Glenn Stevens is leaving his post as governor of the Reserve Bank of Australia and is passing the torch of monetary leadership to Philip Lowe. When it comes to leadership transitions at central banks, there is a track record of incumbents spruiking the property market before retiring just at the right time to leave things for the new guy who “couldn’t see it coming”.

For instance, after 19 years heading the US Federal Reserve, Alan Greenspan retired from his post in 2006 and was replaced by Ben Bernanke. Like Lowe, in the months prior to his appointment as head of a central bank, Bernanke was denying the existence of a debt-financed housing bubble. Bernanke’s brash denial about any problem with subprime lending cost the US dearly. The same could happen in Australia.

As with Bernanke and Mario Draghi, the president of the European Central Bank, Lowe holds a PhD in economics from the Massachusetts Institute of Technology. Likewise, Lowe may eventually engage in extraordinary intervention to bail out a banking system that is dangerously overleveraged and exposed to an inflated housing market. But the RBA must think that’s a good thing – because it let it happen in the first place.

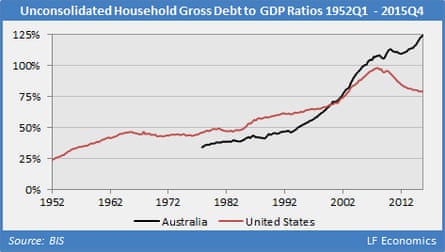

Relative to scale, Australia’s level of household debt dwarfs that of the US at the peak of its housing bubble. Today, the Australian household sector is the most leveraged in the world, with debts equal to 125% of GDP as of the first three months of 2016. In contrast, US household debt peaked at 98% in the first quarter of 2008. The US government was obliged to bail out its overleveraged banking system and mortgage lenders that were too heavily geared towards profiting from mortgage debt.

Just before the collapse of Lehman Brothers in 2008, the four largest banks in America – JP Morgan Chase, Bank of America, Citigroup and Wells Fargo – had a combined loan book equivalent to 21% of American GDP. In Australia, the mortgage book of the Commonwealth Bank alone is equal to 23% of Australian GDP. We are essentially talking about a housing bubble and leverage profile that has reached a completely different realm of “prime” banking and lending.

So what will a future Australian economy look like now under Lowe’s tenure? Though nobody has a crystal ball, RBA policy has been structured in a way to promote inefficient financialisation of the economy and debt-financed speculation to specifically inflate land prices. Unfortunately, it is as simple as that.

Stevens’ legacy (whether he likes it or not) clearly sucked diversity out of the Australian economy by allowing our banking system to engage in a scheme to funnel a disproportionate sum of new debt specifically towards the housing market so many more people can suddenly afford to pay more for a home (which raises house prices).

Though this strategy is already failing in parts of the country, Lowe’s Australia will not, and cannot, afford to care about reforming the economy to be more efficient or innovative. As under the leadership of Stevens, all that matters now is whether house prices rise or fall and household debt continues to expand faster than GDP and household income. If prices rise, already leveraged households feel comfortable spending more. If house prices fall, homeowners who are stuck with a mortgage five to 10 times their annual income place pressure on economic growth and the overleveraged banking system.

If there is a house price correction on the scale some of us fear, expect Lowe to introduce more monetary easing followed possibly by a bailout of Australia’s overleveraged banks with the $300bn bailout facility – called the committed liquidity facility. A bailout of this size for our “too big to save” banks may not be enough to cover all shortfalls without possible nationalisation of some of our financial institutions. Our major banks are simply too big, too leveraged and too undercapitalised to survive a crash in house prices without driving the hard-working middle class a little closer to the poverty line.

If inequality in Australia is wide and rising today, programs such as quantitative easing and bailouts, i.e. the RBA purchasing junk mortgages from banks at a premium, will further boost inequality. It will be an attempt to re-inflate house prices whilst rewarding the same bank executives who messed up in the first place and leaving everyone else to fend for themselves. This will be the RBA policy response under a Lowe leadership.

Quantitative easing can theoretically go on indefinitely. Globally we are in uncharted waters and do not yet know the true limits of QE. However, there are limits to the specific problems QE can solve, particularly structural problems. If it did solve structural problems, Japan’s central bank would have stopped printing money more than a decade ago. Japan’s unemployment rate today is just 3%. Yet its declining population continues to flank economic expansion. Hence in this instance, a wiser approach for Japan would be to reform its immigration policy or restructure the economy to combat a falling population rather than just printing money and hoping it spurs real growth.

Back in Australia, the economy is not looking healthy or progressive amid 17 consecutive quarters (a national record) of falling real net national disposable income per capita, plunging capital expenditure, record low wage growth, immense household debt, negative nominal rental price growth, a trade-exposed sector gutted by the high dollar and a lacklustre innovation scene starved of capital. Unfortunately for Lowe, printing money will not solve these structural issues.

RBA policy has helped to generate the largest debt-financed asset bubble in Australian history. This is defended by the RBA, including government and industry, as a natural result of deregulation and “innovation” by the banking and financial sector. This (Wonder Bra) paper wealth creation model has already been tried and tested on numerous occasions globally. Without exception, all have failed.

Lindsay David is the author of Australia: Boom to Bust