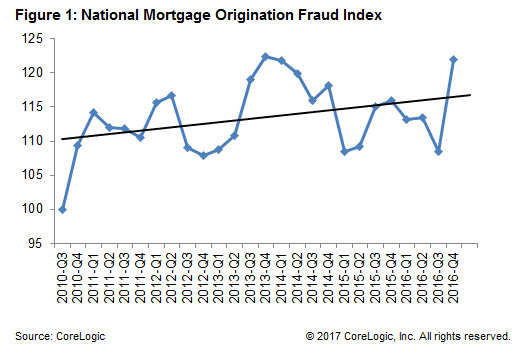

The shifting of the mortgage market toward more purchases as well as declining origination volumes are expected to boost the incidence of mortgage fraud in 2017 according to CoreLogic. The company's Fraud Index is already on the move. It shot up to 122 in the fourth quarter of 2016, matching its highest level in 2014. The jump came even though there was more than a 20 percent drop in mortgage applications at about the same time.

CoreLogic's Bridget Berg, senior director of Fraud Solutions Strategy, writes in the company's blog that mortgage fraud has been at a relatively low level since strong lending controls were put in place in response to the financial crisis. However, she says emerging trends may change that, raising the level of risk significantly. She sees the long-term increase in risk levels as related to a greater share of purchase transactions and increasing risk levels in those transactions, especially a growing share of purchase loans with high loan-to-value (LTV) ratios.

The share of high LTV purchase loans increased from 58 percent in the fourth quarter of 2013 and the same period in 2016. She attributes this, at least in part, to the loosening of credit policies at the GSEs Freddie Mac and Fannie Mae. The fraud index for loans with an LTV greater than 80 percent has increased 32 percent over somewhat the same time frame. It went from 153 in the second quarter of 2013 to 202 in the most recent quarter while the index for conforming loans remained almost flat.

Berg says it makes sense that fraud is more prevalent in purchase originations than in refinances. In the latter, there are fewer players involved, funds generally go from one financial institution to pay off another, and it is harder to manipulate the outcome. In a purchase transaction the process is more complex and proceeds are distributed outside of the closed loop of financial systems, going to property sellers, builders, real estate agents and so forth. This creates more opportunities and motives for fraud.

Purchase mortgage fraud can include falsified down payments, and straw purchasers, while motives can include obtaining or increasing real estate and loan commissions, contingent transactions, seller profits and seller distress. A rise in purchase activity has historically been associated with an increase in mortgage fraud.

The purchase share of the origination market is expected to rise by 6 percent this year, and the market share to be around 68 to 70 percent. Higher interest rates, which appear a certainty for 2017, along with continued increases in home prices will, Berg says, create affordability challenges and may reignite "fraud for housing" schemes.

The same affordability factors are expected to trigger a decline in the overall origination markets, perhaps by as much as $1.5 trillion in 2017. This will probably prompt credit expansion as lenders try to "capture a bigger share of a smaller pie and qualify more fringe borrowers." Lenders have already pulled back some of the overlays that made lending more restrictive than agency requirements - and less risky as well. Berg says one example of this is the reduction in the use of IRS income verifications. She says these roll-backs may have driven CoreLogic's fraud risk alert to increase by 12.5 percent year-over-year in the second quarter of 2016.

One final trend that CoreLogic is watching is the return of small, non-bank players to the market. The crash, the end of subprime securitization and hefty buy-back demands winnowed down the number of small players, and for the past decade most of the lending was done by larger, more-regulated banks. But now smaller lenders are coming back into the market.

Berg says it will be interesting to see what the Fraud Index looks like in the months to come. Stay tuned.