by Calculated Risk on 9/18/2009 04:11:00 PM

Friday, September 18, 2009

Market, “I.B.G. - Y.B.G.” and Fed MBS and Treasury Purchases

While we wait for the FDIC (HomeGnome has a poll each week in the comments!): Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And from Eric Dash at NY Times Economix: What’s Really Wrong With Wall Street Pay?

Note: “I.B.G. - Y.B.G.” stands for what happens - from a trader's perspective - if a huge trade goes South: "I’ll Be Gone and You’ll Be Gone"

And since we've been discussing the possible impact of Fed purchases on mortgage rates, from the Atlanta Fed weekly Financial Highlights:  From the Atlanta Fed:

From the Atlanta Fed:

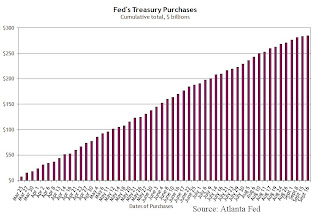

On September 15, the Fed purchased $2.05 billion in Treasuries, roughly in the 10-17 year sector; on September 16, it purchased $1.799 billion in the one-to-two year sector. It has purchased a total of $285.2 billion of Treasury securities through September 16. The Fed plans to purchase $300 billion by the end of October, or about six weeks from now, which makes for a pace of about $2.5 billion in purchases per week.

And from the Atlanta Fed:

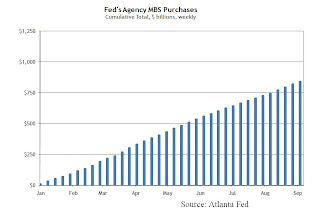

And from the Atlanta Fed: The Treasury purchases have slowed and will end in six weeks. The MBS purchases are ongoing.The Fed has purchased a net total of $18.8 billion of agency MBS between September 3 and 9. It bought $3.6 billion of Freddie Mac, $12.4 billion of Fannie Mae, and $2.9 billion of Ginnie Mae. The Fed’s cumulative MBS purchases have reached $840.1 billion, and it has announced plans to purchase up to $1.25 trillion by the end of the year.