What Can I Do To Lower Your Inflation Today?

The Fed will speak today after its 2-day meeting. All ears will be on what they say about inflation. My guess? They will double down on transitory. Why? Current inflation is almost all due to gas prices and used cars.

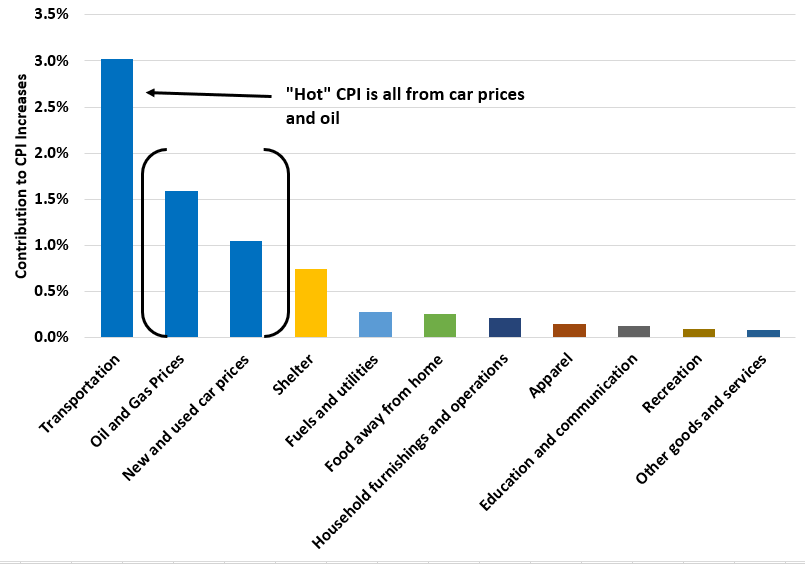

Last month CPI was 5% year-over-year. I did a quick analysis breaking down where that 5% came from. Here are the results:

Of the 5%, 3% is due to “transportation” prices increases. Most of that is simply from oil prices going up (1.6%) and new and used car prices going up (1%). In other words, if transportation prices went up by 2% last month, CPI would barely be above 2%.

It’s also important to remember that this is just a rebound from depressed prices last year. Remember when oil was at -$32 last spring? In fact, the transportation CPI component in May 2020 was -11%.

The Fed is also unlikely to be worried about car prices. We don’t buy cars that often, we can delay purchases, and the shortage in computer chips will end.

Thus, the Fed is probably not too worried about the current 5% CPI level. Unless oil really takes off, in a few months, CPI will start to decline closer to the Fed’s 2% target.