A Quantum Theory of Venture Capital Valuations

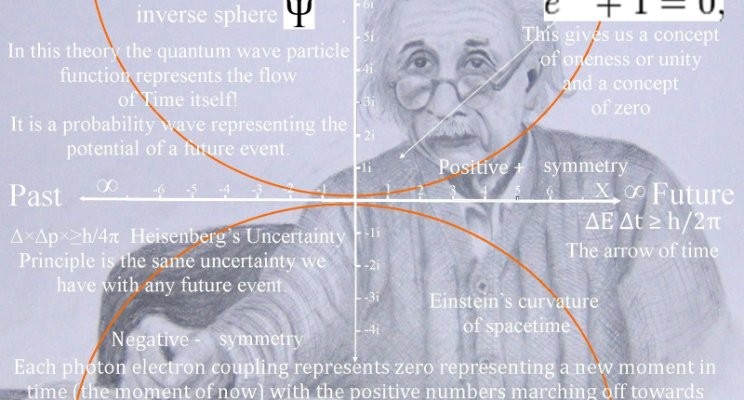

Quantum Theory is so hot right now even English majors like myself want to get in on the act. Unfortunately, the image above represents “post truth” advertising. I can neither speak, read, nor write math, which definitely puts limits on where I can get directly involved. But, ah, when it comes to metaphor, now there I still can hope to rock the house. And in that spirit, I want to introduce you to a quantum theory of venture capital valuations!

The quantum theory of matter says that energy comes in discrete amounts, not gradients. An electron in an atom, for example, occupies a specific place in one or another specific shell, and that placing specifies a particular level of energy. It can move to another place and reach another energy level, but it cannot find any in-between state—it is either at State 1 or State 2. Surprisingly, venture valuations work in much the same way.

When a company gets its first funding, that establishes State 1. Say you raised $1M for 25% of your company based on little more than a business plan, some technical expertise, and a product concept you and your co-founders can bring to market in less than a year. Your company is now valued at $4M overall. Say your plan calls for you to get a couple of customers to prove that the product is at least minimally viable at which point you expect to raise another round of capital, say $4M, to complete the product and win say a dozen or so satisfied customers. Now for this plan to work, when you go out to raise that next round, the company has to be valued much higher than $4M or else you would have to part with 100% of it. So what will have changed in the interim? Why will a next-round investor value your company at, say, $16M instead of $4M? Obviously you have done plenty of work in the interim—that’s what you spent the $1M on—but how valuable is the result?

This is where the quantum theory part kicks in. Value creation in venture capital is not a gradient. Companies do not become a little more valuable every day. Instead they transition between valuation states. The purpose of a round of venture funding is to get your company from one valuation state to the next. If you only get part way there, even if you manage to get most of the way there, that doesn’t cut it. Raise money in this situation and you will be lucky to get any step-up in valuation from the prior round. So how can you know exactly how high a bar you have to clear?

There are no hard and fast rules here, but one way to calibrate a venture valuation model is by what risks you have taken off the table. For example:

- Technology risk is often the first one to tackle. A seed round of funding might go to proving technical feasibility for a product idea. If proof of concept is achieved, then technology risk can be said to have been taken off the table, and the company’s valuation should reflect that.

- Product risk is another step in the journey—can you deliver a minimum viable product, and can you get at least a few customers to buy it, use it, and be a reference for it going forward? If so, that takes another risk off the table.

- Market risk is a third category—can you cross the chasm from early adopters and find at least one target market segment that will adopt your new offer with enthusiasm? If so, your company is well on its way to being a going concern, and that takes a whole bunch of risk off the table.

- Team risk is a fourth area—can you successfully recruit high-quality leaders with strong resumes that demonstrate they know what they are doing when it comes to building out a new company? Will they come work for you? If so, that sends a great signal to the next-round investor.

- Financing and systems risk is a fifth area—having proven you can make the top line, can you make the rest of the P&L work as well? Can you put the systems in place needed to operate effectively and efficiently at scale? Can you get to escape velocity on the capital plan in place? If so, you protect your current investors’ ownership from further dilution.

- Execution risk is a sixth area—have you consistently demonstrated that you are able to do what you said you were going to do? Can you forecast accurately and then meet or beat your numbers quarter after quarter? That’s what it takes to do a successful IPO and to keep your valuation in the quarters thereafter.

Now every one of these risks is something that keeps a venture investor up at night, so the sooner you can take any one of them off the table and do so definitively, the better. That said, “definitive progress” is often in the eye of the beholder. Given such ambiguity, it is critical to get agreement with your prospective investors as to what state change they think they are funding, what milestones they think will clearly demonstrate to a new investor that it has been achieved, and then together with them make a bet on that model being right. The more experienced your prospective investors, the better your odds will be, for these are the folks that have seen this movie many times before.

Let me give an example. At Wildcat Ventures, where I support the general partners as a venture partner, the GP team has many decades of experience, including a lot of investing in B2B SaaS companies. Based on their experience with funding and growing companies in this category, they have identified a Traction Gap, an in-between state where it is a real struggle to raise the next round. One metric of this gap is monthly recurring revenue where companies with a revenue stream between $50K/month and approximately $500K/month are at risk. That is, while there are familiar valuation metrics for funding companies at either end of this spectrum, there are none for companies caught out in the middle. A company at say $250K/month in recurring revenue has obviously made lots of progress over one making $50K/month, but not enough for a new investor to support a significant step-up in valuation. In other words, the company has not materially changed its state. It does not get valued as if it were halfway there. Instead it should think of itself as somewhat like an interview candidate whose resume reads “some college”—until you actually complete the degree, you don’t get any of the credit. Same holds for state changes in venture.

Given this state of affairs, perhaps the most important thing entrepreneurs can do at the outset is to get clarity with their prospective investors as to what state change they think they are funding with the current round and then focus the entire team on getting that change across the finish line before time and money run out. Getting this kind of clarity requires establishing a relationship of trust so that both you and your investor can be as explicit as possible about what that next state has to look like, what resources it is realistically going to take for you to get there, and what intermediate milestones or metrics will tell both you and them whether you are on track or falling behind. Because building trust implies making oneself vulnerable, this is challenging to do because both parties are negotiating with each other at the same time, but there simply is no substitute for it. Venture takes quality people spending quality time to work through challenging issues. That’s part of what makes a great entrepreneur and a great venture investor. Not only do you have to be present to win—you have to be fully present to win. It is a tough ask, but the goals demand it, and the rewards make it worth it.

In this context the frameworks, strategies, and tactics the Wildcat team is fleshing out around the Traction Gap are invaluable both to entrepreneurs and to the VCs wanting to fund them. I encourage you therefore to follow the URL here (www.tractiongap.com), profit from the learnings assembled to date, and bookmark it because the research is ongoing and the benchmarks are only going to get better.

That’s what I think. What do you think?

______________________________________________________________________

Geoffrey Moore | Zone to Win | Geoffrey Moore Twitter | Geoffrey Moore YouTube

Chief Enterprise Architect, Mentor, Business Architecture and Strategy

6yAwesome. Sounds like we should talk, we seem to be on the same path about discussing business as it relates to physics. Have a few insights I'd love to discuss with you.

Increasing sales through customer success®| Learner, Orbit-changer, Coach, Volunteer

6yHello Geoffrey. Nice thinking. Whether valuation is quantum or not...it is certainly not linear. Sometimes it is exponential! Or even reverse. Do the six stages have to come one after the other. There are times where more than one may be important at a single time. Say System Risk. It would have a large play right from the stage of market risk. So perhaps we need another paradigm than that of discrete energy levels. There is also a Heisenberg's Uncertainty Principle at play! We need some more Moore's Laws. Also in an earlier post on start ups, you had referred to a stages of start up being gas, liquid and solid. There are other models to speak of - The Start Up Way or Design Thinking. Is there a benefit of one versus the other to apply...does it depend upon market, product, founders et al. This is what I think. What do you think.

Cornell & Columbia trained Organizational Psychologist. OIA Inspiration Award For Global Change

6yLove it! Great job boiling this aspect of quantum theory down into the key elements that even I could easily understand.

Chief Strategy & Revenue Officer at Q-CTRL // Deep Tech Advisor

6yWell done as usual in advancing thought, Geoff- biggest issue with the risks you highlight above is that the measurement of each (and the perceived momentum if you want to get down to specifics) are both highly subject to human emotions. And venture capital funding is hardly a perfect science. Quantum interactions are subject to none of these imperfections.