How to Protect your Money: The Four Options Strategies

The higher the markets climb, the more investors worry about the impending and inevitable correction that always ensues. Trees don’t grow to the sky, as they say, and the one thing that is guaranteed in this world is that the market will crash again. You cannot accurately predict when the market is going to crash, so getting out too early usually results in missed gains. Yet one is not helpless to the receding tide of equity prices; you can augment a new or existing equity position to sustain value in a correction. And though hedging a position can get complex, the more remedial positions are fairly easy to understand after learning not much beyond the option basics.

NOTE: If you are new to option trading and want to learn more about option basics, you may request for a FREE copy of “The Basic Book of Option Basics” by clicking here.

For the purposes of this brief write up, we will use Apple, Inc. (Symbol = AAPL) as an example. At the bottom of this article the details of the option chain, stock, price, etc. will be provided for those meticulous individuals who are concerned.

1. Covered Call

(See Random Walk’s text Stock, Options & Collars)

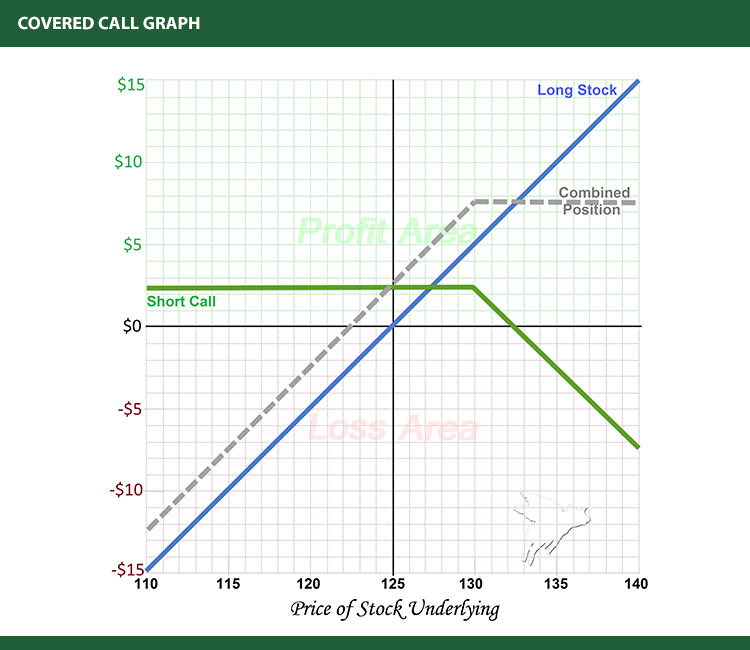

A covered call is the most remedial of hedging trades. The strategy is designed to augment returns rather than protect against a downturn – though it does provide some remedial protection. The strategy is simply the sale of a call option against a long stock or index position. By selling a call option (giving someone else the right to buy the stock) you will limit your upside potential but you are allowed to keep the premiums collected when you sell the option.

The owner of a call option pays a premium for the right to buy a stock at a predetermined (strike) price any time prior to the option expiring. By selling the call you will receive the “premium” the buyer pays in exchange for the obligation to potentially have to deliver the shares. Yes, someone can buy the stock from you, but you already own the shares, and you can avoid actually having to sell the shares.

A trader named Random Walk (“RW” for short) owns 100 shares of AAPL at a price of $125 per share and wants to augment his returns. He decides to sell a call option (1 call option equates to 100 shares) at the 130 strike for $2.66 per share. By selling the call at $2.66 he will take in $266 ($2.66 per share x 100 shares per contract x 1 contract), and RW gets to keep the $266 no matter what.

Since the stock costs $125 per share and RW owns 100 shares, he has a total investment in the trade of $12,500. By selling the call and receiving $266, RW will enhance his returns by 2.13% ($266 option premium / $12, 500 stock value) that month. If the call even gets to the sold strike (130 strike), he will make $5 on the shares (bought at $125 and sold the 130 strike), plus keep the $266 collected by selling the call. This is a total return of $766 ($500 on the stock and $266 on the call).

The covered call trader made $766 (6.13%) while someone who simply owns the shares only made $500 (4%). And if the stock sold instead of going higher, the call seller’s option will expire worthless, and the $2.66 per share received dilutes the loss from the share decline. The hope of a covered call trader is to keep collecting that $266 every month of the year, and make an additional 2.16% monthly.