Microsoft Stock Prediction: Two Reasons Why You Should Stay Long Microsoft

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Around 15% of the global population experiences some form of disability. That’s around 1 billion people. Many of them are gamers or could be gamers.

- This is the reason why Microsoft decided to create the $99 Xbox Adaptive Controller for disabled people. This is a great example of inclusive product design.

- Microsoft’s Xbox Adaptive Controller can also be used with Windows 10 games. Going forward, Microsoft has long-term benefits from helping disabled people have better access to video games.

- The next reason to stay long Microsoft is its upcoming affordable Surface 2-in-1 laptops. It could boost the overall hardware sales of Microsoft.

- A sub-$300 Microsoft Surface 2-in-1 laptop can be a hit in the education market and among business users.

Microsoft (MSFT) has the world’s 6th biggest annual budget for research and development. It spent $12 billion on research and development last year. It is therefore worth appreciating that Microsoft has an inclusive approach to its product design approach. The upcoming $99 Xbox Adaptive Controller is a controller which can be customized for disabled persons.

(Source: Microsoft)

I am staying long MSFT because I like how it is willing to service the needs of disabled persons. Some form of disability burdens around 15% of the world’s population. That’s one billion people. Disabled persons form a large chunk of our population. Companies are not obliged, but I firmly believe that designing products should be inclusive of the disabled population.

Microsoft can sell 10 million units of the $99 Xbox Adaptive Controller in first two years of release. However, the revenue stream is not only limited to the hardware itself. Microsoft can also benefit from disabled gamers purchasing new video games and in-app purchases.

Why Investors Should Give A Damn

Microsoft is admirable because of its generosity in breaking down economic and social barriers for disabled persons. Profit taking was my motivation why I sold some of my MSFT stake. However, the $99 Xbox Adaptive Controller has inspired me to buy more Microsoft shares last night. My takeaway is that Microsoft has long-term economic benefits from serving the needs of disabled persons.

Aside from it being a beautiful public relations move, we should never forget that a man without a right arm or one eye can still be well-employed. He or she still has enough money to spend on video games. The Xbox Adaptive Controller could help boost sales of Microsoft’s console products. Going forward, a disabled person who wants to make video games his/her favorite entertainment deserves to have all the tools he/she needs.

The reality is Sony’s (SNE) PlayStation 4 is notably outselling the Xbox One. Sony sold 19 million PlayStation 4 from April 1 2017 to April 2018. There are now 76 million PlayStation 4 around the world. This is something that Microsoft is trying to address by creating an Xbox Adaptive Controller for disabled persons. By being the first company to create a controller for disabled gamers, Microsoft can expect new Xbox One X customers.

Further, Microsoft’s hardware move (to include disabled gamers) will also eventually lead to game developers making their games more accessible to disabled persons. Profit can be made from attracting disabled persons to choose video games as their main form of entertainment. Recruiting 100 million disabled persons to become hardcore console/PC gamers can lead to new multi-billion dollar revenue streams.

Making Cheaper Surface Laptops Is Also A Tailwind

Aside from Microsoft’s expansive move on gaming hardware-for-disabled-persons, I also like its upcoming low-cost Surface 2-in-1 laptops. A $249 or $299 Surface tablet/laptop product can help neutralize the new $299 iPad 2018. Price-wise, a Surface product already comes with a free keyboard. K-12 and colleges can save money by choosing Microsoft’s new low-cost Surface product over the iPad 2018.

Microsoft cannot let kids of today become lifetime users of Google’s (GOOGL) productivity apps. Chromebooks targeted the education system because Google wanted kids to become early adopters of its web/mobile applications. Microsoft needs a larger presence in the K-12 market to train young minds on how to use Microsoft Word, Excel, PowerPoint, Skype, and Cortana.

Selling affordable computers for students is a battle for the loyalty of future workers of tomorrow. I like it that Microsoft is willing to sacrifice on hardware margins just to make sure Google and Apple do not dominate the education market.

A low-cost Surface tablet/laptop is also an attractive proposition for enterprise customers. Budget-conscious small and medium-sized companies looking to get the best laptops for their employees are also potential buyers of a $299 Surface 2-in-1 tablet/laptop.

Selling computers helps Microsoft enforce the dominance of its Office 365 and other cloud-first applications on the enterprise market. Microsoft cannot solely rely on PC vendors to help keep its productivity apps remain dominant in Windows PC users.

Selling affordable computers helps fortify Microsoft’s leadership position in the enterprise Software-as-a-Service industry. Growing the number of subscribers of Azure and Office 365 helps Microsoft carve out a bigger share of the $180 billion/year cloud computing industry.

Conclusion

I listed two formidable reasons why you should stay long (or go long) on Microsoft. It is a great company which has a massive annual budget for research and development ($12 billion last year). Microsoft is creating new products/services that cater to disabled persons and students. New products/services help Microsoft’s continuous evolution outside of its old boxed-software business model.

An analysis of MSFT’s technical indicators and moving averages trend patterns also support my buy recommendation.

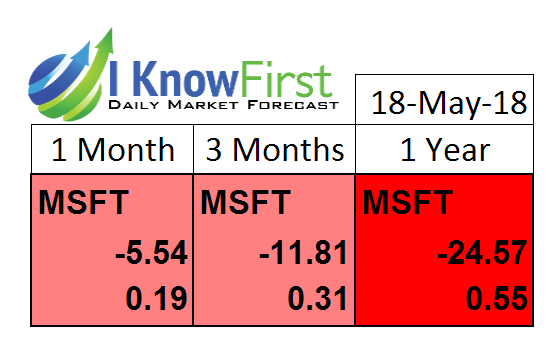

On the other hand, the stock-picking algorithm of I Know First does not support my buy rating for MSFT. Microsoft’s stock still has bearish market trend signals from I Know First. You can trust the artificial intelligence verdict of I Know First or you can ride my bullish sentiment over Microsoft.

Past I Know First Forecast Success with MSFT

I Know First has made accurate predictions about MSFT in the past bullish forecast from June 14, 2017.

The article discussed Microsoft adapting new strategies to get more people on Windows and advancements to Microsoft’s intelligent cloud such as Cortana, which could compete with Alexa. Additionally, the article mentioned a focus on artificial intelligence (AI), in particular, to prevent workplace injuries. Microsoft’s commitment to AI was also exemplified by their purchase of Hexadite, an Israeli startup that can identify and protect against cyber attacks using AI. Microsoft also had consistently strong financial ratios that made it a formidable stock. Since the article was published, MSFT has increased by 38.25% to a close of 97.32 on May 16, 2018.

This bullish forecast for MSFT was sent to the current I Know First subscribers on June 14, 2017.

To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.