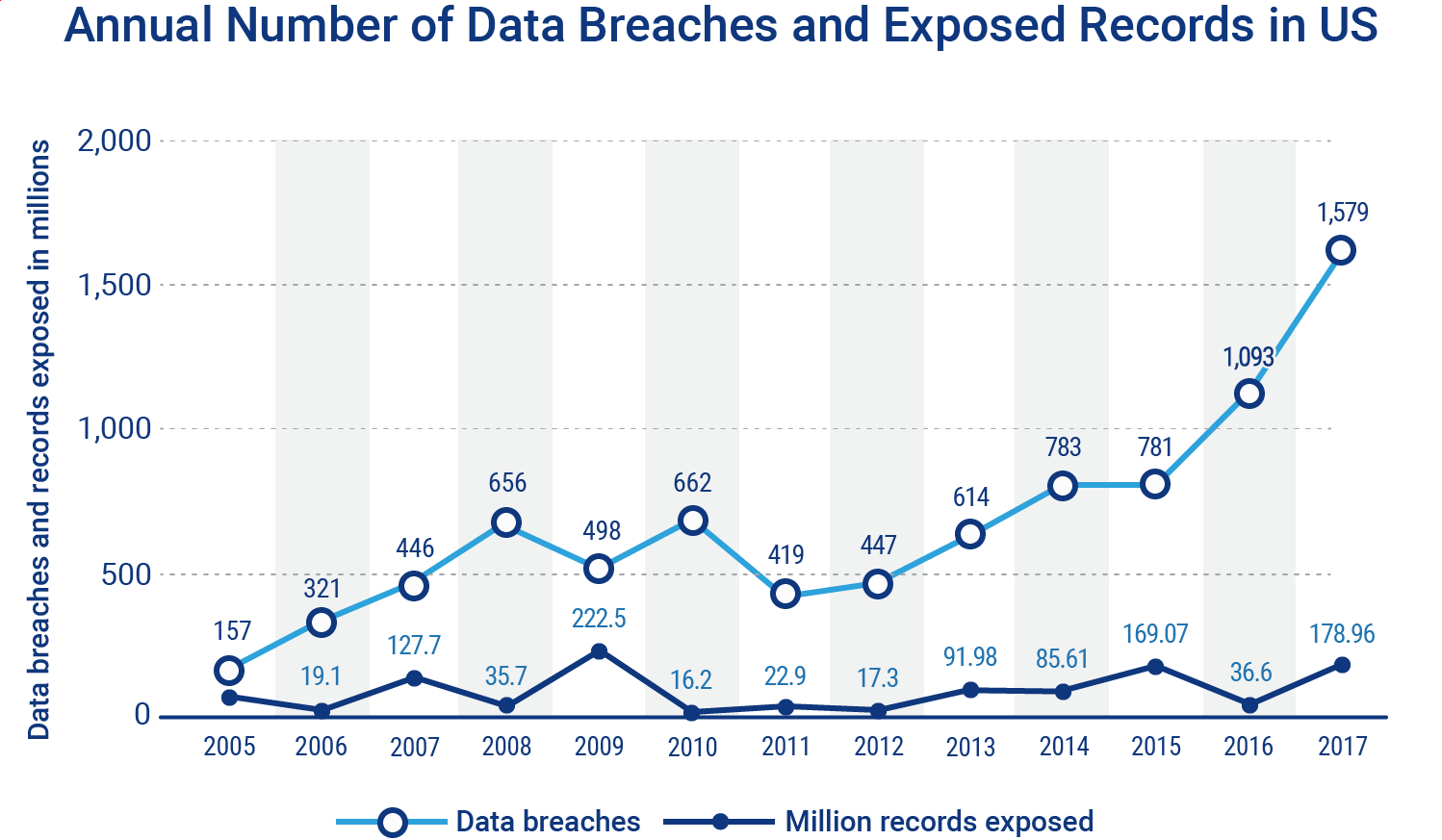

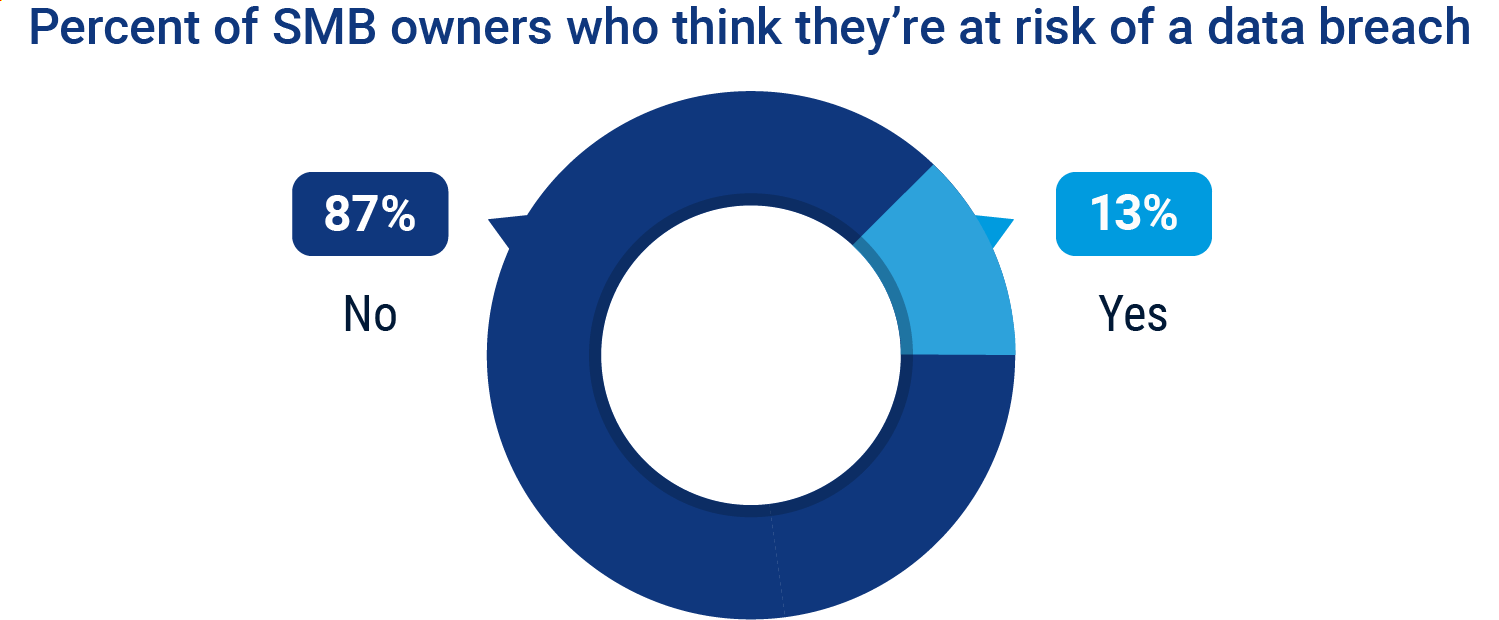

Now that data breaches are becoming more and more popular, companies are finding themselves in the cyber hot seat. There are a number of things that can keep a business from buttoning up security. They may not have the required time and resources, they may be living in denial, or just not understanding it enough to take the first steps.

But what happens if a hacker attacks and steals mountains of sensitive data? You've now unintentionally released all of your customer's data to a stranger. It shouldn’t come as a surprise that they, and Americans in general, are not fans of cyberattacks and actually fear them more than getting murdered.

An independent Insurance agent can help you build a solid incident response plan with cyber insurance so your company can survive a breach.

First, the Customers Get Angry

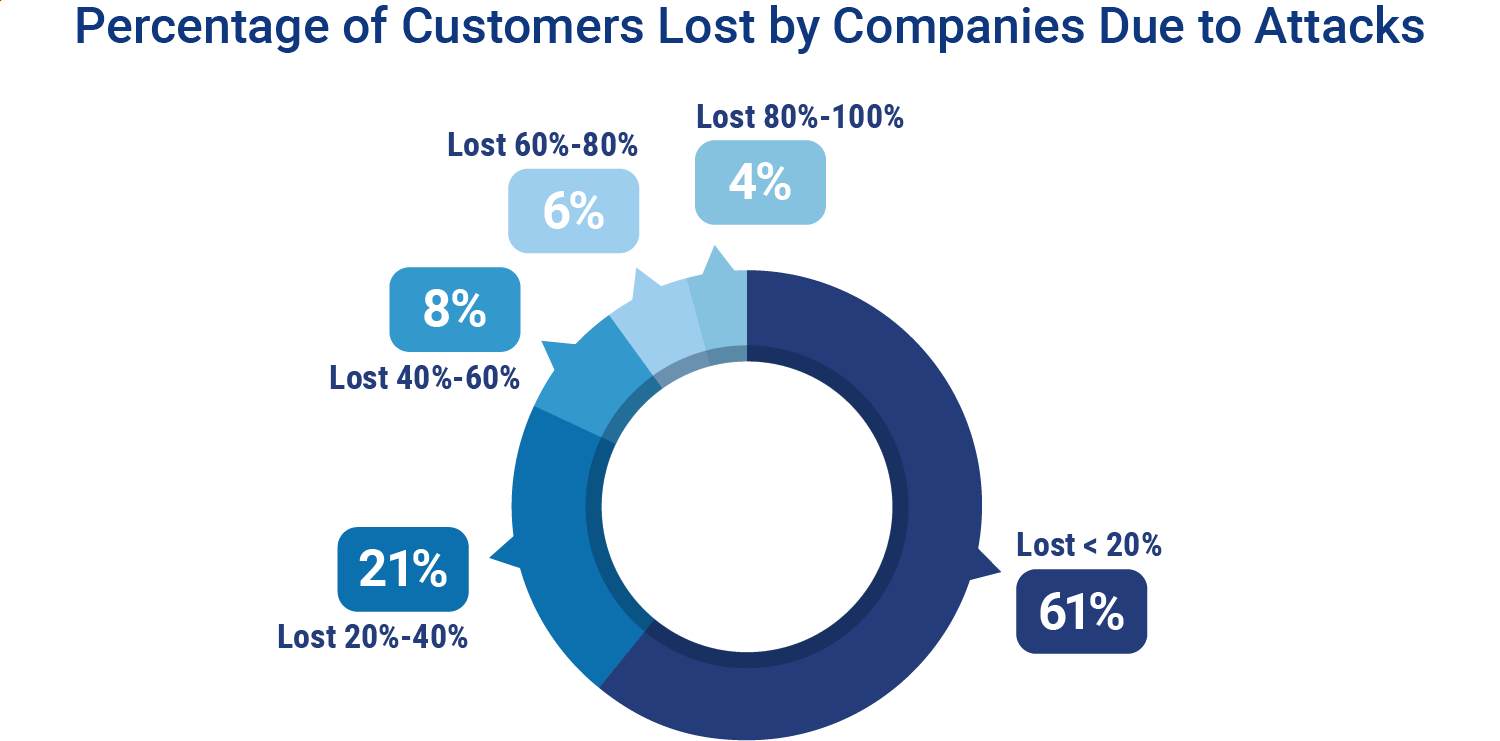

Even if your patrons are in love with your brand, losing their data can end their admiration instantly. Angry customers not only lead to less purchasing, but can result in bad reviews and bad word of mouth.

It takes time to build a brand’s reputation and trust with their customers. And in one fell swoop, a hacker can tarnish your reputation and turn loyal customers against you. Unfortunately, it doesn't end there.

Then, the Internet Does Its Thing

Unfortunately, we're in a world where people love to take to the internet with their complaints. It only takes one influential person to start a hashtag against your company and get a lot of people on board whether they're familiar with your business or not. That's why it's important to consider your reputation post data breach and take measures to not let it be tarnished.

If you become a trending topic, then it becomes a contest about who can come up with the best burn, and it can get all kinds of nasty. If you’re smart, a genuine public apology should be your only response. No matter what's being said about you, you never want to engage in arguments online.

Sadly, Breach Fatigue Can Be a Good Thing

If you’re hoping for some kind of miracle that will soften the blow of an attack, breach fatigue might be what you’re looking for.

Now that data breaches are becoming more common, people are starting to become numb to them. If they’re not personally affected, they might forget the whole thing altogether. For big companies, breaches could just be tiny blips and eventually fall off everyone’s radar, but small companies may not be so lucky.

Due to hacking concerns, shopping behavior is trending towards major brands and retailers. Consumers think the big players will have the funds to make things right or the social visibility to be forced to. That being said, if it does happen to you, is your product or service so awesome that it’s worth their trouble? And will you have the funds to recover?

Preventing Public Outrage

As much as you wish that your customers, online trolls, and the general public would recognize you as the innocent victim, it’s probably not going to happen. Instead, you will be considered the person at fault until an investigation has been completed.

During your time under the microscope you will have to prove that you weren’t negligent and admit anything you could have done to prevent the breach. If you can prove that you did everything you could, the world, including customers, regulators, and the law, may show you some mercy.

The Importance of an Incident Response Plan

Having a solid incident response plan is key to surviving a breach. This will help you address and conquer a cyberattack while limiting damage and cutting recovery time and costs.

Coming up with this emergency protocol is a journey no business owner should go alone. If your company isn’t big enough to have an IT department or a C-Level exec for this initiative, then hiring a legit cybersecurity company will be your best bet.

Double-Check Your Cyber Liability Insurance

With data breaches being so common, we still learn that companies are not double-checking their policies. Even if you do everything you can to prevent a breach and respond like a pro, it’ll cost you. Having the right cyber liability insurance can be your ticket to recovering financially.

Unfortunately, cyber coverage in most business plans is not as awesome as you’d hope. But finding adequate protection isn’t as hard as you think.

Risk placement services (RPS) make it incredibly easy to get accurate quotes in minutes. Plus, it only takes four simple questions to bind coverage up to $100 million in revenue. So you’ll have that going for you.

Benefits of an Independent Insurance Agent

And there it is, a handful of data breach talking points to take to your company. Remember, the reason you’re in business is your customers. And if you lose their sensitive info and their trust, you could be on a direct path to liquidating your assets on Craigslist.

Independent insurance agents have access to multiple insurance companies, ultimately finding you the best coverage, accessibility, and competitive pricing while working for you. Find an independent insurance agent in your community here.

Human References: Evan Francen, Suzy Feine and Stefan Dorn from FRSecure

Reference: from our friends at Gallup (2015)

Reference: from our friends at Cisco (2017)

Reference: from our friends at Identity Theft Resource Center (2017)

Reference: from our friends at Manta (2017)