15 Things Entrepreneurs Need to Know

By Rieva Lesonsky

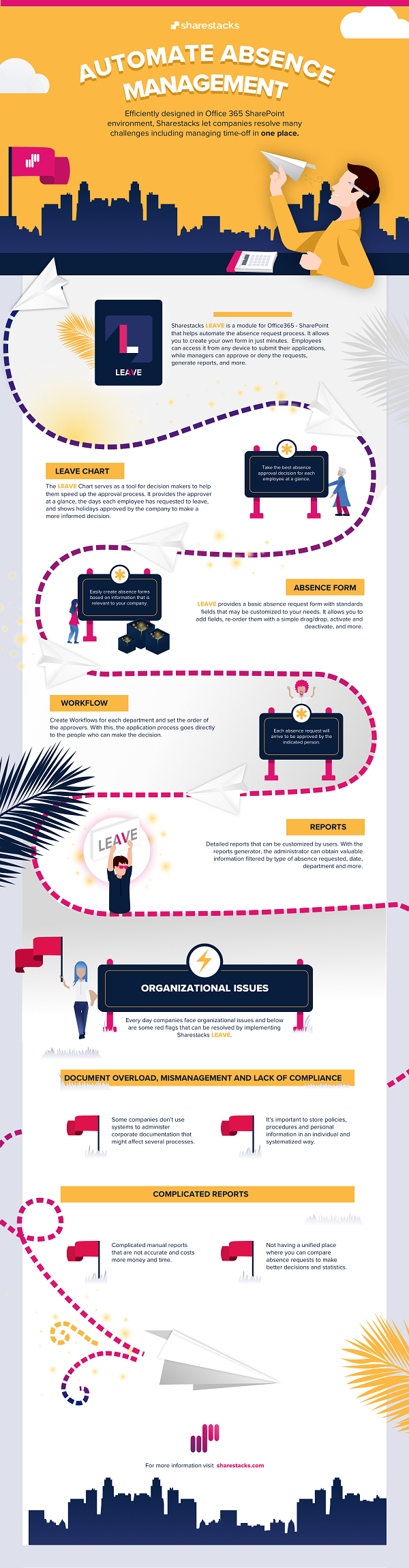

1—What Font Should You Use?

True confession—I love playing with fonts. So I found this infographic from Creative Canary, a corporate branding development company in Australia, very interesting. Check it out to find the best font for your business.

2—Going Cashless

What are the world’s most cashless countries? Check the infographic below from Forex Bonuses to find out.

3—Mobile Apps Statistics

Mobile technology is so important to small business owners these days, and it’s hard to keep up. Clutch has compiled this great list of stats, culled from the numerous mobile app studies they released in 2017.

Mobile App Marketing from How to Make an App Guide

- 37% of app developers recommend social media for an app marketing strategy, followed by paid advertising (28%).

- QR codes are the leastrecommended app marketing strategy among app developers.

- 61% of app developers recommend a “freemium” strategy, in which an app can be downloaded for free but then offers paid upgrades, to monetize an app.

E-Commerce Apps from Clutch E-Commerce App Survey

- Consumers primarily use e-commerce apps to receive deals and offers (68%), for the flexibility to buy at any time (64%), and to compare products and prices (62%).

- Consumers prefer features like discounts on products similar to past purchases (85%), in-app purchasing (84%), and discounts from push notifications (84%) on e-commerce apps.

- 84% of e-commerce app users would make purchases on their apps to receive discounts

- 63% of consumers currently use their preferred e-commerce apps to receive deals and offers that are only available in the app

- 54% of e-commerce app users would use augmented reality features on their app.

User Experience of Mobile App Onboarding from Clutch App Onboarding UX Survey

- 72% of respondents think the app onboarding process should take 60 seconds or less.

- 44% downloaded an app “for fun,” making that the most popular reason.

- 82% of users want clear reasons for apps’ information requests

- 76% say the safety of their personal information when using an app is very important.

Small Businesses and Mobile Apps in 2017 from Small Business Mobile Apps 2017

- 67% of small business planned to have a mobile app built by the end of 2017.

- Small businesses mainly built an app to increase sales (39%) & improve customer service (30%).

- Small businesses that planned to build an app in 2017 were primarily motivated to improve customer service (36%).

- Small businesses most value social integration (20%) and mobile payment (19%) features on mobile apps.

- 85 % of small businesses with fewer than 10 employees do not have a mobile app.

Cost of Building a Mobile App in 2017 from App Development Cost Survey 2017

- 67% of app development companies require a pre-research or “discovery” stage before beginning development.

- 33% of app development companies requiring a minimum project size, say their minimum project size is $5,001 – $10,000.

- 75% of app development companies most commonly built iOS native apps. 61% built Android native apps.

- 63% of app development companies say app testing & deployment costs $10k less.

- For 56% of app development companies, the cost of app maintenance after one year costs $10,000 or less.

Check out the list of the top mobile app developers.

4—Cost-Effective Digital Marketing Strategies

Guest post by Christopher Mohs, a digital strategist and founder of Cora+Krist.

Remarketing: The number-one tactic I often see small-businesses leaving behind is remarketing. This is the process of tagging people that visit your website and then remarketing to them based on what they may have viewed. There are two primary ways to deploy remarketing by using backend website coding that is installed to track what users are viewing so you can reach out to them with display ads from Google or post boost in Facebook and Instagram. Google Remarketing with the Google Remarketing Tag and Facebook Remarketing which utilizes Facebook’s Pixel code are the most widely used. These allow you to deploy better targeted display ads across Google’s display network and targeted social media posts on Facebook and Instagram.

You can manage campaigns in a highly robust way directly via Google Adwords or Facebook’s ad platforms. But this does take skill, know-how and a bit of elbow grease to get great results and maximize your marketing spend.

Power your display and social remarketing efforts through email marketing: Another tactic we find to be underutilized is email marketing. By far, these activities are the most productive and least expensive ways to interact with prospective and existing customers. Platforms like MailChimp have made tremendous advances in the past few years with support for automation and integration with several ecommerce services to make email marketing a breeze.

Today, MailChimp even supports integrations that tie remarketing efforts for both Google and Facebook (described above) with your email marketing efforts into one seamless package. The solution and platform is by far our service of choice for small businesses.

The process of setting remarketing campaigns and coordinated email marketing efforts is difficult for many DIY small business marketers and business owners, however engaging with an agency that specializes in small business support is a great first investment if you need the extra help.

Leveraging look-a-like audiences: This is the process where platforms such as Google Adwords and Facebook leverage your existing customer list to identify new customers that closely match the similarities in your existing audience. As you can imagine, these individuals are far more likely to engage with your message over a general wide cast net of “men and women from 25-45 who live within 20 miles of my business”.

Look-a-like audiences help you cast a targeted net to attract new customers in a way that yields great results.

Final Notes: Before diving into using these tactics, small businesses should be ready to commit to the following:

- Make it easy to maintain a database of current and prospective customers to build your email marketing list. Consider opportunities to win a service each month by dropping in your business card, or deploy customer feedback cards with a promise to get specials and discounts.

- Treat your customers more like fans. Engage with them and encourage them to share. This is especially critical with Instagram and Facebook.

- Automate, automate, automate. Tools like MailChimp help you make almost any marketing activity automated. Birthday messages, stop back in reminders, thank you for frequent visits or follow up for a “how are we doing” review.

- Commit to being consistent and ready to maintain a campaign. You can’t just go hard and heavy for three months and then die off and go silent. Any good digital marketing campaign requires consistent and constant attention and activity.

- Organize your website in a way that allows you to easily identify customer segments and to customize the remarketing message.

-

- i.e. If you are a restaurant, split your breakfast, lunch, and dinner messages onto separate pages to easily identify the visiting intent of a customer. If you are a salon, separate men’s, women’s, and children’s haircut services to speak more to the scheduling and style needs of the customer.

5—Record Number of Small Business Transactions

The number of annual small businesses transactions reached record highs in 2017, topping 2016’s totals by 27% percent according to BizBuySell’s annual and Q4 2017 Insight Report. The uptick corresponds with a steady economic growth and retiring Baby Boomers (contributing to 58% of overall sales).

Highlights & insights:

- 2017 experienced the biggest annual rise. A total of 9,919 closed transactions were reported in 2017.

- Q4 made for a strong record-breaking year-end. BizBuySell’s Q4 2017 data reveals similarly strong numbers as the year-end totals, led by a 23% increase in transactions compared to the same time in 2016.

- Franchise sales helped spur drastic transaction increase. Closed transactions of franchise businesses made a 49% leap in 2017 compared to 2016. In 4th quarter of 2017 alone, franchise media revenue grew 22% and cash flow jumped 8%.

For 2018, 90% of the surveyed brokers believe SMB transaction prices will either remain consistent with last year’s numbers or continue to increase.

6—Small Business Owners are Confident…

VISTAGE, the world’s leading business advisory and executive coaching organization recently released its 2017 Q4 CEO Confidence Index. Optimism among SMBs in Q4 of Fiscal Year 2017 surged to its highest level in a decade. Planned increases in their workforce and expected revenue growth were the highest in a dozen years, anticipated profit growth was the highest in 10 years, and intentions to expand investments in their productive capacity reached the highest level since the closing quarter of 2004.

Report highlights:

- Surge in Hiring and Investment Intentions: In Q4, 71% planned to increase the size of their workforce, up from 62% in Q3 and 60% in 2016.

- Intentions to increase investments in new plants and equipment rose to 54%, up from 47% one quarter and one year earlier, and the highest number to plan increased investment spending in more than a dozen years.

- Robust Revenue and Profit Outlook: Prospects for revenue growth were at their highest level since 2005.

- 83% of firms anticipated gains in revenues during the year ahead, marginally above Q3’s 77%, but well above the 69% recorded in the quarter prior to Trump’s election.

- 67% anticipate higher profits in the year ahead, slightly above last quarter’s 62% and last year’s 64%.

- Economic Growth Improves

- Among all firms, 66% reported the economy had recently improved, up from last quarter’s 52% and last year’s 42%.

- When asked about prospects for the year ahead, 45% anticipated continued gains, up from 32% in the prior quarter, but below last year’s 4th quarter reading of 58%.

7—…And Optimistic

Small business owners entered 2018 feeling the most optimistic since early 2007, according to findings from the latest Wells Fargo/Gallup Small Business Index.

In the latest quarterly survey of small business optimism, the overall Index score came in at 107, up from 103 in November 2017, and the highest score since early 2007. A jump in the “future expectations” score – which measures how business owners expect their businesses to perform over the next 12 months – largely drove the improvement in optimism. In January, the score improved five points to 65, the highest reading since December 2006.

In January, 52% of business owners reported their revenues increased a little or a lot over the past 12 months, up from 46% in November 2017, and the highest reading on this measure since 2007. The survey also showed 66% of small business owners expect their companies’ revenues to increase over the next 12 months, which is the highest reading on this measure in the history of the survey. Other key drivers in the first quarter included:

- Healthy cash flow outlook: 77% of business owners expect their cash flow will be very good or somewhat good over the next 12 months, up from 73% in November 2017 and the highest reading on this measure in the history of the survey.

- Improvements in capital spending: 38% expect the amount of money their businesses allocates for capital spending to increase a little or a lot over the next 12 months, compared to 33% in November 2017. This is the highest this measure has been since December 2003.

- Ease of obtaining credit: 46% expect credit will be very easy or somewhat easy to obtain, compared to 45 %in November 2017.

- Continued hiring: 33% of business owners expect the number of jobs at their company to increase in the next 12 months.

8—Business Travel Expenses

Leading automated travel and entertainment expense management software provider Certify, just released the results of its 5th annual SpendSmart™ Report. The big winners? Uber was the most expensed brand of 2017. Lyft saw a big jump too. Taxis and car rental services were the big losers. “A healthy business travel market is a key driver of a strong economy, and year over year we are seeing a sharp increase in our business travel data,” sas Robert Neveu, Certify’s CEO.

Research highlights

- Certify processed 50 million + receipts/expenses in 2017

- Uber was the most expensed brand of with 9% of all receipts/expenses, followed by Starbucks at 4%

- Airbnb has nearly doubled each year in the Certify data since 2014, yet still represents just under .5% of the lodging category overall today

- Starbucks was the most expensed restaurant, Hampton Inn the most expensed hotel, National the most expensed car rental agency, and Delta the most expensed airline

The current and previous quarterly and full-year SpendSmart™ reports are available here.

Most-Expensed Restaurants

Starbucks: 5.22%, averaging $12.94

McDonald’s: 2.91%, averaging $9.34

Panera Bread: 1.71%, averaging $44.35

Chick-Fil-A: 1.41%, averaging $26.63

Subway: 1.4%, averaging $20.26

Most Expensed Restaurants by Meal

Breakfast: Starbucks 17.34%

Lunch: McDonald’s 3.38%

Dinner: McDonald’s 1.78%

Top Rated Restaurants (1 to 5 stars, as indicated by travelers)

Chick-Fil-A: 4.4

Jimmy John’s: 4.3

Panera Bread: 4.3

Starbucks: 4.3

Chipotle: 4.3

Most Expensed Airlines

Delta: 20.32%, averaging $396.66

American: 18.68%, averaging $316.55

United: 14.44%, averaging $369.67

Southwest: 11.42%, averaging $274.32

Alaska Airlines: 1.6%, averaging $253.14

Top Rated Airlines

JetBlue: 4.7

Southwest: 4.5

Alaska Airlines: 4.4

Delta: 4.3

American: 4.2

Most-Expensed Hotels

Hampton Inn: 8.95%, averaging $240.59

Marriott: 8.48%, averaging $272.15

Courtyard by Marriott: 7.4%, averaging $193.11

Holiday Inn Express: 4.63%, averaging $234.64

Hilton Garden Inn: 4.47%, averaging $227.87

Top Rated Hotels

Hyatt 4.4

Marriott: 4.4

Westin: 4.4

Hilton Garden Inn: 4.3

Homewood Suites 4.3

Most Expensed Car-Rental Services

National: 27.10%, averaging $185.61

Enterprise: 16.43%, averaging $199.17

Hertz: 13.95%, averaging $195.12

Avis: 11.97%, averaging $178.02

Budget: 3.72%, averaging $187.25

Top Rated Car-Rental Services

National: 4.4

Enterprise: 4.3

Hertz: 4.1

Avis: 4.0

Budget: 3.8

2017 T&E Expense Category Breakdown (% of total spending, benchmark average)

Meals 19%, averaging $31.48

Airfare 15%, averaging $318.74

Hotel 13%, averaging $250.09

Misc. 15%, averaging $71.19

Fuel 19%, averaging $46.90

Taxi 1%, averaging $38.48

Cell Phone 4%, averaging $51.71

Car Rental 5%, averaging $190.37

Supplies 3%, averaging $65.88

Shipping 2%, averaging $103.66

Tolls 1%, averaging $31.74

Parking 4%, averaging $106.08

Quick Takes

9—How to Monetize Your Blog

Here are 37 tactics for making money from your blog, courtesy of the Authority Hacker.

10—How to Retain Employees

One of the biggest challenges business owners face today is retaining their employees. If you’re facing that issue, here are 39 ways to help your keep your team in place, thanks to Time Doctor.

11—Sage Payment Solutions Rebrands to Paya

Sage Payment Solutions, Inc., a leading provider of integrated payment processing and business solutions in North America, recently announced it will now operate under the new brand name of Paya (pronounced pie-ya).

“The Paya name represents the fresh and progressive company we are building for our employees, partners, and customers as we work to become the foremost technology platform helping companies run their businesses better,” says Joe Kaplan, Paya CEO. “Our mission is to deliver new technologies to the market and offer innovative, integrated payment solutions that will help our customers simplify business complexity and concentrate on growing their business.”

At the same time, the company is expanding its channel partner program , adding new, robust tools and assets to help attract, bring value to, and monetize new and existing opportunities. Paya’s Partner Program targets participation from technology providers, referral organizations, and ISOs to leverage the program’s assets and benefits of its omni-channel solutions platform.

Paya provides a technology platform that enables merchants to streamline their business, optimize organizational efficiency, deliver consistent value, and accelerate growth. Unlike other solutions that offer a complex and fragmented set of technologies, Paya delivers a purpose-built solutions platform that works to reduce complexity and increase business intelligence, ensuring that companies can confidently and quickly adapt to changes in technology and in the marketplace. The highly compatible platform is designed to integrate effortlessly with today’s technology and adapt to tomorrow’s market.

12—Networking via Email

Check out this Guide to Writing Networking Emails That People Can’t Ignore from RooJet.

Cool Tools

13—Online Financial Education Tool

SmartBiz Loans, an SBA loan marketplace and bank-enabling technology platform, recently launched SmartBiz Advisor, the first, AI-driven, online education tool that makes the financial insights and analysis provided by a typical CFO available to small businesses at no cost.

“The power of AI and machine learning is transformative in every industry and this is the first online tool that brings that power to small business owners,” says Evan Singer, CEO of SmartBiz Loans. “For the first time ever, small business owners have easy access to the type of financial advice that CFO’s regularly provide large companies, enabling them to make better business decisions and get access to the low- cost funds they deserve.”

SmartBiz Advisor is an intelligent online platform that allows small business owners to easily and quickly learn how banks typically evaluate their business on key criteria before applying for a loan. Business owners simply sign up for Advisor at no cost and upload their most recent tax returns. The platform then generates their Loan Ready Score™ in only a few seconds. The Loan Ready Score is used to help assess the probability of approval for a low-cost SBA or bank loan. The platform also generates a series of customized insights about what business owners can do to improve their standing on key financial criteria and calculations used by banks. Small business owners can return to their SmartBiz Advisor dashboard again and again to benchmark progress against their financial goals over time.

SmartBiz Advisor is the first of its kind in a category of tools that SmartBiz Loans calls the “Intelligent CFO™.” By combining proprietary machine learning and AI tactics with the white-glove concierge service provided by SmartBiz’s team of Advisor Consultants, SmartBiz Loans is enabling small business owners across the U.S. to take advantage of the power of AI and high-level financial analysis at no cost.

14—Next Gen Monochrome Laser Printers

Brother International Corporation just announced its newest line of monochrome laser printers and all-in-ones. The new lineup includes five printers and four all-in-ones to address the evolving needs of the busy home or small office, including the first Brother XL Extended Print laser models that include up to two years of toner in the box. Printers in the new lineup offer fastest-in-class print speeds, high-quality prints, and superb reliability, all while keeping budget in mind.

All the models in the new monochrome laser printer lineup are feature-rich, including versatile connectivity and mobile printing capabilities. The new models help improve efficiency with up to 250-sheet paper capacity and class-leading print speeds, meaning more printing, fewer refills and less waiting.

The entire new fleet of monochrome laser printers and all-in-ones are auto-fulfillment enabled, including options like Brother Refresh and Amazon Dash Replenishment, where replacement toners are automatically shipped before customers run out. New models include: Brother HL-L2350DW, HL-L2395DW, DCP-L2550DW, MFC-L2710DW, HL-L2390DW, HL-L2370DW, HL-L2370DW XL, MFC-L2750DW and MFC-L2750DW XL. These models are now available in store and online through leading retailers and office super stores.

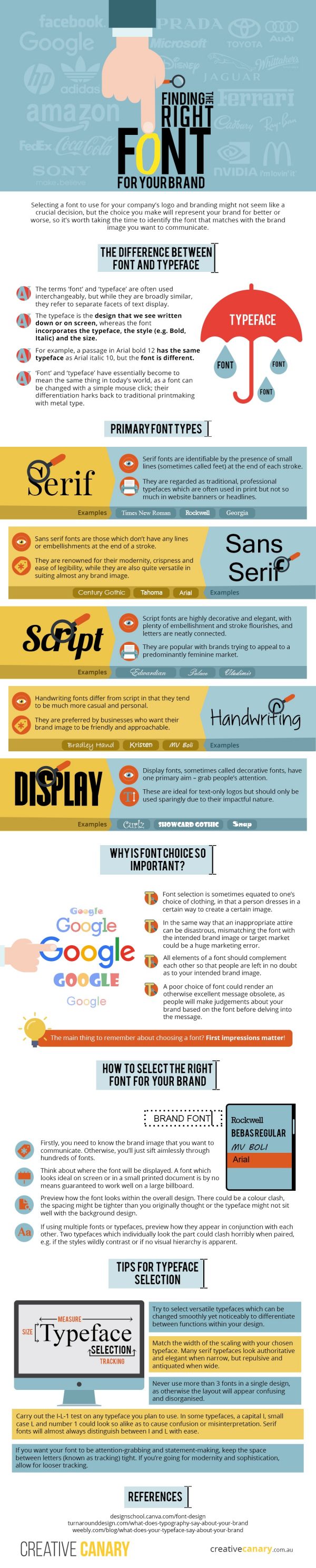

15—Be More Efficient in 2018

Guest post by Alberto Lugo, President INVID LLC. You can reach him on Twitter is @albertol.

When you are running a small business, you need to be on top of your game—wear many hats and be the Jack (or Jill) of all trades. This holds true with technology applications to save time, money and resources. The problem is entrepreneur don’t know what they don’t know. In fact, many small business owners throw money at software licenses thinking their problems will just go away.

For example, a small business owner may be using Microsoft Office 365 Business Premium just to run their email archiving system without knowing they are paying for a full-line of software components that may automate processes in multiple departments. Office 365 brings all office applications including Outlook, Word, Excel, PowerPoint, OneNote, and Publisher. On top of that, it brings Exchange (for email archiving), OneDrive, SharePoint, Skype for Business, and Teams. For must of our customers, these are just a bunch of applications that come in their subscription but they have no use for them—or so they think. Aside from Office 365; they pay for a Help Desk system to track tickets from customers or employees, for a vacation management system to keep track of employee’s vacations and all kind of other software that don’t talk to each other.

But, there’s a lot to learn about the systems you already have before pouring more money at all kinds of software.

For example, SharePoint is a very powerful intranet and document management solution that allows users to create forms, organize content, and share information within their organizations and even with vendors and clients.

After more than ten years consulting with all types of businesses and eager to solve one of the most significant customer challenges, we created Sharestacks on top of Office 365 and SharePoint. Sharestacks is a series of modules for Office 365 & SharePoint, to simplify the implementation of intranets and help automate some of the most common processes in the workplace.

By using these modules with your Office 365 subscription, you can leverage the power and use of your software and access the other applications and systems securely with the same credentials you currently use with Office 365.

Available Sharestacks modules:

- Brand: The ultimate integration module that brings together Office365, SharePoint, Skype for Business, Yammer and OneDrive. It will transform your intranet into a modern and intuitive workplace and will allow you to customize your portal with branding, logo, and images fully. You can also share relevant news, events, meetings and more.

- Leave: By automizing your absence request process, you will not only save time and paperwork, but you will also avoid conflict, misunderstandings, and request duplicity while making your employees feel taken care of. Provides a natural interface employees use to submit their request so that supervisors can manage them efficiently.

- Help: Provides affordable solutions to two critical and highly frustrating situations: the feeling of helplessness employees experience when technical or mechanical workplace issues are not promptly addressed, and the feeling of being overwhelmed the tech staff gets when there’s too much going on with no accountability. It creates an optimal platform for asking for help, reporting incidents or requesting new services in any department.

- Reserve: Find and book the ideal conference room or meeting space based on amenities and location within your organization. Allow your employees, vendors, and clients to reserve a conference room with ease.

The Bottom Line

The first step to having the right set of tools for your organization is to take the time to learn about what you already own and see how you can leverage those tools to automate as many tasks and processes as possible before considering other software and tools. Only when the tools you already own won’t resolve your needs, then go to the market to search for alternatives.