The push to spend is intense this holiday season — it feels more like holiday shopping season. My inbox is bursting with so-called deals, and my phone apps are constantly nagging me to BUY, buy, BuY! If I tuned into all these app attacks and nosy notifications I’d have to say BYE, bye, ByE to my money. Buh buy!

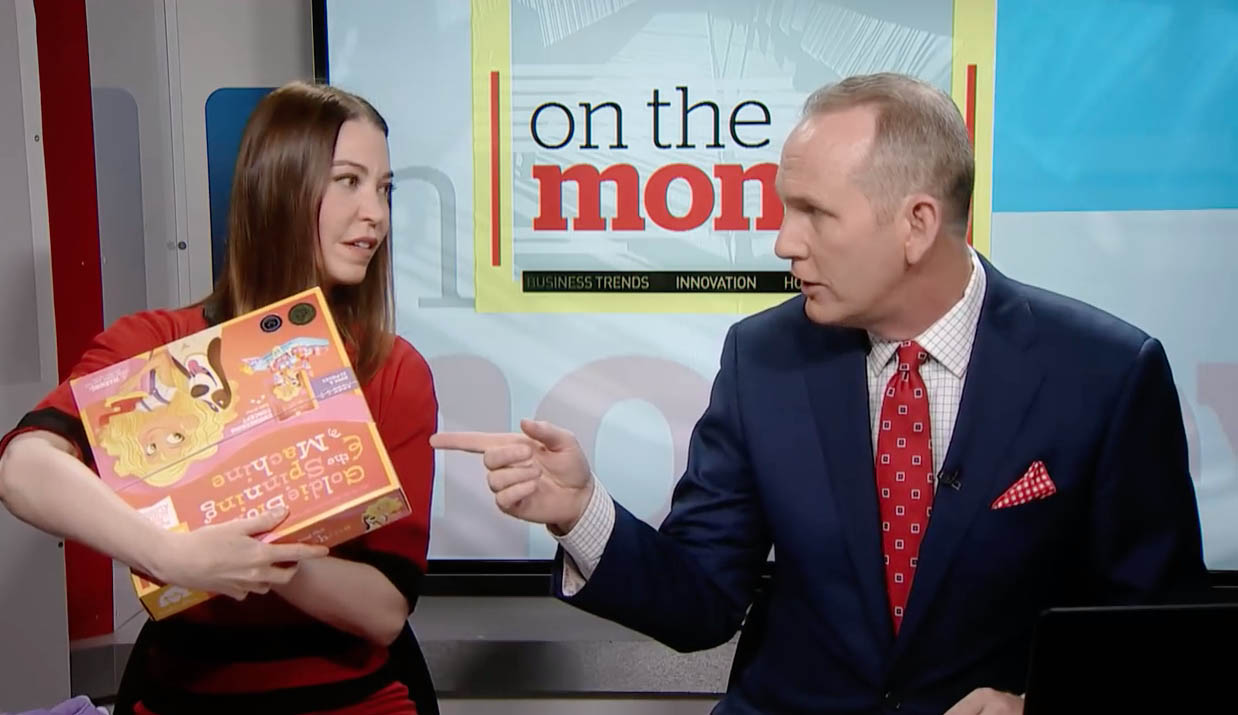

I admit it’s tough to stay steely and resist the urge to splurge during the holidays, so I did a Facebook Live with CBC’s On the Money and host Peter Armstrong to talk about holiday shopping pressures, shopping tips to avoid overspending, and how not to blow your dough and risk going into debt in the New Year.

Here’s the video!

Here’s how to get the gifts you need on the budget you can afford, and still have money left for food and holiday fun. My five money-saving holiday shopping tips can help you avoid overspending.

1. Talk with your family. They will understand!

Make the holidays less emotional by being honest with your family. It may seem super hard, but realistically family and friends will totally understand if you say: “Can we set a gift limit or do something else this year? Money is tight and I just can’t afford it.”

Do not be embarrassed by being financially responsible.

In my circle we do a gift exchange where we pick one name from a hat and buy one gift! We place a cap on the cost of that gift too. Buying ONE GIFT is easy and reduces the stress of shopping for multiple people. This tactic also helps to avoid competitive gift giving — a strange holiday shopping phenomenon where everyone tries to top the other and no one wins. Ever.

Holiday shopping gift strategies:

- Set a limit: No gifts over $10 or $20 or whatever!

- Make it fun: White Elephant Gift Exchange. It’s a party game where inexpensive, silly, or amusing gifts are exchanged and then “stolen” during play. The goal is to nab the best unwrapped present before the final round ends. There are many variations and game rules, but it’s always fun to play.

- Buy One Gift: Secret Santa holiday gift exchanges. Pick a name from a hat and buy that family member a personalized gift. But shhhh, the gift-giver is kept a mystery.

- Potluck Dinner: Everyone contributes a dish! Why should dinner be the responsibility of ONE person or family? Diversify the cost and labour of the meal across all party-goers by bringing a dish.

Related: Christmas Decorations: 5 Ways to Decorate Your Holiday Table on a Budget

Feeling a little less stressed? I’ve got more help.

2. Skip holiday shopping. Focus on experiences, not stuff.

Do the holidays differently this year by skipping the “Too Much Stuff Under The Tree Syndrome”. This is a real syndrome – I know because I checked WebMD. 😐

The truth is “Stuff” has a shelf life and many kids tire of new toys quickly. The fix?

Do things, don’t buy things. If your holidays are truly for spending time with family then why is there such a big focus on gifts? Blame the marketing! So reclaim the holidays and move the focus away from collecting gifts and aim to collect experiences.

Related: A recent post and video on How to set gift expectations with your kids.

Related: The 9 Best Toys of All Time Don’t Cost a Thing

Experiences Over Stuff:

- Do things, don’t buy things. Focus on building memories, not a pile of stuff.

- Experiences can be free or have a cost. Free-ish: Get outside with the family, go hiking, play boardgames with kids, tobogganing, stream movies. Costlier: Buy movie passes, spa treatment certificate, CityPasses for travel, sporting or concert tickets.

- Family Memberships — the gift that can be enjoyed year-round! Buy a family pass once and visit the attraction often. So passes to museums, galleries, the science center, or the local recreation center. Many attractions have reciprocity agreements with partner centres, so one pass can entertain the family across multiple places.

Need fun stocking stuffers? Here’s something I do every year: 12 Gift ideas disguised as Christmas ornaments.

Experience-based gifts won’t leave you roaming the mall tempted to overspend, and wholesale stores like Costco sell discounted gift passes and certificates which can be emailed to you fast if you’re in a pinch for time.

3. Make the second-hand economy your FIRST economy

Don’t snub the second-hand economy for holiday gifts. Make the second-hand economy your FIRST economy to save up to 95 percent, especially if you have younger kids. With Kijiji or Craigslist and Facebook Buy & Sell groups there are endless listings of nearly new and brand new toys, books, and kids’ gear waiting to be bought for way less than retail.

Related: If you’re shopping online, be sure to read How not to get duped by dynamic pricing

If you’re new to shopping second-hand, take my 80/20 Rule for a spin. Aim to buy 80 percent of your holiday items used, and spend 20 percent on new. I’ve used this shopping rule for years on everything from clothing to toys and I’ve saved big big money by using thrift and being sustainable too.

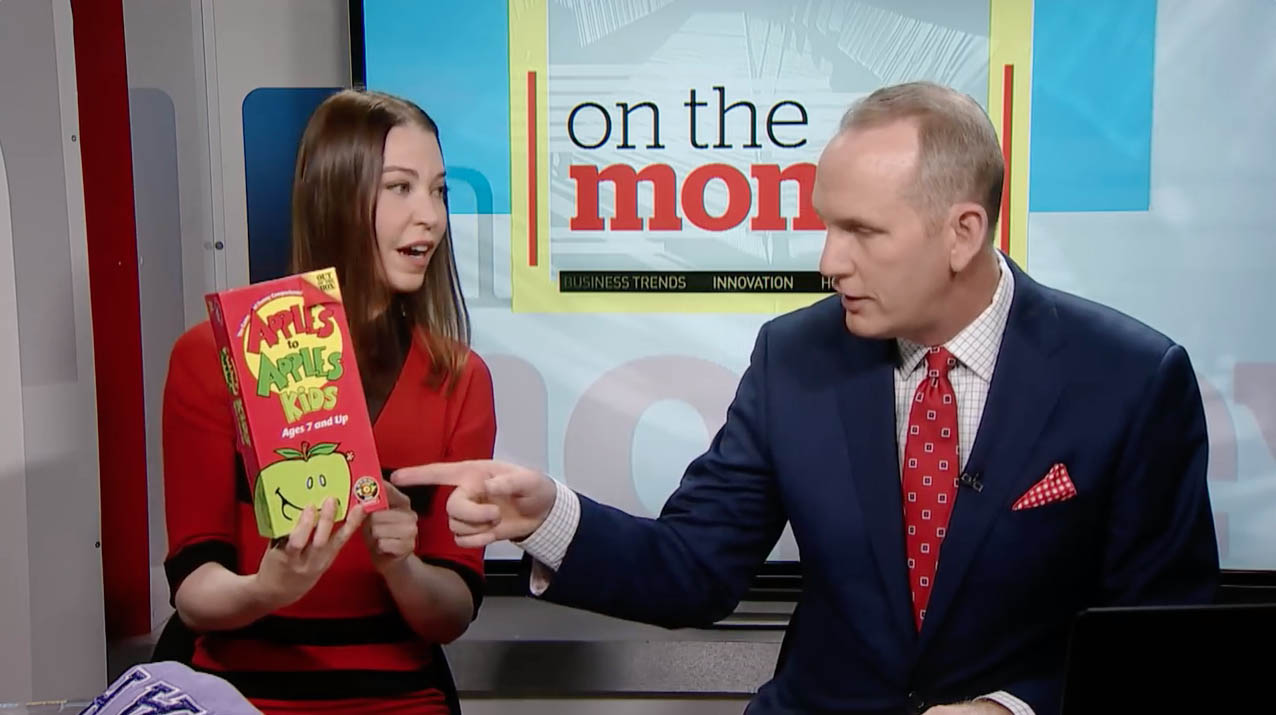

In my CBC segment (video above) I share a few kid gifts I found for pennies on the dollar. Here’s the list:

- Gap Logo Hoodie: Regular $40, Spent $3 (Saved: $37)

- Goldie Blox Spinning Machine: Regular $35, Spent $2 (Saved $33)

- Fairy and Unicorn Djeco Puzzle: Regular $20, Spent $2 (Saved $18)

- Apples to Apples Game: Regular $25, Spent $4 (Saved $21)

- Night Sky Projection Kit: Regular $30, Spent $4 (Saved $26)

Bottom Line: Total Retail Cost: $150, Second-Hand Cost: $15, Total Saved: $142 or 95 percent.

Tip: If you’re new to shopping at thrift stores, be sure to know your pricing! Always comparative shop the prices of new items to gauge if the second-hand item is worth it or overpriced. Check out Are you getting gouged at Value Village? for a laugh.

BTW: Many of these items listed above are brand new with tags, so can too can save big bucks on the stuff selling in stores today. I bought all of my daughter’s presents last year for $15 at Value Village.

4. Redeem your Reward Points

I generally don’t love reward loyalty programs and credit card points programs because they can encourage us to SPEND, sometimes overspend. But if you’ve collected the points, don’t save them – USE THEM towards your holiday expenses.

Loyalty programs can change with little notice or increase the points needed to redeem for rewards leaving the value of a point or the availability of rewards in jeopardy. Use them or lose them.

So check your loyalty points for Air Miles, Shoppers Optimum, Scene, travel credit cards, and any credit card that offers cashback on your balance to redeem and reduce your expenses.

Related: My Opinion piece for the CBC: Why you should be wary of loyalty programs — not enticed by them. If you’re not careful, it’s easy to get duped into spending more for the thrill of getting something for free

5. Avoid Sneaky Holiday Debt

Yes, I’m gonna drop the B-Word and tell you to build a badass Holiday Budget with my free download.

Then I’ll mention it’s a good idea to track ALL your spending and make a Gift Giving Worksheet.

Lastly, I’ll give you a little nudge with my debt reduction worksheet because you are loved.

Don’t let the gotchas get you and have a safe and wonderful holiday season.

Love love love,

Kerry

Great List Kerry.

I’d like to add one more idea. SHOP EARLY (and use that spreadsheet idea to keep track of costs, purchases, who gets what…). I was about 80% done with my shopping by Thanksgiving and 95% by Dec 1. SO the pressure to finish my list was gone… I am leisurely wrapping gifts and now can focus on holiday baking (my husband’s families’ traditional pizzelles, and I’m an amature cookie artist and enjoy planning and making decorated sugar cookies–and the homemade cookies are part of our holiday gift giving). So bottom line, shopping ahead gave me lots of options for sales and bargains, AND I have more time to wrap and attempt to enjoy the season and stay away from the mall and shopping! Yeah!

Love your no nonsense blog, been reading for years. 😉

-Terri

Any rule of thumb for how long grandparents give Christmas and birthday gifts to grandchildren? I have 8 grandchildren – all but 3 are over 21 years old. None of them live close to me; I only see them about every 2 years. I usually send money rather than gifts. I also give a substantial monetary gift upon high school graduation. I am retired now and have limited income.

There is also the option of celebrating Christmas AFTER the boxing day sales. That way, you can buy all your gifts on sale. Of course, you have to convince your loved ones first, but it can add up to important savings.

I have to say that I haven’t done anything for Christmas as I was busy with our annual craft fair and been sick the past week. I have my trusty savings account for gifts only and I’m comfortable with the amount of money set aside (so much every month; I’m re. The buying will probably happen next week. With four stepgrandchildren under the age of 6, they will get money which will go to their RESP’s. The other grandparents are in better financial situations to give them “stuff”. My stepchildren are pretty good about not overdoing it and I’m very grateful! We usually get concert tickets or memberships for organizations we enjoy. And one of my stepchildren gets family photo books professionally bound and given to all the family members; great memories!

Hi,

It was a nice list of advice and great tips for those who are financially broke or tight. I love your opinion on “Do not be embarrassed by being financially responsible” of course we are living in a corporate culture and facing high inflation rate which doesn’t allow us to spend money on holiday shopping. So, in order to manage our finances, we need to plan them on a monthly or annual basis. Follow an effective money-saving strategy can make our holiday and shopping season great.

Exactly – skip the shopping. Experiences are the most valuable.