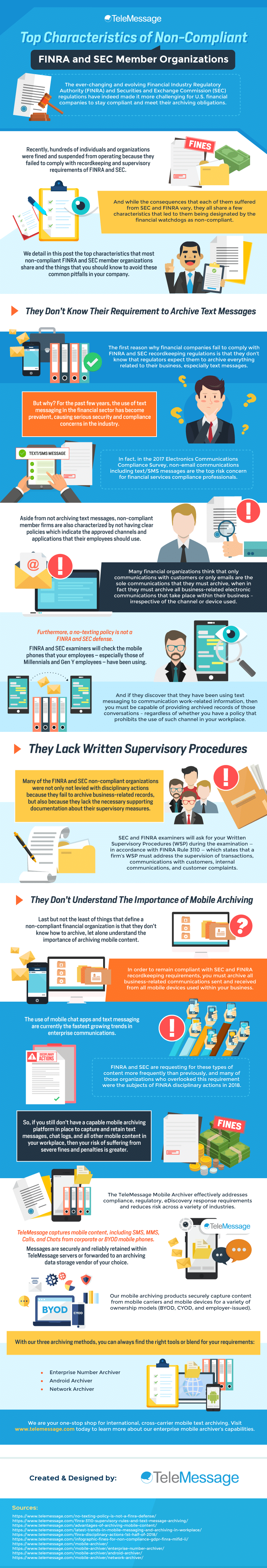

The ever-changing and evolving Financial Industry Regulatory Authority (FINRA) and Securities and Exchange Commission (SEC) regulations have indeed made it more challenging for U.S. financial companies to stay compliant and meet their archiving obligations.

Recently, hundreds of individuals and organizations were fined and suspended from operating because they failed to comply with recordkeeping and supervisory requirements of FINRA and SEC. And while the consequences that each of them suffered from SEC and FINRA vary, they all share a few characteristics that led to them being designated by the financial watchdogs as non-compliant.

We detail in this post the top characteristics that most non-compliant FINRA and SEC member organizations share and the things that you should know to avoid these common pitfalls in your company.

They Don’t Know Their Requirement to Archive Text Messages

The first reason why financial companies fail to comply with FINRA and SEC recordkeeping regulations is that they don’t know that regulators expect them to archive everything related to their business, especially text messages.

But why? For the past few years, the use of text messaging in the financial sector has become prevalent, causing serious security and compliance concerns in the industry. In fact, in the 2017 Electronics Communications Compliance Survey, non-email communications including text/SMS messages are the top risk concern for financial services compliance professionals.

Aside from not archiving text messages, non-compliant member firms are also characterized by not having clear policies which indicate the approved channels and applications that their employees should use. Many financial organizations think that only communications with customers or only emails are the sole communications that they must archive, when in fact they must archive all business-related electronic communications that take place within their business – irrespective of the channel or device used.

Furthermore, a no-texting policy is not a FINRA and SEC defense. FINRA and SEC examiners will check the mobile phones that your employees – especially those of Millennials and Gen Y employees – have been using. And if they discover that they have been using text messaging to communication work-related information, then you must be capable of providing archived records of those conversations – regardless of whether you have a policy that prohibits the use of such channel in your workplace.

They Lack Written Supervisory Procedures

Many of the FINRA and SEC non-compliant organizations were not only not levied with disciplinary actions because they fail to archive business-related records, but also because they lack the necessary supporting documentation about their supervisory measures.

SEC and FINRA examiners will ask for your Written Supervisory Procedures (WSP) during the examination — in accordance with FINRA Rule 3110 — which states that a firm’s WSP must address the supervision of transactions, communications with customers, internal communications, and customer complaints.

They Don’t Understand The Importance of Mobile Archiving

Last but not the least of things that define a non-compliant financial organization is that they don’t know how to archive, let alone understand the importance of archiving mobile content. In order to remain compliant with SEC and FINRA recordkeeping requirements, you must archive all business-related communications sent and received from all mobile devices used within your business.

The use of mobile chat apps and text messaging are currently the fastest growing trends in enterprise communications. FINRA and SEC are requesting for these types of content more frequently than previously, and many of those organizations who overlooked this requirement were the subjects of FINRA disciplinary actions in 2018. So, if you still don’t have a capable mobile archiving platform in place to capture and retain text messages, chat logs, and all other mobile content in your workplace, then your risk of suffering from severe fines and penalties is greater.

The TeleMessage Mobile Archiver effectively addresses compliance, regulatory, eDiscovery response requirements and reduces risk across a variety of industries. TeleMessage captures mobile content, including SMS, MMS, Calls, and Chats from corporate or BYOD mobile phones. Messages are securely and reliably retained within TeleMessage servers or forwarded to an archiving data storage vendor of your choice.

Our mobile archiving products securely capture content from mobile carriers and mobile devices for a variety of ownership models (BYOD, CYOD, and employer-issued). With our three archiving methods, you can always find the right tools or blend for your requirements:

We are your one-stop shop for international, cross-carrier mobile text archiving. Visit www.telemessage.com today to learn more about our enterprise mobile archiver’s capabilities.