Trending

The Valley’s MVPs

The San Fernando Valley, Los Angeles’ sleepy longtime suburb, seems to be waking up.

Improving public transportation, increasing pro-development policies and a dwindling set of opportunities in more urban neighborhoods are luring commercial real estate investors to the mountain-ringed region northwest of the city’s downtown, industry insiders told TRD.

While the gains across neighborhoods and real estate market sectors in the roughly 250-square-mile region can seem uneven — offices in the Valley still have a relatively high vacancy rate, at 13 percent in the second quarter, according to CBRE — a place that was once considered a secondary market for investment seems to have become a top destination, continuing a recent trend.

“It was as suburbia as you can get, and it still is,” said Mike Smith, a senior director at the firm Berkadia, who grew up in the Valley and lives there today. But higher-density development in pockets like North Hollywood and Woodland Hills, coupled with a revitalization of main retail strips like Ventura Boulevard, have made the area more attractive as a place to live, work and invest, he said, adding, “We are starting to fill in.”

And many brokerages are thriving in the area as a result, according to The Real Deal’s first-ever ranking of the firms that are doing the most commercial sales in the area.

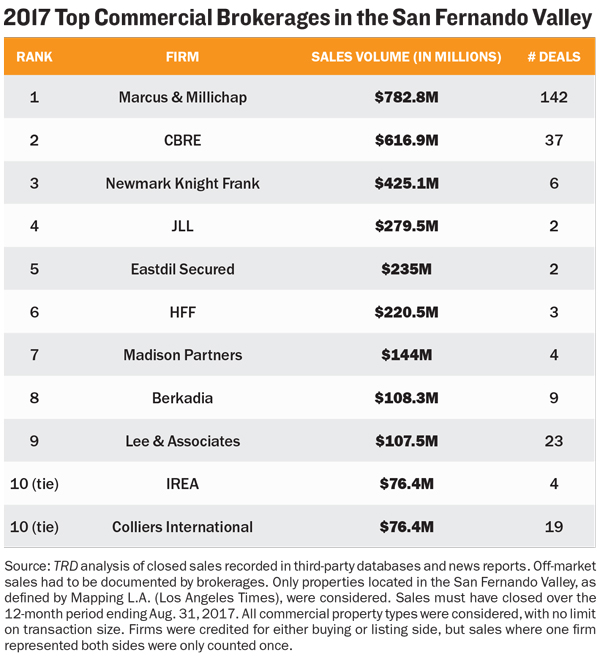

Well-known national firms make up the bulk of the top 10 finishers on TRD’s list, which is based on dollar volume of deals from September 2016 to August 2017, using data from the research firm Real Capital Analytics.

Marcus & Millichap, CBRE and Newmark Knight Frank, for instance, crossed home plate in first, second and third place, respectively.

But the data does show that a couple of home runs from smaller players can offset many big agencies’ base hits. Consider Investment Real Estate Associates, known as IREA, an 18-year-old firm based in Los Angeles. The company, tied for 10th place with Colliers International, was able to crack the top 10 with just four deals, which included the nearly $55 million sale of Northridge Plaza, a 17-acre shopping center whose tenants include Target.

David Leibowitz

For the ranking, TRD counted only those companies functioning exclusively as real estate brokerages and considered every commercial asset class including development sites recorded in third-party databases and news reports. Off-market sales had to be documented. Only properties located in the San Fernando Valley, as defined by Mapping L.A. — a Los Angeles Times project outlining the boundaries of L.A. County — were considered, and sales must have closed over the 12-month period ending Aug. 31, 2017. All commercial property types were considered, with no limit on transaction size. Firms were credited for either the buying or listing side, but sales where one firm represented both sides were only counted once.

Apartments lead the way

If one asset class is outperforming the rest in the Valley, it’s the apartment complex. Renters are seeking out cheaper alternatives to Westside Los Angeles — think places like West Hollywood — where rents have soared.

In the last decade, the average rent for a three-bedroom apartment has shot up about 50 percent, from $2,000 a month to $3,000, said Rick Raymundo, a senior managing director at Marcus & Millichap. Naturally, deals followed en masse. Existing complexes are trading in a flurry of activity, brokers say.

“It used to be when you were cool and young, you would live in West Hollywood, then move to the Valley when you had kids,” Raymundo said. “But that’s changing.”

First-place finisher Marcus & Millichap, which brokered nearly $783 million in sales over 142 deals, reveals that right now, it pays to specialize in the multifamily sector. The firm, which has four L.A. offices, including one in Encino in the Valley, had a hand in dozens of apartment deals over the past year.

Chief among them was the sale of the 348-unit Waterstone Apartment Homes complex in the Chatsworth neighborhood, which the national pension firm TIAA-CREF bought from Legacy Partners Residential, a local landlord, for $73 million. Marcus & Millichap represented both the seller and buyer in the deal. The complex, built in the early 1970s, is near a station for the Metrolink commuter railroad, which has grown increasingly popular in what is still a car-centric metropolis.

“Millennials like these options because they don’t drive,” said David Leibowitz, an IREA partner who specializes in multifamily trades.

But Marcus & Millichap, whose average deal price was just $5.5 million, also does not appear to be afraid to jump on relatively small opportunities. For example, the firm was a broker in the $2.4 million acquisition in November 2016 of 8400 Amigo Avenue, a low-slung, stucco-sided apartment complex in the Northridge neighborhood.

Raymundo, who has been working as a broker in the Valley since 1998, said the area’s basic economic indicators pointed toward continuing success in the multifamily market. The average asking residential rent in the Valley of about $2,000 a month is up about 5 percent from the same time last year, according to a third-quarter report from Marcus & Millichap.

The rising rental prices explain why investors have flocked to properties like 14618 Wyandotte Street in Van Nuys, which traded for $5.7 million in August, or about $200,000 per apartment — a significant sum in an area where $150,000-a-unit rates are more typical, Raymundo said.

The rising rental prices explain why investors have flocked to properties like 14618 Wyandotte Street in Van Nuys, which traded for $5.7 million in August, or about $200,000 per apartment — a significant sum in an area where $150,000-a-unit rates are more typical, Raymundo said.

Similarly in Van Nuys, a once-shabby area near a Metrolink station, builders have sensed opportunities. For instance, IMT Residential this year put the finishing touches on its phased IMT Sherman Circle complex, a mix of apartments and townhouses on the grounds of a former hospital.

Longtime owners are also starting to sell, said Leibowitz, as in “guys who have owned properties for 30 years but had no idea how strong the rental market has become.” In February, he brokered the sale of 13535 Moorpark Street, a 20-unit 1950s complex in affluent Sherman Oaks, for about $6 million.

The Valley, which in the mid-20th century counted defense contractor Lockheed among its larger employers, has also gradually been redeveloping some of its industrial parcels to include new residences.

For example, plans are afoot for a team led by Boston Global Investors to turn a 46-acre former Rocketdyne plant in Woodland Hills into a high-density, mixed-use neighborhood.

But not all sites that could support apartment buildings will be the subject of bidding wars. Today, residential development deals are fewer and farther between, Raymundo said, adding that sites that would sell today wouldn’t likely add buildings for a least a few years.

Cubicle contraction

Although the office market in the Valley is still dotted with empty cubicles, it has improved notably since the dark days of the recession, agents said. The county’s August unemployment rate was just 4.8 percent.

Overall, in the Valley’s sweeping 20.5 million-square-foot office market, the vacancy rate is about 13 percent, according to a second-quarter market report from CBRE. But it could be worse: In Downtown Los Angeles, the vacancy rate was about 17 percent over the same period.

Average annual asking rents in the Valley, meanwhile, are about $2.50 per square foot a month, CBRE said, versus $4.75 in West L.A.

Marcus & Millichap brokered the $73 million sale of the 348-unit Waterstone Apartment Homes complex in Chatsworth.

As residential tenants migrate over the hills to the Valley, office tenants are expected to be close on their heels, brokers said. And with almost no new office construction on the horizon, the market is expected to tighten.

If some firms can seem to troll for deals in specific sectors, CBRE, the global behemoth, casts a much wider net. Its 37 transactions in the Valley, which totaled nearly $617 million, encompassed office, retail, multifamily and even senior housing properties.

The firm’s priciest deal? The $69 million sale of 5161 Lankershim Boulevard, a four-story, 197,000-square-foot 1980s office building on the corner of West Magnolia Boulevard in the NoHo Arts District of North Hollywood.

And the deal, in which Beacon Capital Partners, an office-focused Boston firm, snapped up the property from the Los Angeles-based Kennedy Wilson group, may speak to the local office market’s growing strength.

The building, which is home to Endemol Shine North America, a TV production company, last sold in 2013 for $45 million, meaning its value jumped more than 50 percent in just four years.

And with little new product planned in the Valley and a steady stream of movie companies relocating their offices there from Hollywood in search of discounts, the Valley’s office market is only expected to improve, brokers say.

The old, industrial Valley

As online commerce continues to boom, warehouses throughout the region are being utilized as distribution centers, according to brokers. The result is an extremely low vacancy rate of about 1 percent, according to a second-quarter CBRE report. All told, the San Fernando Valley, which includes industrial zones like City of Industry, contains about 173 million square feet of warehouses, movie studios and similar structures, CBRE reported. There’s just about 1.1 million square feet under construction, so supply is expected to remain constrained.

Annual average asking rents for those warehouses are about 85 cents a square foot a month, CBRE said, among the region’s highest rates.

With an average deal price of about $5 million, brokerage Lee & Associates, which conducted about $108 million in transactions across 23 commercial sales over the 12-month period surveyed, was particularly active in the middle market. It handled the $8.7 million sale of 14955 Calvert Street in Van Nuys, where the TV show “Melrose Place” was once filmed. Lee’s other warehouse sales included a $15 million transaction in City of Industry at 14750 Nelson Avenue East and another for $4.6 million in Burbank at 2517 North Ontario Street.

Bulking up on smaller deals is also an approach favored by Colliers International, which had 19 deals for a total of $76.4 million. Its priciest deal, for a vacant 48,000-square-foot warehouse in North Hollywood, went for about $10 million, while at the opposite end of the spectrum, the firm also closed on the sale of a single-story medical building in North Hollywood for $700,000.

But by some measures, the commercial market does not have a lot of room to grow. Capitalization rates, which measure a building’s profit-making potential and can reflect demand, have remained low in the Valley, around 4 percent in the most in-demand areas along the Valley’s southern edge, according to CBRE.

“2017 was considered a plateau, and the thought was, ‘how low can you go?’” said Chalvis Evans, a senior vice president at CBRE. But as interest rates, and thus borrowing costs, remain stable, cap rates should stay compressed for a while longer, he said.

“We thought that we were in the ninth inning last year,” Evans said. “But now it seems like the third inning of the first game of a double-header.”

Hitting home runs

The players who deal in pricier properties got some numbers on the board recently. In third place in the ranking, with $425 million over just six deals, was Newmark Knight Frank, which has five offices in L.A., though none of them are in the Valley. Still, the firm seems to have gravitated toward the North Hollywood or NoHo area, which has two stops along the Red Line of L.A.’s Metro subway system. Investors see the proximity to mass transportation as a huge asset.

Last November, Newmark agents represented Kennedy Wilson, the seller of 5200 Lankershim Boulevard, a two-building, 175,000-square-foot complex built in the early 1990s with tenants who work in the movie and TV business. It sold for $62 million.

Also with a relatively minuscule deal flow relative to its standing was JLL, which wound up in fourth place with nearly $280 million in just two transactions, including the $146 million purchase of a pair of office buildings at Warner Center by New York investor Angelo, Gordon & Co. partnered with Dallas-based Lincoln Property Company.

Likewise, Eastdil Secured, in fifth place, was good for $235 million in two deals, both of which were for office properties at Warner Center.

Similarly, HFF, in sixth, had just under $221 million over three deals, and L.A.-based Madison Partners, in seventh, brokered $144 million in four deals that were mostly office properties. HFF did not respond to requests to confirm its sales numbers, and Madison did not respond to emails. Berkadia, a joint venture between Warren Buffett’s Berkshire Hathaway and the Leucadia National Corporation, exclusively brokered just over $108 million in nine deals, which was good enough for an eighth-place finish.

The firm, which has three Los Angeles offices, including one in the Valley at the Warner Center, focuses mostly on residential plays.

Will retail rally?

If the Valley has a soft spot, it’s retail. The Valley has 15 million square feet of stores, where the average annual asking rents are $2.50 a square foot a month. Though CBRE reported that the region’s retail sector had a 5 percent vacancy rate in the second quarter of this year, it’s expected to rise. Malls have been particularly hard hit, brokers say.

In contrast, in West Los Angeles, CBRE said, rents were about $12 a square foot.

But some firms, likely assuming the sector will improve, have not shied away from stores, like Encino-based IREA, which handled four deals for $76 million, for a 10th-place tie. Retail transactions figured largely in the deals, including the sale of a strip mall-type offering called Parkland Center, a Spanish Colonial-style building at 16107 Victory Boulevard in Lake Balboa that’s home to a Vallarta supermarket. The building traded for $13 million in September 2016.

Also notable was IREA’s $55 million sale of Northridge Plaza, a 17-acre shopping center at 8840 Corbin Avenue with Target and Kohl’s as anchor tenants. It was sold by a family entity that owned it since it was built in 1980, according to news reports.

Elsewhere in the Valley, new coffee shops, restaurants and bars, especially in North Hollywood, are raising the area’s profile even more, said Derrek Ostrzyzek, a director of Moran & Company, a firm that oversaw the $72 million sale of Studio 77, a NoHo apartment complex, built by AvalonBay Communities, a national real estate investment trust.

“It’s as if,” Ostrzyzek said, “the Valley has suddenly become one big emerging neighborhood.”

— Harunobu Coryne provided research for this article.