In our recent blog, 5 Collections Strategies to Improve Cash Flow, we discussed collections strategies you should seriously consider that will improve your cash flow. One of the most dreaded pieces of that is how to handle client objections to collections.

Most small businesses don't have a dedicated employee to manage collections - they are typically handled by an office administrator or manager under the catchall category of "other duties as assigned". As a result, when a payment is overdue, you either sit patiently and wait, or gobble up more of your employee's already precious time chasing down payments from past due clients. Here are three tips for a better approach...

1. Anticipate Client Excuses

Track record and intuition tell business owners which clients are more likely to pay. You know best when it's time to fire your repeat offenders and unleash the collection hounds. However, if this is their first missed payment, you can improve your in-house collection performance by anticipating client responses to your request for payment.

Your staff should always be ready for possible responses when you call a client who has a past due bill. Here are the common excuses and some answers that can help your collections:

Excuse: “I’ll give you a partial payment now.”

Response: “Great, may I ask why are you only making a partial payment? When can we expect to receive the balance?”

Excuse: “I’m having a short-term cash flow problem. We’ll pay you in a few weeks.”

Response: “No problem, we want to work with you. Can you send a post-dated check? We’ll hold it until the promised date. This way we both save time on getting this resolved.”

Or, Alternative Scenario

Response: “How bad is the situation?”

“Can we enter a repayment schedule and get a little bit each month?”

Excuse: “I’m not happy.”

Response: “What do we need to do to make you satisfied and close out your balance?”

Excuse: “I didn’t receive the invoice.”

Response:

Make sure the person making the calls has the billing information at their fingertips so they can tell the client when the invoice was sent out.

QuickBooks has the ability to email invoices in real time and allow customers to view invoices and attachments (such as expense receipts) online through a portal. Give the person making the calls access to the screens needed to send another copy of the bill.

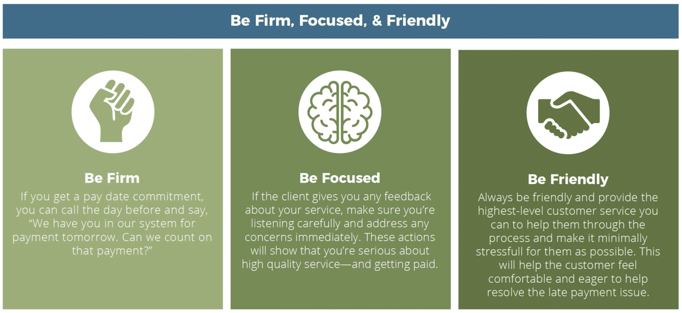

2. Follow the 3 F’s of Collections

By planning your phone script for handling late payments, you are more likely to engage in a professional and direct conversation, however, it takes more finesse than simply regurgitating a script. You must also follow the three F's of collections - be Friendly, Firm and Focused.

This means you need to be a good listener, immediately follow up on the client's concerns or requests, and never end the call without securing payment or a commitment. Being polite, prepared and responsive tells your client that you are just as serious about providing customer service as you are about getting paid.

3. Automate Invoicing & Payments

Use Pay Now Button in QuickBooks Bill Pay

Intuit has a service that allows you to email an invoice with a “pay now” button. Your client can click on the “pay now” button, enter their credit card information and have it automatically processed through Intuit Merchant Services.

A few days later, when you get the payment in your account, QuickBooks then automatically applies the Merchant fee against the outstanding receivables.

This system automates billing, collections, and even cash application. It reduces both the amount of time it takes to get paid, and your accounting fee, so you can put that time and money to work elsewhere.

Utilizing tools like Intuit Payment Solutions™, which can embed a “Pay Now” button in emails, will help you get paid faster.

Intuit Payment Solutions sends bills by email, and if a payment hasn’t been made within a week, it automatically sends a reminder. When customers start receiving emails each week about an invoice that is due, they’ll want the emails to stop—so they’ll pay their bills.

You’re also making it easy for your customers to pay their bills; plus, you’re eliminating a week of float while the check is in the mail and in transit at the bank. By using Intuit Payment Solutions, we’ve seen DSO at our clients drop from 30 to 14 days. The saving and lack of distraction by having cash in hand justifies the 2.5% credit card fee.

To learn more than just collections to improve your cash flow, read our latest ebook - The CEO’s Guide to Improving Cash Flow - 28 Ways to Gain Efficiency and Peace of Mind Using Cash Flow Best Practices...