3 Reasons Why Whole Life Insurance Is A Bad Idea [We Discuss The Details & Your Options]

Updated: April 12, 2024 at 9:40 am

Chances are, if you are reading this article, some agent presented the virtues of whole life insurance to you. Or, maybe you purchased a whole life policy and having second thoughts. Truthfully, whole life insurance isn’t bad. Really, it’s not. However, it definitely isn’t for everyone. Moreover, for most people, it’s a bad deal. In this article, we discuss the 3 reasons why whole life insurance is a bad idea to buy. If an agent is telling you that you need whole life insurance without a concrete reason, run, don’t walk, away.

Chances are, if you are reading this article, some agent presented the virtues of whole life insurance to you. Or, maybe you purchased a whole life policy and having second thoughts. Truthfully, whole life insurance isn’t bad. Really, it’s not. However, it definitely isn’t for everyone. Moreover, for most people, it’s a bad deal. In this article, we discuss the 3 reasons why whole life insurance is a bad idea to buy. If an agent is telling you that you need whole life insurance without a concrete reason, run, don’t walk, away.

And contact us for our help. We can have an honest discussion and figure out if whole life insurance is right for you. Remember, we discussed how whole life insurance can be a good idea. It can be. Its purchase depends on your situation and what you are trying to accomplish.

Let’s start by giving a brief overview about whole life, and then we will dive into the reasons.

What Is Whole Life Insurance?

First, a quick lesson on whole life insurance. It is a permanent life insurance policy. This means it is designed to last for your entire life provided premiums are paid. Over time, cash value accumulates in the policy. You can borrow from the cash value and repay it back. At some point, you can even cancel the policy and receive the cash value.

Not to get into the weeds, but that cash value is yours. It offsets the death benefit. Upon death, your beneficiaries receive part cash value and part remaining death benefit. Here’s an easy example. You purchase a whole life policy of $50,000. Six months later, you die. There’s no cash value, so your family receives $50,000.

Fast forward 25 years. You die. There’s $27,000 of cash value. Your beneficiaries receive $27,000 cash value and $23,000 death benefit, for the full $50,000.

See how that works? MANY people get this wrong. Agents, too.

This structure allows carriers to offer whole life at level, guaranteed premiums. Contrast with indexed universal life, which does not offer guaranteed premiums. (In fact, nothing is guaranteed with an IUL.)

Why Whole Life Insurance Is A Bad Idea

Without further ado, let’s discuss why whole life insurance is a bad idea. Please note: whole life insurance is only a bad idea if it does not fit your situation. There are cases where it can be a good idea. We described those situations in our article about the good reasons for whole life.

#1 Reason – You Only Need Life Insurance To Cover You IF You Die

Compared to a basic term life insurance policy that will provide your beneficiaries with a death benefit IF you die, a whole life policy will pay a death benefit WHEN you die. So, naturally, the premiums of a whole life policy will be more. The carrier insures you for your entire life and expects to pay the death benefit.

This is the #1 reason why whole life is more expensive than term. The carrier already expects to pay a death benefit to your beneficiaries.

The real question is do you really need whole life insurance? Most of us do not. We just need a term life insurance policy that will pay a death benefit in case of our unexpected death.

Many people mess that up. They think they need whole life, when all they need is a cheap term life policy.

All death benefits from life insurance – whether term, whole life, or another type – is income tax-free. Your surviving family could use the money to remain in your home, continue their standard of living, establish a college fund, or a slew of other reasons.

Term life insurance, on the other hand, is cheap. For a 40-year-old woman, good health, non-smoker, she is looking at paying about $35 per for a $500,000 death benefit. However, a $500,000 whole life policy will cost around $470 per month ($5,300 annually)!

Nevertheless, if you need a $500,000 whole life policy to cover a permanent need (say to provide funding and caretaking for a disabled child upon your death), the $470 is the best money you can spend.

The decision always goes back to your needs and situation.

#2 Reason – Cash Value Takes A Long Time To Accumulate

If you were sold a whole life policy, the selling point could have been on the cash value.

Think of the cash value as a savings account. (But it is not!)

The carrier backs and guarantees your cash value. They also provide a non-guaranteed value. While the agent should have discussed the guaranteed cash values, I bet your attention focused more on the non-guaranteed values.

However, be aware. The cash in a life insurance policy takes a long time to accumulate, on average 12 to 15 years. Why? There are various reasons. The main reason is that the carrier’s operating costs – and risk of your policy forfeiture – are much greater in the early years of the policy. In other words, the carrier protects itself by keeping cash value low in the first few years to compensate for those policyholders who cancel their policies.

Generally speaking, once you hold the policy for over 12 years, you will see the cash value exponentially grow. But, it takes a long time to get there.

Moreover, do you really need it? That is the subject of our next reason…

#3 Reason – You Invest The Difference And Come Out Ahead

You may have heard about “buy term and invest the difference”. Here is what this means: if a term policy costs $300 annually, but a whole life policy costs $2,000 annually (for the same death benefit) then you have $1,700 to invest.

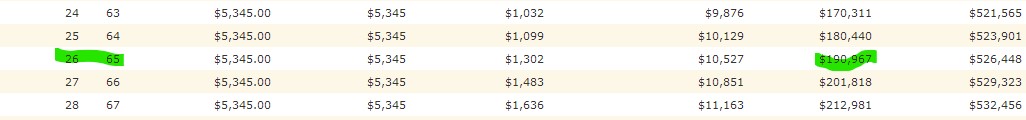

Let’s use our example again of the 40-year-old woman. She plans to retire at 65. In that 26 year span, she could have accumulated about $400,000 during that timeframe if she invested the “difference” – just under $5,000 annually in this case ($5,345 annual premium – $400 annual premium)- in a fund that returned 8% on average.

Contrast this amount to the whole life insurance policy illustration that the agent presented to you. Chances are, the cash value in the illustration is much less. (In fact, here is an illustration showing the cash value at age 65 – the $190k highlighted in green.) And, yes, even for those high-dividend participating policies agents like to throw around here and there.

Of course, the “difference” is subject to stock market risk. Chances are, though, you need to save – or save more – for retirement anyway! Saving through a whole life policy won’t get you to a comfortable retirement. In fact, it may cost you significantly from the effects of inflation.

Alternatives If You Need Permanent Insurance

John, you make great points. But, I do need permanent insurance like whole life insurance.

Then, whole life is right for you. You see, your situation dictates the need for whole life insurance. Maybe you need it for estate taxation or funding the care for a disabled child upon your death. Nevertheless, whole life insurance does have a place and importance with financial planning.

But, if you don’t want to pay high whole life premiums, you have a few alternatives.

One, for example, is what we just said. Invest the difference. If you were going to pay for a whole life insurance policy anyway, invest the difference. The problem is, usually, most people don’t invest the difference. They spend that difference on lifestyle wants and other material needs. Nevertheless, the money is there to invest. Be aware to weigh your options carefully.

If you feel you need permanent coverage, but don’t want to spend the money, there is an alternative called guaranteed universal life insurance. A guaranteed universal life (GUL) policy will last your lifetime, but these policies don’t have the cash value like whole life. In this case, a GUL costs much less than whole life, but more than a 30 year-term. The premium cost is usually in between these two.

For example, let’s say our 40-year-old woman purchased a $500,000 GUL. Her premiums are about $2,800 annually or $240 per month. Wow! Again, the premiums are higher because the carrier plans to pay a death benefit to your family.

Now You Know The 3 Reasons Why Whole Life Insurance Is A Bad Idea

Now you know three reasons why whole life insurance is a bad idea. You have options. Term life insurance is a type of life insurance we all pretty much need. If you feel you need lifetime coverage, look into a GUL. It is like whole life without the cash value. All things being equal, it is much cheaper than whole life and offers lifetime coverage.

However, as we described, whole life insurance does have its place. The decision depends on your situation.

What is best for you? We can help. We have the independent knowledge to assist you in the right decision. Unlike other agencies, we aren’t beholden to any insurance carrier, but we are beholden to you and making sure our recommendations fit your needs and situation.

If we feel you need whole life insurance (and some of us do), we will tell you. If something else, we will tell you that, too. Remember, there’s no risk of contacting us. If we can’t help you, at the very least, you’ll learn something new, and we’ll part as friends.

Feel free to contact us or use the form below. We are here to help.

Learn More

Are you interested in learning more about the information in this article? Please fill out the form below, and we will email you additional information or give you a call. We always work in your best interest. By entering your information, you are providing your express consent that My Family Life Insurance may contact you via e-mails, SMS, phone calls, or prerecorded messages at any phone number(s) that you provide, even if the number is a wireless number or on any federal or state do-not-call list. Additionally, you understand that calls may be placed using automated technology, and that consent is not a requirement for purchase. Your information will NOT be sold and will remain private. However, you may opt out at any time. We respect your privacy first and foremost. By contacting us, you agree to receive text messages from our number (800) 645-9841. If you no longer wish to receive text messages, you may opt out at any time by replying "STOP".

16 thoughts on “3 Reasons Why Whole Life Insurance Is A Bad Idea [We Discuss The Details & Your Options]”

Comments are closed.

I am 65 yrs old, on social security and want to get a life insurance policy. I receive an annuity pmt. every month of 80. dollars and want to spend that money for a life ins. policy. Want to find the best deal. Thanks, JERRY

Hi Jerry – we have your information, and a follow-up email is on its way. I appreciate your reaching out.

John

Hello, I had a 20years term life insurance that i paid $35 per month, I recently convert it to whole life that cost me $82 now, is that a good deal?

Hi Shantte,

Thanks for reading our article and writing to us. Without knowing your situation, I can’t honestly answer that. As we said in the article, it is not that whole life is “bad”. Most of the time, whole life does not fit our situation. The prime example of this is when you are covering temporary needs, in case you unexpectedly die, with whole life insurance.

If you are using the whole life for a long-term need such as paying your burial expenses, then the whole life conversion may have been a good decision. We wrote as well there are times whole life makes sense and is a good idea, rather than a bad one.

Converting to whole life makes sense as well if you are stricken ill and uninsurable, which underscores the need to have a conversion option on your term life policies.

John

I have a small life insurance policy for my mom right now who is 78 and on a fixed income and I need to get another insurance/better policy on her. My family is known for living well into their 90’s and 100’s. What should I be looking into?

Thanks, Cindy, for reaching out. A lot of factors are involved with an answer to that question. I will send you an email shortly.

John

Hello, I would like to discuss what life insurance is best for me.

Hi Ranea,

Thanks for your inquiry. Discussing which type of life insurance is right for you can be a difficult process, but we can help. I will email you some information.

John

Hi my question is:

is term life insurance going to pay natural death or old age death or died of any sickness death ? or only accidendental death ?

thanks

Hi Christine,

Good questions. Term will pay only if you die within the term or if you decide to annually renew the term. Here is what I mean. During the term, you pay the same premium every month. The term could be 10, 15, 20, or 30 years. You select. After this term period ends, the premiums on the policy go up every year to the point where they are unaffordable in a majority of cases.

If you die within the term, the carrier pays the death benefit. To answer your question, you can die of natural, sickness, or accidental death. There are some exclusions that a carrier won’t pay that you need to read in the contract and be aware.

Term life is really needed to cover unexpected death. We don’t expect to die young or before we are old. But, that happens. So, term life is good in this case. Term life will only pay a death benefit if you have the policy in force. The level premiums of most term policies end for people in their 80s or earlier depending on when they purchased the policy. If you die outside of having coverage, the policy doesn’t pay. Whole life or permanent policies are more useful when you want to have a death benefit at old age that can fund your funeral expenses or anything else.

John

I am 42 year old female. I currently have a whole life policy and pay $131 monthly. I am trying to decide if I should switch to a term policy to reduce my monthly expenses. I have read some previous questions where you explained the time for term policies, 10,20,30, year etc, you stated that once that term is up insurance premiums become unaffordable. That is quite confusing to me. If I choose a 30 year term policy and I do not die within those 30 years, and I want to renew my term policy that means it will be priced so high at that point I won’t be able to afford it?? You also made more than 1 comment about having whole life insurance policy to cover burial expenses. Why can’t my family use the payout from a term policy for burial expenses??

Hi Michel – thank you for your comments. It might be easier to contact you personally so we can have a discussion. However, generally speaking, you can always buy term and invest the difference between the $131 and what you pay on the term. You can always use this “difference” to then pay for your funeral or use it to buy a policy with a smaller face amount. There are many options and I will contact you to discuss so you can make an informed decision on what is best for you.

John

I would definitely agree on this. Choose your insurance policy based on what you need andIts always best to an insurance broker or agent and analyze their condition before buying.

James Martinez

Hi James – thanks for reaching out. I think I know what you mean.

John

“This is the #1 reason why whole life is more expensive than term.” WOW, I’ve been trying to figure this out for my retirement strategy. This helps clear it up! Thanks!

Thanks for your comment, Layla. Best of luck.

John