Foreclosures Widen Wealth Gap in Philly, Zillow Study Finds

Data graphic: Zillow.com

While the bursting of the housing bubble caused widespread pain, many homeowners have since recovered from the bust as house values in many U.S. metropolitan areas now stand close to or even above their pre-bust peaks.

But one group in particular has not been able to share in the recovery: low-income homeowners who owned properties in the bottom third of the market. A study released last week by the real estate search site Zillow.com found that this class of homeowners was hardest hit by the foreclosure crisis — and as a result have been unable to recover the investments they lost as house values at the bottom have rebounded from their post-bust lows, even shooting past their pre-bust peaks in some markets.

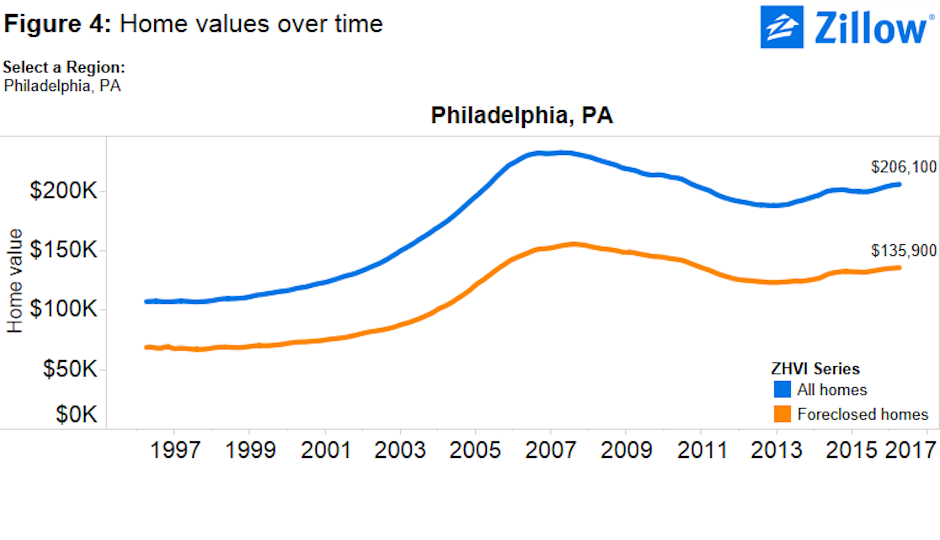

Bottom-tier homeowners in metro Philadelphia have been hit especially hard by that double whammy, according to Zillow data.More than 57 percent of the homes that were foreclosed on after the housing bubble burst in this market were in the bottom third of it, more than in any other U.S. metro save Detroit. Meanwhile, foreclosed homes in the local market have recovered nearly all the value they lost after the bubble burst; the Zillow Home Value Index for foreclosed homes in metro Philadelphia stood at $135,900 in April of this year, which is slightly more than 87 percent of where they stood at their pre-bust peak.

(The recovery of foreclosed homes closely tracks that of all homes in the market; the index for all homes in the greater Philadelphia market as of April stood at 88.2 percent of its pre-bust peak. In terms of rate of recovery, foreclosed homes both here and nationwide have regained lost value faster than the overall market; where the value of all homes locally now stands 9.5 percent above its post-bust low, foreclosed homes now stand 10.1 percent above their post-bust lows.)

“Philadelphia as a market didn’t experience the housing bubble as drastically as some markets, like Las Vegas or Phoenix, did,” said Zillow Chief Economist Svenja Gudell. “But it did have a housing boom and bust.

“What happens during a boom is that people are encouraged to get into housing. They put whatever savings they may have into housing.” The trouble comes when the boom turns into a bust. Gudell explained that low-income homeowners often have little or no cushion to fall back on when hard times hit. “They may have lost their job, or they were hit with a balloon payment because their teaser rate went away, so they lost their home and their investment” when they could no longer afford to make their mortgage payments.

Then, she went on, “to make things worse, they’re forced to rent.” Unlike house values, rents tend not to fall during a housing recession, so low-income homeowners may end up paying more than they would with a mortgage once they lose their homes. “And to make matters even worse, when the recovery comes, a lot of the people who were foreclosed on were not able to get another mortgage for some time” — typically seven years, the length of time it takes for most negative information to disappear from credit reports. “So they couldn’t get back into the market.” Instead, bargain-hunters scooped up foreclosed homes and turned many of them into rentals, so some of the foreclosed homeowners might end up renting homes just like the ones they lost.

Nationally, foreclosed homes have outperformed the overall market in annual appreciation, peaking at an annual increase of 12.4 percent in January 2014 while annual growth in overall house values peaked at 7.9 percent in April 2014. Locally, foreclosed houses have tracked closer to the overall market in terms of price appreciation, peaking at an annual increase of 6.3 percent in September 2014 while the overall market peaked at 5.6 percent in May.

When asked whether there were any policy changes that might help either close the gap or ease the pain for low-income homeowners whose investments were wiped out, Gudell said, “One thing we could think of on the policy side is zoning laws. Could you build something a little more dense that increases supply so that people can move into something a little cheaper than we’re seeing today?

“House values in the city of Philadelphia have actually surpassed their peak, so if you live in the city, homes are more expensive than they’ve ever been. In the metro as a whole, homes are 10 percent off their peak in 2006, so it’s a little cheaper, but not by much.”

Follow Sandy Smith on Twitter.