IVO’s Plan to Turn Contract Momentum into Ongoing Revenues

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

If you’ve been tuned into ASX small-cap tech plays lately, you’ll know that Invigor Group Limited (ASX:IVO) has had no shortage of good news. Barely a week has gone by without the company announcing another contract win.

The latest news, coming in October, was that IVO’s Condat business had secured A$1.25 million in new contracts with German public broadcaster RBB and performance rights agency GVL.

It followed that up in November by announcing two major contract wins for its Insights Pricing platform — leading international winemaker Accolade Wines (which produces the popular Australian brand ‘Hardys’) and globally recognised beverage company Asahi Beverages.

During the same month, IVO announced a 33% increase (over the three months prior) in revenue-generating contracts for its Saas mid-tier pricing platform SpotLite, including customers across a range of sectors in Australia, New Zealand, the US, the UK and Norway...

It isn’t just IVO’s Retail and Spotlight ‘Insights 360’ platforms which have been drawing a crowd. Its mall visitor analytics solution — the Invigor Loyalty module — has quite literally been drawing a crowd (of eager shoppers) as it clocks up new clients too.

The last time we wrote about IVO in July (‘ Putting the Spotlight on IVO’s Recent Contract Wins ’), we told you about its recent avalanche of deals and gave an update on the Sprooki business it acquired in the previous quarter. The momentum has continued for IVO in the shopping mall space, with the company announcing earlier this month that it had locked in a major Asian mall group, Ayala Malls.

Ayala Malls is a division of Ayala Land in the Philippines, owner and operator of over 30 malls. Initially, the Invigor Loyalty module will be deployed over the festive season in the newest Ayala Mall property called ‘The 30TH’.

It should be noted here that IVO’s current activities does not preclude this from being a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

The sky could be the limit for Invigor. Or rather, its Sky(ware) Logistics offering after this week advising it would be expanding Skyware into the Asia Pacific region, with the division having enjoyed year on year growth of 100% and anticipating revenue of $2 million for 2018.

IVO has been busy beyond the sales pipeline, too. In the third quarter the company signed an MOU with Microsoft which included the optimisation of Invigor Shopper Insights on Microsoft Azure for a key (unnamed) Australian retail customer. IVO has previously announced channel partnerships with eBay and GoDaddy for the SpotLite platform, and is no stranger to working with big brands.

That all amounts to a lot of developments over a matter of months for a company that only has a market capitalisation of ~A$6.5 million. Given its recent deal flow, there seems to be a discord between its business developments and its share price. Which is why IVO appears to have shifted its focus to addressing its balance sheet... with the intention to convert all of its recent wins into major growth evidenced by its bottom line.

It’s not uncommon for small-cap tech companies to make huge strides in product development, requiring a lot of early spending, and focus less on the balance sheet.

IVO has no plans to continue down that path, however, and in early December it released an update outlining how it was going to strengthen its balance sheet. A recent capital raise has brought in $732,000 with options equalling a potential total raise of $1.1 million. Further, it has initiated a $600,000 cost reduction program.

But what is potentially the biggest news as far as finances go — the board has agreed to seek bids for the media division of its wholly-owned Berlin-based Condat business (which currently has ZDF and Ericsson as clients). It could reasonably be expected that IVO will sell the business for, at a minimum, the current annual revenue of Condat Media —approximately A$6 million.

Considering the company has received several offers already from IT and private equity companies in Europe, this transaction could be wrapped up as soon as the first quarter of 2018. As things stand, its sale of Condat Media for ~$6 million would bring in funds matching the company’s current market capitalisation... at which point, we could see a significant correction in the company’s share price.

Read on to get re-acquainted with:

Contract wins continue to stack up

In October, IVO informed the market it had secured A$1.25 million in revenue-generating contracts for its Condat AG business, including European media organisation RBB and GVL. News that should bode well as it looks to sell this side of the Condat business.

Late November saw the company announcing a major contract win, signing up Accolade Wines, one of the largest producers of new world wines globally. Its portfolio includes Hardys, which is the highest-selling Australian wine in Britain, the UK’s second largest wine brand Echo Falls, as well as the UK’s most popular South African brand Kumala.

Accolade also owns House of Arras from Tasmania, Mud House from New Zealand, and Petaluma, Grant Burge and St Hallett from South Australia.

Clearly bracing for the festive season, IVO also added Asahi Beverages to its client list within weeks of the Accolade announcement. Under the sales agreement, Asahi will deploy the retail module of the Insights 360 platform to gain immediate insights into industry and pricing changes as they happen, generating revenue for IVO.

For those unfamiliar with IVO’s Insights Retail service and how it works, the following video will bring you up to speed:

Asahi markets and sells 24 premium liquor brands across Australia and New Zealand. It’s a long list of big names which includes Asahi Beer, Peroni, Somersby Cider, Cricketers Arms, Vodka O, Vodka Cruiser, Woodstock and others.

The Asahi deal boosts IVO’s growing footprint in the alcohol and beverage market, with Asahi and Accolade joining a client list that already includes Treasury Wine Estates, Pernod Ricard Australia and Moet Hennessy.

How much of this market IVO can attract remains to be seen, so investors should consider all publicly available information and take a cautious approach to any investment decision made with regard to this stock.

It also represents part of IVO’s plans to service both bigger and smaller companies across a broad range of sectors in a drastically changing landscape currently being disrupted by e-commerce giants like Amazon. Big data has never been more important for retail companies.

SpotLite subscription surge

In the same bumper month for IVO, the company provided an update on its SpotLite platform, informing the market it had a 33% surge in revenue-generating contracts in the three months to November 15.

New SpotLite customers who came on board during the fourth quarter of 2017 include Hanes (Bonds), Healthy Life, ITW, Smart Electrical Outlet, Baby Village, Metabo, New Zealand natural health products maker Comvita (Manuka Honey), US online retailer It’s Worth More, and Telia, the leading telephone company and mobile network operator in Sweden, Norway and the Baltic states.

A moment ago, we mentioned the impacts of Amazon on IVO’s business... this is being felt in no area more than the company’s SpotLite Insights Pricing cloud-based platform, which offers the ability for clients to monitor competitors and gain pricing intelligence in real-time as well as optimise its pricing day to day.

Of course, Amazon’s success in competing across all manner of retail industries is due in large part to its data-driven online pricing. SpotLite tracks products across more than 25 different industries on every single continent, including online retailers and marketplaces including Amazon, as well as eBay.

Skyware expansion into Asia Pacific

IVO is in the process of selling the media division of its Germany-based Condat AG business. It will retain, however, its Skyware Service Control, a logistics and workforce management solution. This month it announced IVO would be expanding Skyware into the Asia Pacific region, having had significant uptake of the product across Europe.

Skyware assists ecommerce companies in managing mobile workforce deployments to streamline delivery and mobile order management, in particular, the ‘last mile’ aspect of the process. It includes automated, GPS-assisted field force dispatching as well as mobile order management functionality, resulting in cost savings and greater productivity for the companies who use it (list which currently includes Daimler Benz, Liberty Media Group and the operator of German railway network Deutsche Bahn).

Skyware has experienced year on year growth of 100%, with the company forecasting an impressive A$2 million in revenue for the 2018 calendar year.

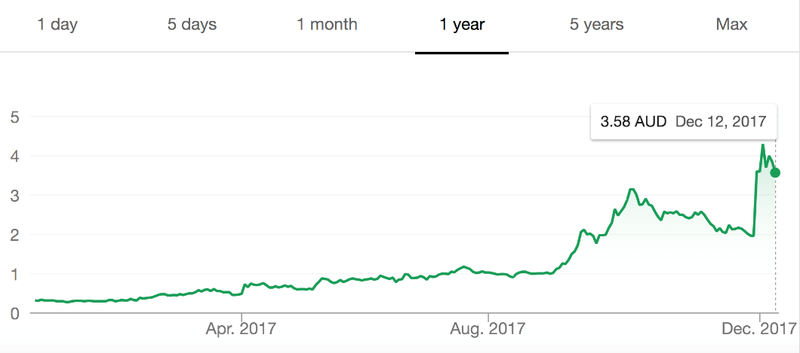

For comparison’s sake, let’s take a quick look at Skyware competitor, GetSwift (ASX:GSW) to give an idea of how huge the market is for logistics software and ‘last mile’ delivery tracking. GetSwift is also a logistics software business, offering a cloud-based SaaS platform intended to streamline the delivery and logistic channels for businesses using tracking software — effectively, the same business need IVO is addressing with Skyware.

IVO is offering a comparable high-quality product, meanwhile GetSwift has a market cap of ~A$278 million with a whopping $100 million in cash reserves, having just raised $75 million at $4 a share in an oversubscribed capital raise...

A year ago GSW’s share price hovered around $0.30. It has since risen to as high as $4, having soared 84% in early December.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

This is the kind of potential that could be in store for IVO thanks to its Skyware product.

The small-cap balancing act

A good company knows when is the right time to re-assess and adjust its focus, and that’s exactly what IVO is doing right now.

Following a review of its finances, it has announced several measures to tighten up the balance sheet including capital raisings, a $600,000 cost reduction program and the upcoming sale of its Condat Media business. It also has plenty of tenders in the pipeline to keep revenue flowing in the near and medium term.

IVO’s recently completed a capital raising amounting to $732,000, with a potential total raising of $1.1 million including options.

Earlier in the year, IVO issued Convertible Notes, which will soon expire... likely bringing in another several million dollars.

All these measures are likely to tip the balance sheet in the right direction within only a few months — right in time to boost the momentum IVO is enjoying across its product portfolio. In particular, the sale of Condat Media is set to have the biggest impact, with a reasonable expectation of fetching IVO a very handy ~A$6 million to start with.

With several parties expressing interest, the company can afford to be choosey and select the best deal to bolster its bank balance and, ultimately, turn around its bottom line. As we noted earlier, the sale could result in an injection of cash equal to the company’s current market capitalisation... and thereby have a significant effect on its share price.

As we don’t yet know what the impact of this deal will be, investors should seek professional financial advice for further information before making an investment decision.

With the numbers side of the company about to be right-sized, there will be very little standing in the way of success for IVO. These fiscal measures will work in conjunction with other near-term value drivers (such as Skyware’s expansion into the Asia Pacific and the uptake of its Visitor Insights platform), and add to its renewed sense of focus and maturity.

Amazon is here and there’s more change on the horizon

We’re seeing the demand for big data solutions and analytics intensify across the retail and e-commerce worlds. In Australia, this is coinciding with the arrival of e-commerce giant Amazon, and the threat it poses to retail companies both big and small.

IVO seem well on the way to capturing an even greater share of several key markets, and partnering with multiple leading global brands. Each time it wins another contract it’s a further validation of the competitive edge it has with its sophisticated product suite.

What it needs now is to find its feet in terms of its fiscal performance, and it’s looking well prepared to do so with the strategy it announced recently.

With the constellation of developments outlined above, we wouldn’t be surprised to see IVO’s share price enjoy a serious uptick in early 2018.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.