Q I am based in London and work full-time earning around £33,000. I'm keen to get onto the property ladder as I'm nearly 37-years-old and feel that time is running out. I would look to buy on the outskirts of London or further out if I could commute in easily. Based on my income I estimate I could apply for a mortgage of between £105,000 and £125,000. I'm working hard to pull together a deposit and hope to have 5% to 10% saved in about a year's time. Based on my current salary I estimate I could purchase a property of around £160,000 with Help to Buy.

There has been a lot written about the second phase of the government's Help to Buy scheme and in my circumstances applying for the scheme is very attractive as it would help me get on the housing ladder a lot more quickly, with a smaller deposit in London, where prices are so high. I'm not sure I could save for a deposit large enough without the Help to Buy scheme if I wanted to buy in London before I'm 40-years-old.

In a couple of years' time I expect my salary to increase as I move roles which could mean I borrow more if I applied for a mortgage later but I would prefer not to wait until then.

My concern with Help to Buy is all the controversy that surrounds it and comments from economists about inflating the property market but it would help me personally get a foot on the property ladder. Should I take advantage of Help to Buy or should I wait longer to save a bigger deposit further down the line (though due to my age I wouldn't want to do this any later than 40 and I may not catch up if prices continue to rise)? SM

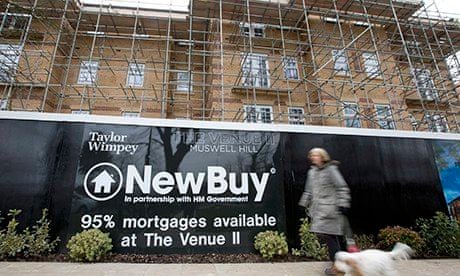

A A lot has been written about the second phase of the government's Help to Buy scheme in recent weeks because it has been launched earlier than originally planned. Unlike the first part, which offers homebuyers an interest-free loan, the second phase of Help to buy doesn't give the buyer any cash but instead provides a limited number of mortgage lenders with a partial mortgage guarantee to encourage them to offer mortgages of up to 95% of the value of the property. In common with the first phase of Help to Buy, buyers will have to provide a cash deposit on their home of at least 5% of the purchase price.

The taxpayer-backed guarantee does not, however, guarantee that you will get a 95% mortgage, as you will need to pass lender affordability checks and have no history of difficulties in meeting debt repayments. Even if you do qualify for a 95% Help to Buy mortgage, the question you should be asking yourself is not whether you want to use Help to Buy but whether you want to take on that level of debt. If you bought somewhere for £160,000 with a 95% 25-year repayment mortgage (interest-only aren't allowed) with an interest rate of 5%, your monthly mortgage payments would be just under £890. Only you (and a potential lender) can say whether that's affordable but over a year, it works out as just under a third of your pre-tax salary.

I suspect that if you really do want to get on the property ladder as quickly as possible, you might be better off going for a new build property with the first stage of Help to Buy. For a property costing £160,000, you would need a deposit of £8,000, a 75% mortgage of £120,000 and a cash loan of £32,000 from the bank of Dave and George to put towards the purchase price. Again, assuming an interest rate of 5%, your monthly mortgage repayments would be about £700. In addition, for the first five years, there would be no interest to pay on the government loan so if, as you say, your salary will increase in the future, you could aim to save up enough to repay at least some of the interest-free money before you have to start paying interest on it in year six of the loan.

Note that the equivalent of the first stage of the Help to Buy scheme in Scotland, Northern Ireland and Wales works differently, although the second mortgage-guarantee Help to Buy scheme is available throughout the UK.

Comments (…)

Sign in or create your Guardian account to join the discussion