Climate Roulette: Getting to the heart of the climate challenge

‘An ounce of prevention is worth a pound of cure.’ It’s a cliché, but it holds an important lesson for climate change. So far in our blog series on climate risk, we’ve talked about the severity of the risks we face, what those risks mean for us, and how we can reduce those risks by adapting to a changing climate. In this fourth and final blog, I’m going to talk about reducing the degree of climate change we experience in the first place.

The task before us

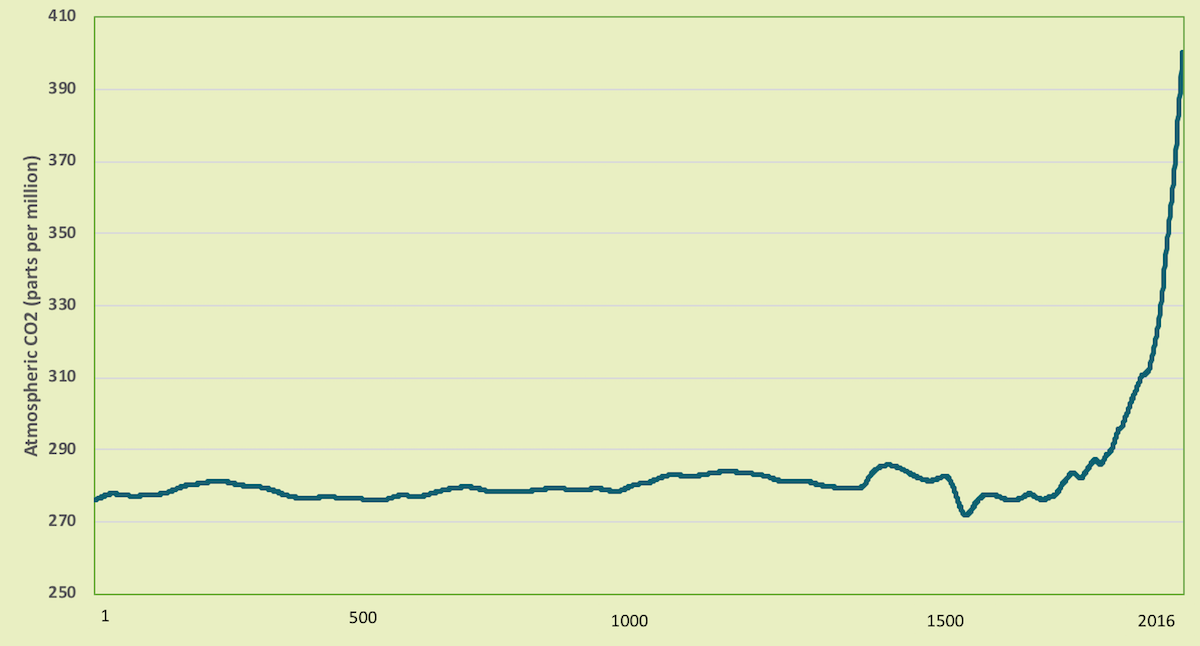

To reduce the risk of our climate changing, we need to reduce the concentration of greenhouse gases (GHGs) in the atmosphere. The more GHGs we emit, the higher this concentration climbs. And the higher it climbs, the more climate risks we face, and the more likely we are to suffer major consequences. To avoid these consequences, we need to reverse the trendline in the figure below. And soon.

Figure 1: Atmospheric CO₂ concentration over the last 2000 years

Source: Our World in Data

Source: Our World in Data

Climate change is a monumental collective action problem, so relying on people to voluntarily reduce their emissions won’t cut it. Carbon pollution is a market failure. Dealing with it requires public policy.

But what kind of policy? Which policy tools should we use? How stringent should they be? And to whom should they apply?

Three different—and competing—goals

Discussions about climate policy get bogged down because there are multiple, competing goals at play—goals that people weigh differently.

To explore this idea, I’m going to borrow from our 2018 report Responsible Risk: How putting a price on environmental risk makes disasters less likely. The report focuses on a slightly different context: managing the risks of environmental disasters like spills, leaks, and explosions. But it breaks down the policy goals surrounding risk management in a useful way.

Essentially, when grappling with risk, we have three different goals:

- Deterrence: we want to reduce the risk of harm occurring in the first place

- Economic activity: we want to protect and support our economic prosperity

- Compensation: we want to ensure that unfair impacts get addressed

All three goals are legitimate. The problem is that it can be hard to achieve them all. Reducing risk to zero usually has an economic cost. But is zero risk worth its costs? And if it isn’t, what is the “right” amount of risk?

Part of the reason we get stuck in arguments over climate policy choices is because we’re really arguing over how much weight we should give to different priorities. Emphasizing one goal over another can lead us to draw different conclusions about the same set of tools.

- Deterrence – reducing the risk of climate change

Emphasizing deterrence means seeing climate change first and foremost as a risk-management problem. It means reducing the probability of the kind of impacts we talked about in the second installment of this series, especially the catastrophic ones that scientists tell us are becoming more and more likely.

Reducing emissions is critical to the deterrence goal. David Roberts uses the term climate hawks to describe people who think the risks of climate change are sufficient to warrant a robust response. Climate hawks don’t care what policy instruments governments use (carbon taxes, regulations, whatever), so long as they’re stringent enough to deeply reduce emissions. And some may even call for an ‘all-of-the-above’ approach to ensure the job gets done.

- Economic activity – protecting and supporting prosperity

Emphasizing economic activity means looking at climate policy options through the lens of investment, jobs, and economic growth. This doesn’t mean choosing to ignore the costs of a changing climate. Rather, it’s a matter of wanting to bring the right tools to bear, so that we decarbonize our economies in a way that doesn’t unnecessarily harm living standards—both current and future.

Various concerns can motivate this outlook. In many cases, it’s simply a matter of recognizing that, given the scale of the challenge, we cannot afford economically-inefficient solutions.

We should take these concerns seriously. A low-carbon transition risks being extremely costly if we get it wrong. And we’re more likely to get broad-based support if we can show we’re going about it intelligently. This is why we focus so much on cost-effectiveness here at Ecofiscal.

- Compensation – addressing unfair impacts

Emphasizing compensation means wanting to help and support those who stand to lose the most from climate change. Compensation can come from either helping people avoid harm in the first place (i.e., via adaptation) or by redressing it after-the-fact.

Various types of groups may deserve compensation, for example:

- Municipalities are on the front lines of climate change, but given that existing revenue tools leave them ill-equipped to absorb the additional costs, they may need outside support to successfully respond.

- Northern Indigenous communities’ way of life is already under threat from climate change, and the impacts are expected to get worse.

- Developing countries will suffer disproportionately from the impacts of climate change, but without international climate finance they will struggle to adapt (which will have consequences for developed countries).

- Canadians all over the country risk losing their livelihoods and property to climate change.

But who should pay for compensation? Basic principles of fairness suggest that it should be those who disproportionately create the problem. Does that mean that as the consumers of fossil fuels, we’re all culpable? What about the producers? Are they only liable if they acted with full knowledge? And what about current versus historical responsibility for climate change? There are no easy answers here.

Almost all of us will support compensation of one form or another. But we’ll also likely have differing views of what we consider “fair.”

Reconciling the three priorities

In climate policy discussions, it’s understandable that people would want to mitigate climate risk, maintain prosperity, and support those in need. We want all of these things. But different policy mixes are going to give us different outcomes across these goals. As a result, it’s understandable that people are going to disagree about climate policy choices.

At the same time though, just because we can’t have it all doesn’t mean we can’t find a reasonable balance. Carbon pricing in particular stands out. While it can’t do everything, it can reduce GHGs at a lower economic cost than any other policy instrument. And it can generate revenues that can help fund climate adaptation.

But regardless of which climate policy instruments we choose, they will only reduce risk if they are stringent—and this is one area where compromise is not a good idea.

One of these things is not like the other

Our three-goal framework has a key limitation when we apply it to climate risk. In Responsible Risk, we were agnostic about how policy-makers dealing with risk should weigh their three goals.

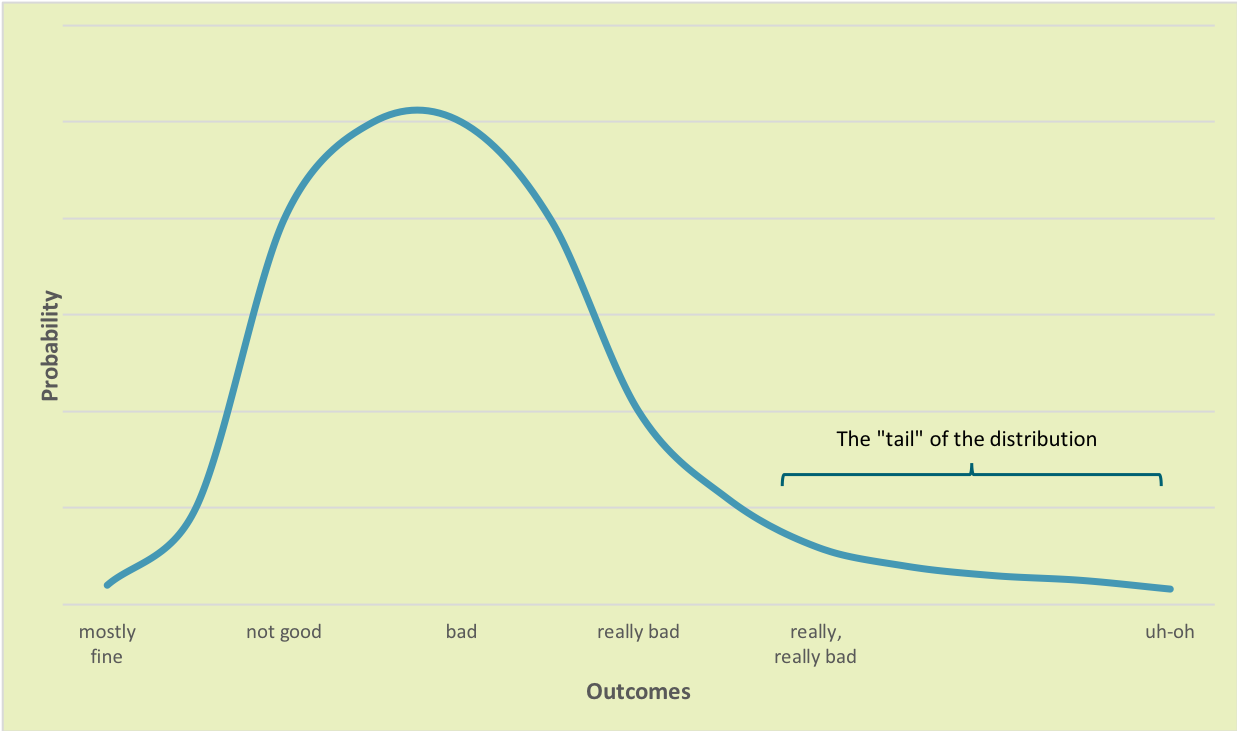

But climate risk is different. The costs of climate change’s more extreme scenarios are, frankly, devastating. Climate change is a “fat-tailed” risk. When the probability distribution for a risk has a fat tail, extreme impacts are possible, as illustrated in the figure below.

Figure 2: Illustrating climate change’s “fat-tailed” risk

While there’s probably some band of climate outcomes that most people could live with, nobody would comfortably accept climate change’s tail risks. Yet scientists are telling us (as unequivocally as scientists get) that the tail risks are real, and getting more real with every day of inaction. Climate change is putting the future of human civilization at stake—to say nothing of the planet’s plants, animals and insects. It is, without a doubt, the biggest risk we face.

A risk we shouldn’t accept

Yes, climate policy should be economically efficient. And yes, it should help the most vulnerable. But most importantly, it should be stringent. Because if fairness asks us how we want to divide the pie, and if prosperity asks us how we want to grow it, climate risk is asking us whether we’re comfortable wrecking the entire pie.

Thankfully, climate change is a risk we still have control over. The policy choices that we will make in the coming years have the potential to significantly reduce the amount of climate change we’ll experience. It is not a risk we have to accept.

1 comment

Fat-tailed risk – thank you for that clear explanation. In general I’ve been promoting ‘cheap, steep and deep’ as a way to describe a stringent use of broad based carbon pricing. But not too steep: assets -human assets like career disruption, and capital assets like long-lasting machinery- can become stranded -retired before their end-of-life- and at a cost to the economy, so called stranded asset costs. One way to reduce stranded asset costs is to signal / tell people early / now what the price per tonne will be in a decade or two, so when making career or long-lasting machinery or business decisions now, they can take future prices into account. And that’s something that I haven’t hear much of yet in public discussions. My own un-professional estimate: if Canada used only carbon pricing -which is the cheapest per tonne abated- we need about $200/tonne by 2032 and $350/tonne by 2042 to get Canada on track for Paris targets. In saying that I hope I will save ordinary people from costs of stranded assets as they make long term decisions today.

Comments are closed.