Should I get multiple installment accounts?

If you’re dealing with less-than-ideal credit, you know you have to take action. Opening new accounts that will be reported to the credit bureaus and making on-time payments can be an important part of building or rebuilding your credit. If you’re itching to work your way into the excellent score range, you might be looking into using more than one account to add positive payments to your credit history.

With that in mind, CreditStrong created an easy way for customers to quickly add a second installment loan to their account. Here’s what you need to know.

The Benefits of Opening Another Credit Builder Loan

As with your initial credit builder loan, the benefit of adding a new account is that you’ll be adding an additional loan and its payment history to your credit reports.

- Each on-time payment gets reported to the credit bureaus, adding to your positive credit payment history — one of the most important credit scoring factors, accounting for about 35 percent of your FICO score.

- If you only have a few accounts in your credit history you may have a “thin file,” which could limit your creditworthiness. Adding another credit builder account can help “fatten” your credit file.

With two Credit Strong accounts, you’re also building more savings each month. You still won’t have to make an initial deposit, there won’t be a hard inquiry (a credit check that can hurt your scores), and you’ll continue to get free FICO® Score tracking to monitor your progress.

Considerations Before Opening Another Credit Builder Loan

There are some items you should consider before opening a second credit builder account.

The primary one is that you’ll have another monthly payment, which can make it more difficult to afford all of your bills. If you’re 30 or more days late on a payment, CreditStrong will report the late payment for that account to the credit bureaus, which could hurt your credit.

Opening a new account can also lower your average age of accounts, which may hurt your scores at first. However, over time, having two accounts aging in your credit history is better than one.

How To Open a Second Credit Strong Loan

If the benefits of opening an additional Credit Strong account make sense for your credit goals , we’ve made it easy to add another loan to your account.

To qualify, you’ll need to have made your first payment and paid the administration fee for your initial credit builder loan. If you previously had a Credit Strong account that is now closed, you can still open a second account. However, you won’t be eligible for a third account.

The information from your account will be automatically filled in on your new application, making it easy to add another credit builder loan to your credit history.

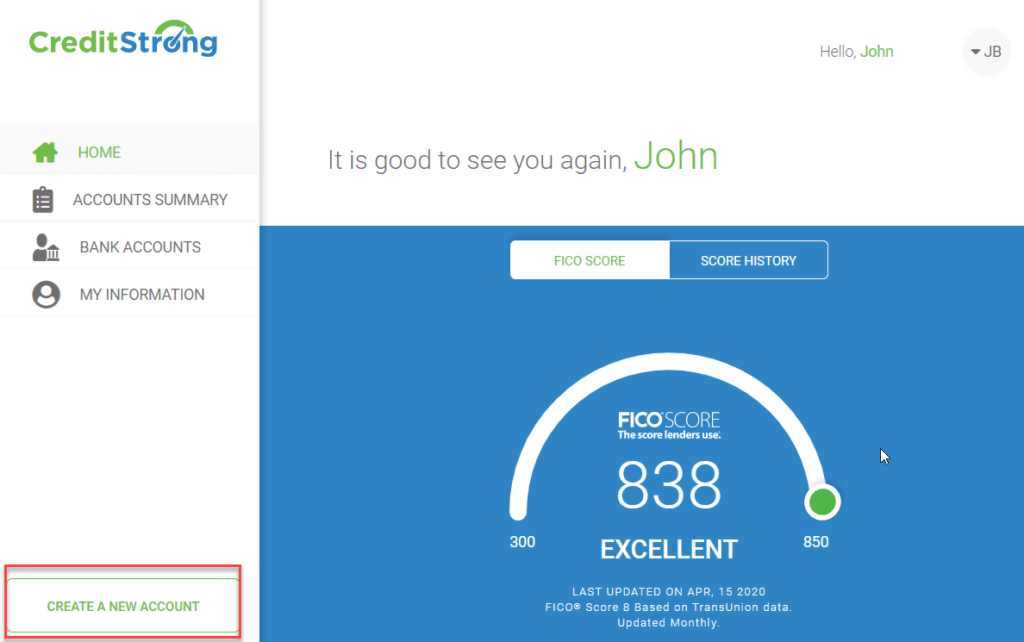

- Log into your online portal and click “Create New Account” on the main navigation menu.

- Verify everything is correct on the application and make necessary changes to the pre-populated fields, such as your address.

- Choose your new account type from Credit Strong’s product offerings; Subscribe, Build & Save, or Magnum, depending on your specific credit and savings goals.

- Select your payment method, which will update the payment method for both of your loans.

- Complete the agreement and sign the contract. Your new credit builder loan will be added to your account, and you’ll be able to see it in your “Account Summary” tab.

You can also make payments on either loan, schedule auto-pay, and see your savings progress by logging into your Credit Strong customer portal.

Frequently Asked Questions

Does having multiple accounts increase my credit score faster?

Having multiple credit accounts can help move you from a thin file to a full file, which could help your creditworthiness.

Additionally, making on-time payments on multiple accounts may be better than making on-time payments with only one account. However, missing payments on multiple accounts can also hurt your scores more than missing a payment on one account.

Will having two installment accounts increase my “credit mix”?

Having experience with different types of credit accounts can increase your credit scores. Sometimes this scoring factor is called “credit mix,” and it impacts about 10 percent of your credit score.

Credit mix refers to whether you have experience with both installment accounts (such as auto, mortgage, student, and credit builder loans) and revolving accounts (such as credit cards). And, credit scores will look at both open and closed accounts when considering your credit mix.

Will owing more money hurt my credit?

Owing more money on a loan might not hurt your credit scores a lot, although it can impact your creditworthiness in other ways.

With credit cards, the portion of your credit limit that you’re using is an important factor in your credit scores. The scores compare your reported credit card balance to the card’s limit to determine your “utilization rate.” Lower utilization (i.e., using less credit) is better for your scores.

However, credit utilization rates aren’t negatively impacted by installment accounts. The amount you owe relative to the initial loan amount can still impact your scores, but it’s generally a much smaller impact than your revolving accounts’ utilization.

Credit scores aside, your monthly debt payments can impact your debt-to-income ratio, which creditors may consider when reviewing your application for a new account. Owing more money each month may hurt your creditworthiness even if it doesn’t hurt your scores much.

How does taking out an installment loan impact my credit?

Applying for and taking out an installment loan can impact your credit in several ways.

- The application could require a hard inquiry — when creditors review your credit report — which can hurt your scores. (Credit Strong accounts don’t require a hard inquiry).

- A new account will also decrease your average age of accounts at first, which can hurt your scores a little. However, over time, the new account can help your credit by increasing your average age of accounts and adding your on-time payments to your payment history.

- If you don’t already have an installment loan on your credit report, the new account can also add to your credit mix, which can help your scores.

- Most importantly, making on-time payments on your new loan can help you build a positive payment history and greatly improve your credit.

In the long run, an installment loan could help or hurt your credit depending on if you make your payments on time.

How much can a credit builder loan help?

A credit builder loan can help your credit as much as another type of installment loan. The Credit Strong loan will be reported to all three credit bureaus — Equifax, Experian, and TransUnion — and your on-time payments will help you build credit across the board.

Is using a credit builder loan a good idea?

A credit builder loan can be a low-cost way to build credit and increase your credit scores. You’ll also be building your savings at the same time. You can end the credit building process with better credit scores and an emergency fund. The fund can be important, as you can use it during an emergency to avoid late payments that can hurt your credit or for a down payment on a financed purchase.