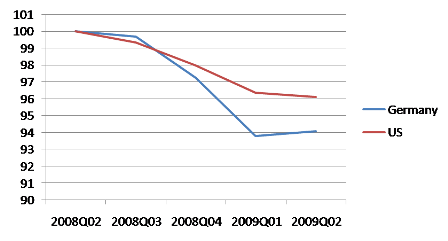

There’s been quite a lot of reporting on the eurobounce — the surprising early return to growth in Germany and France. It’s important, however, to keep some perspective. Here’s real GDP in Germany and the United States, with 2nd quarter 2008=100:

Source: Eurostat.

Yes, Germany grew in the second quarter — but this was after suffering a much deeper slump than the US, despite the fact that Germany didn’t have a housing bubble.

So you don’t want to jump to the conclusion that Germany responded well to the crisis.

Comments are no longer being accepted.