Will Hong Kong innovation scheme enrich investors rather than drive tech ideas?

Preferential terms on the table for private partners in government investment initiative could make it little more than a get-rich-quick scheme, experts say

A new scheme that the government is pumping billions of dollars into to stimulate private investment in Hong Kong tech start-ups has come under scrutiny, with critics saying it has no clear aims and can be exploited to enrich investors rather than drive innovation.

Financial and business experts told the Post that the government was placing itself in an unfavourable position under the terms of an agreement to be signed with investment partners applying for the scheme.

The initiative lacked clear targets or broader policy support, they said, which would limit the benefits of the money poured in.

At the centre of the controversy is the HK$2 billion (US$255 million) Innovation and Technology Venture Fund set up last year under the government’s Innovation and Technology Commission. The commission has been searching for venture capital partners to co-invest in 40 to 50 local start-ups at a ratio of about 1:2.

The commission said it had received 14 applications from interested investors in January, and internal assessments of the candidates would begin this month, with results to be announced before the end of the second quarter.

Under the agreement, the partners must focus on investing in local information technology, and put up a minimum capital commitment of HK$120 million.

Hong Kong’s budget funding for innovation is a smart start

Government investment in each start-up will be capped at HK$50 million, and they will be limited to those with fewer than 250 employees. Total investment with public money will be no more than HK$400 million.

When the government sells its share in a start-up, the private partners will be paid a “performance incentive” equal to 35 per cent of the capital gain. The usual practice in the industry is to pay about 20 per cent.

Partners will also be given an option to purchase all the shares within five years. That can be exercised at the principal cost of the stock plus relevant interest accrued for related investments, according to the agreement.

“The incentives are a bit too much ... The fact that the government will co-invest in the start-ups already offers enough motivation and will help share the risks,” said Terence Chong Tai-leung, an economics professor at Chinese University of Hong Kong.

Will cash boost for Hong Kong Science Park drive real innovation?

Chong said allowing the partners to buy back government shares at a low cost amounted to a loophole that would enable them to profit from selling later at a much higher price.

“If the partner has already identified a third party willing to acquire the start-up at a high price, that partner can acquire the government’s shares first and sell them for a big profit later,” Chong said.

A spokeswoman for the Innovation and Technology Commission said if partners invested in more than one start-up and decided to exercise the option to buy the shares, they would be required to purchase all the stock in the portfolio to prevent them cherry-picking.

The main purpose of the funding scheme was not to generate monetary return for the government but to stimulate private investment in local IT start-ups, she said.

But Chong and Erwin Huang, an associate professor in entrepreneurship at the University of Science and Technology, said the start-up incubation zone should not adopt the same funding model as the venture fund scheme.

Hong Kong’s Science Park to take the lead on driving innovation and technology as it receives major cash injection

Huang said the scheme was largely focused on ensuring the government could successfully exit from its investments in the start-ups. He agreed that this created a loophole allowing partners to profit.

“What matters more is to make it clear which sectors the government would like investment in. For example, is it technologies addressing the ageing population, or creating big data for China?” he said. “The government will also need to devise policies to support the development of such markets ... otherwise it will be hard to see the growth of these industries, even with huge investment in the start-ups.”

Huang cited Finland’s success in injecting HK$5 billion into the country’s mobile gaming industry in each of the last three years, which included grants for foreign investors and policies that reduced investment risks such as importing talent and offering cheap co-working spaces.

“The Finnish government didn’t ask for shares in the start-ups at all. Their principle was to make investments that would also benefit local industries and communities,” Huang said.

Hong Kong needs more financial innovation to effectively tap Greater Bay Area opportunities

Chinese tech giant Tencent’s acquisition two years ago of the Finnish maker of mobile game Clash of Clans was an example of the success of the country’s innovation policy, Huang said.

The use of public money there had paid off, he added. The tax paid by the game’s developer, Supercell, and its founders, in just two years was three times the yearly funding the government had granted to start-ups.

Huang also questioned how much Hong Kong’s venture fund scheme would help smaller start-ups or whether bigger ones would be the main beneficiaries.

The government said in a paper submitted to lawmakers that the scheme would target start-ups at Series A and B stages – A referring to those receiving a first round of financing from a venture capital firm, and B to those who want to scale up their companies.

On the 35 per cent performance incentive for investment partners, Denis Tse Tik-yang, research committee chairman of the Hong Kong Venture Capital and Private Equity Association, said it was reasonable considering the absence of a management fee for the funds dolled out.

“Fund managers are usually paid an annual fee to manage funds, but this scheme doesn’t pay the agents until the start-ups have made a profit,” Tse said.

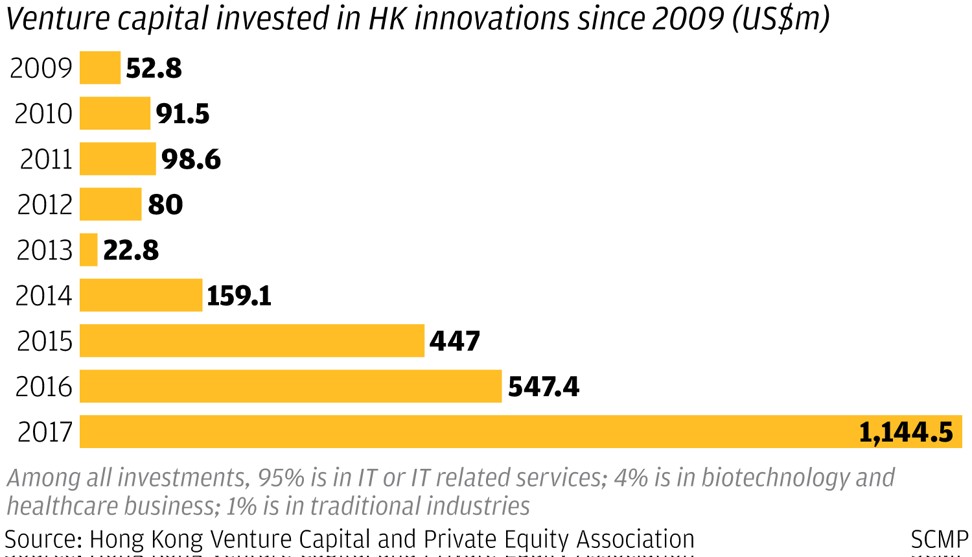

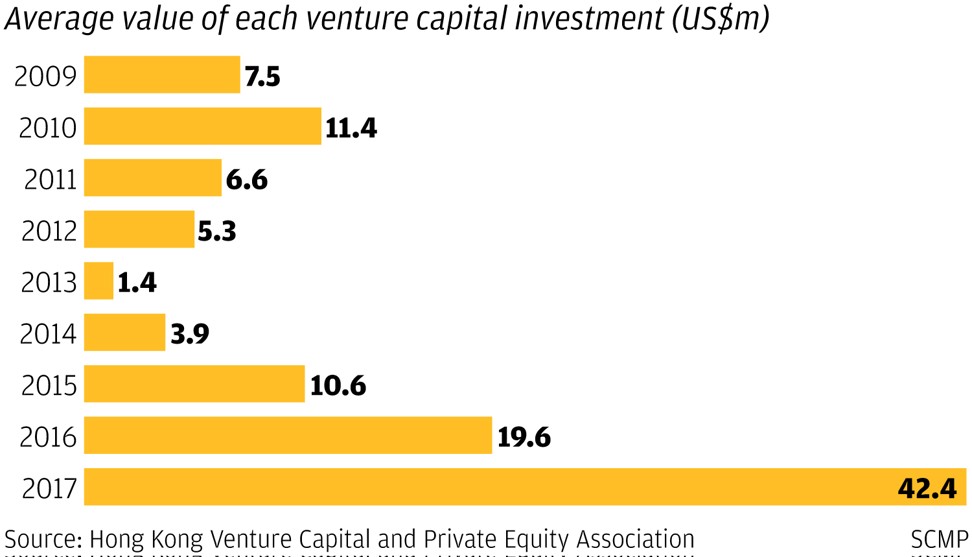

Statistics from the association show total venture capital invested in Hong Kong last year amounted to US$1.1 billion, more than double that of 2016. The average value of each deal also doubled over the same period, to US$42.4 million.