We’ve had an overwhelming response by property managers wanting to make sure their tenants are covered with renters insurance!

Now, we’d like to provide you with a sample letter that you can use (or edit) in a mailout:

Dear Residents,

One of the requirements of your lease is that you must maintain personal liability insurance. The most common way to do this is with a renters insurance policy.

The landlord is not responsible for any damages to your personal property arising from fires, leaks, and other unforeseen events. A renters insurance policy generally will include personal property coverage to protect your belongings. This is an important component of your lease and failure to maintain the required coverage will be consider

ed a breach of the lease and is subject to any and all legal remedies.

If you do not have coverage, please reach out to an insurance provider or visit tenantfile.sureapp.com to get covered. The process is quick and hassle-free.

Sincerely,

Management

* Remember, you can send this email out through the Tenant File Program under the ‘Miscellaneous > Easy Email’ selection.

YOUR TENANTS PAY AS LITTLE AS $9.00 PER MONTH

For more information, click here

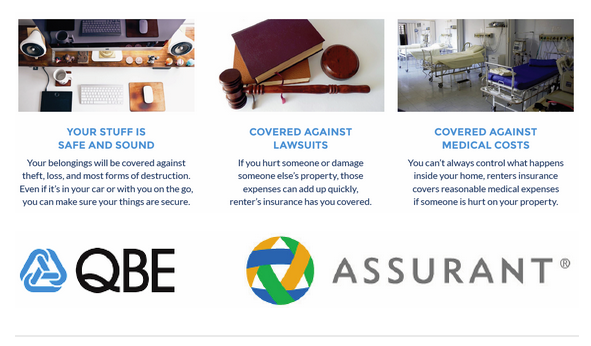

* Renters Insurance is covered through a partnership with Sure. With Sure and their wide partner network including Nationwide, landlords and property managers can provide their tenants with a way to get comprehensive coverage from vetted, reliable partners at the best price — all in one, easy-to-use online app for computers, iPhone and Android devices.

Questions? Call us at 1-800-398-3904