Global slowdown amid still elevated inflation to characterize most part of 2023.

The economic backdrop foreseen for the next 12 months suggests that the ongoing correction will continue through the first half of 2023, featuring a profits recession and still elevated (albeit moderating) inflation. In H2 some of the headwinds should abate (with lower price pressures and the Fed on hold), supporting a gradual shift from the current defensive stance (with its tilt towards gold, investment grade credit and, marginally, government bonds) to increased risk exposure (mainly via DM equity and high-quality credit).

In 2023, the business cycle will be shaped primarily by two interconnected factors: a significant global slowdown, featuring still above-target inflation – and its fallout on monetary policy - and the resulting profits recession. Growth is expected to decelerate across developed markets (DMs), ranging from sub-par levels in the United States to a few quarters of contraction in the Eurozone and United Kingdom. The cost-of-living crisis generated by the exceptionally fast pace of increase in global inflation experienced over the past 18 months and its persistence into 2023 – albeit at a slowing pace – will hit both consumer spending and sentiment severely. Central banks (CBs), which were forced to respond aggressively to the spike in price dynamics in 2022, will stay on the hawkish side at least until Q2 2023 in an effort to ease inflationary pressures further by cooling demand and preventing any unwanted loosening of financial conditions.

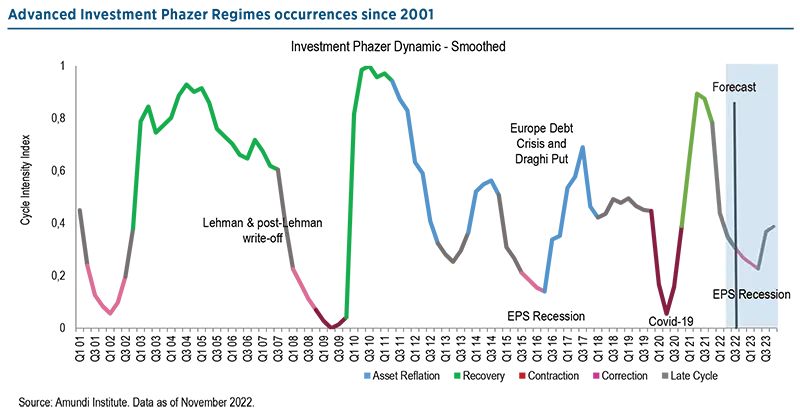

Such an economic backdrop will result in a profits recession, which we foresee in Q1 and Q2 2023, with US EPS contracting by -10% and -15%, respectively, on a twelve-month trailing basis. Earnings and margins will be under pressure, with the former challenged by top-line deceleration caused by the dollar’s strength and weaker nominal GDP growth, and the latter suf fering from increased costs from the main factors of production of capital and labour. Below-trend growth and very-weak-to-negative earnings are the main features of the correction phase and, according to Amundi Institute’s Investment Phazer, will be the prevailing economic regime from Q3 2022 and should persist through the first half of 2023.

Over this period, the resulting asset allocation is predicated upon a defensive stance, with a tilt towards gold and investment-grade (IG) corporate bonds. As for the position towards government bonds – which a ‘typical’ correction phase would favour – we believe the duration component would have to be managed more actively than during similar regimes in the past. Indeed, recent downward surprises to US inflation readings (i.e., October US CPI) are unlikely to trigger a clear dovish Fed pivot, and the hawkish stance is likely to persist well into the first half of 2023, adding upside risks and volatility to government bond yields in H1.

When moving into the second half of 2023, the expected sizeable correction in inflation dynamics expected in H2 will be a crucial driver of an improvement in the business cycle and a switch from correction to late-cycle. Despite the ongoing economic slowdown, price pressures should ease but remain above average pre-pandemic levels and CB targets on a YoY basis. In the United States, headline inflation momentum should keep weakening. After having peaked at 9% in Q2 2022, headline US CPI is set to print at a more moderate pace throughout 2023, mainly as a consequence of a drop in gasoline prices, and stabilise at an average YoY rate of 4.1%, compared to 8.1% in 2022. However, the main source of price stickiness will be core inflation, as core PCE is expected to average 3.5% YoY in 2023 compared to 5.0% in 2022. Here, while momentum is fading in the core goods component, the opposite is occurring in core services . Indeed, services price dynamics rely on rents, where the deceleration currently materialising in actual rental prices should be reflected on official CPI figures only at a later stage, probably from Q2 2023 onwards.

To sum up, the multi-decade PPI peak seen in 2022 should more than halve – in YoY terms – next year on a lower-base effect and a more benign commodity outlook. Finally, developments on the cost of labour will also be crucial in sizing the risks of a wage-price spiral and its fallout on the monetary policy stance, which should be tightened further in the event that high inflation expectations become entrenched.

The above inflation scenario is the backdrop for Amundi Institute’s Inflation Phazer, which is indeed signalling a transition from the hyperinflationary regime that has prevailed in 2022 – and is highly likely to persist until Q1 2023 – to the more benign inflationary regime that has historically featured YoY price pressures in the 3-6% range. Although still above target, moderating price pressures should mitigate the burden of the rising cost of living on consumers, allowing an economic recovery from first-half lows and causing the Fed to halt interest rates hikes.

From an asset allocation standpoint, onhold monetary policy – with the next move expected to be a cut – should make yield curves bull-steepen and conditions supportive for risky assets, with a tilt towards DM equity and high-quality credit.