EUR/USD Current price: 1.1361

View Live Chart for the EUR/USD

The EUR/USD pair fell down to a fresh 2-week low of 1.1134, despite a Greek deal is under way, and improved Eurozone economic growth. With the Greece problem out of the way, investors seem to have focused in the imbalance between economic policies between both economies, as whilst the ECB is buying €60bn per month, the FED has already announced at least two quarter point rate hikes in the way. In the meantime, European stocks surged strongly and yields eased from their latest highs, also reverting their last 3-weeks trend. In the US, data resulted mixed, as Durable Goods Orders for May resulted worse-than-expected, printing -1.8% against a 0.6% drop. Nevertheless, orders for business equipment rose, indicating demand for American-made manufactured goods is stabilizing. New Home sales however, rose the highest level in seven years, whilst the Markit Manufacturing PMI registered 53.4, the lowest reading since October 2013, but still above the 50 threshold that indicates economic expansion.

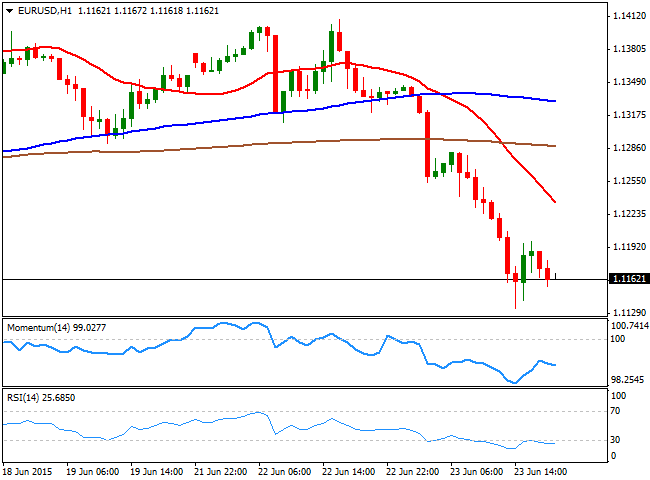

Technically, the pair has broken through several critical supports without looking back, and the short term picture suggests the EUR/USD can continue falling, as in the 1 hour chart, it has extended far below its moving averages, with the 20 SMA having crossed below the 100 and 200 SMAs, and now around 1.1230, whilst the technical indicators have resumed their declines after some limited corrections from oversold levels, well into negative territory. In the 4 hours chart, the Momentum indicator has accelerated toward the downside, whilst the RSI maintains its bearish slope near 32, and the 20 SMA has turned lower well above the current level, all of which supports additional declines particularly on a break below the 1.1120 level, a strong static support zone.

Support levels: 1.1120 1.1050 1.1010

Resistance levels: 1.1200 1.1245 1.1290

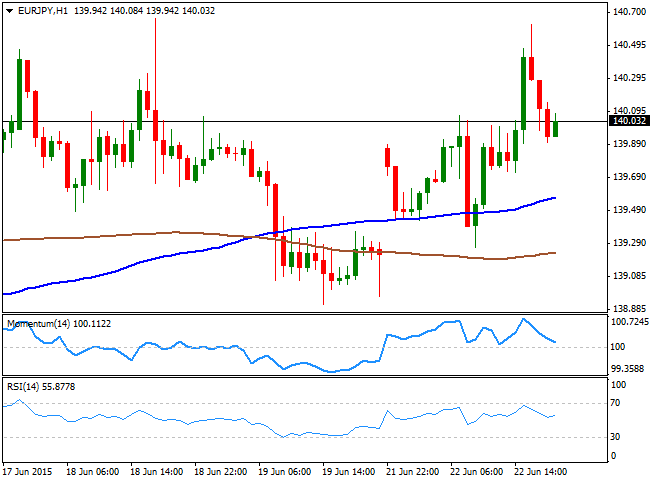

EUR/JPY Current price: 138.25

View Live Chart for the EUR/JPY

The EUR/JPY pair fell down to the base of these last 3-weeks range around the 138.00 level, as investors dumped the common currency. On Monday, the pair advanced up to 140.62, but failed to sustain gains above the 140.00 mark, resuming its decline early in the Asian session. The pair has been trading between 137.90 and 141.00 pretty much since June started, which means the range is still in place, albeit the risk towards the downside has increased exponentially. Short term, the 1 hour chart shows that the price broke below its 100 and 200 SMAs, with the shortest still above the largest, whilst the Momentum indicator heads sharply lower below the 100 level and the RSI is beginning to look exhausted towards the downside around 24. In the 4 hours chart, the price is now below its 100 SMA for the first time since late May, while the Momentum indicator heads slightly lower in neutral territory, but the RSI indicator anticipates additional declines around 35. Should the price break below 137.90, the bearish momentum will likely accelerate by triggering stops, signaling a probable downward continuation towards 135.95, May 18th daily high.

Support levels: 137.90 137.45 136.80

Resistance levels: 138.60 139.10 139.65

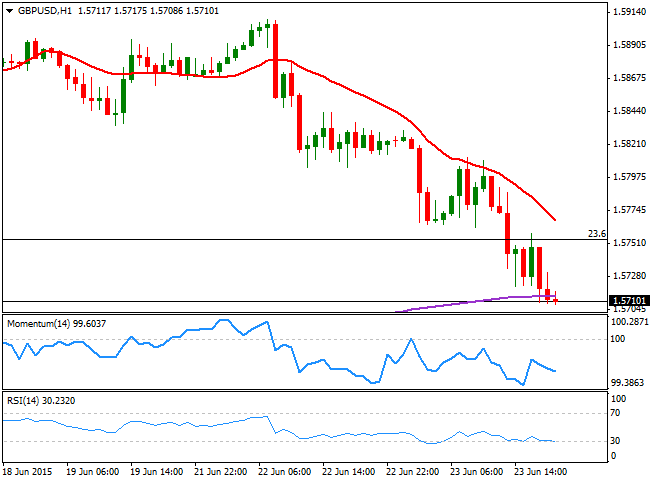

GBP/USD Current price: 1.5709

View Live Chart for the GBP/USD

The British Pound trades at a fresh 6-day low against the greenback, a couple of pips above the 1.5700 level, weighed by broad dollar strength. Earlier in the day, data coming from the UK showed that a fall in export demand slowed the recovery in the UK’s manufacturing sector in June, according to the CBI Industrial Trends Survey. The GBP/USD pair broke below the 23.6% retracement of its latest bullish run between 1.5189 and 1.5292, maintaining the bearish bias in the short term, as the 1 hour chart shows that the price remains capped below a bearish 20 SMA, currently around 1.5770, whilst the technical indicators maintain their negative tone near oversold levels. In the 4 hours chart, the Momentum indicator heads sharply lower below the 100 level, whilst the RSI also heads down near 39, supporting further declines, towards the 1.5650 level, 38.2% retracement of the same rally.

Support levels: 1.5700 1.5650 1.5120

Resistance levels: 1.5755 1.5790 1.5840

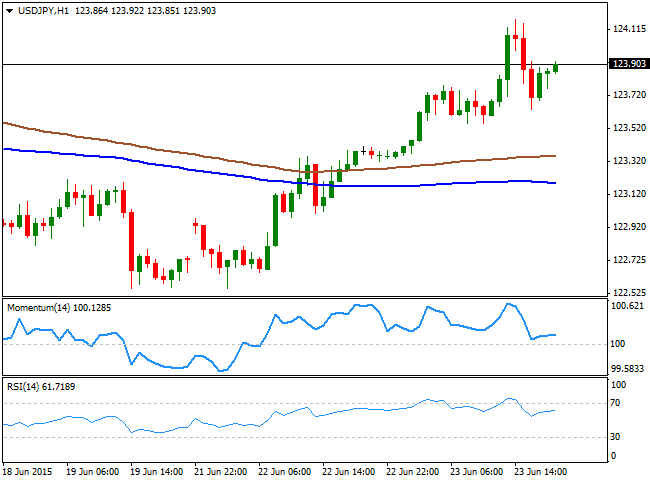

USD/JPY Current price: 123.96

View Live Chart for the USD/JPY

The USD/JPY pair surged up to 124.17, but was unable to sustain gains above the 124.00 level, holding however, nearby. During the past Asian session, Japan released its Flash Manufacturing PMI for June, down to 49.9 against 50.9 in May, signaling economic contraction in the economy. Although the reading is barely below the 50 mark, investors are probably starting to price in further stimulus coming from the BOJ, which means the pair may return to the 125.00 region. Technically however, the 1 hour chart shows that the technical indicators retraced from overbought territory, now heading slightly higher above their mid-lines, whilst the price extended above its 100 and 200 SMAs, both now in the 123.00/30 region. In the 4 hours chart, the price is aiming to advance beyond its 100 SMA, whilst the technical indicators present a more constructive stance, heading higher well above their mid-lines. Nevertheless, some follow through above the immediate resistance at 124.10, is required to confirm a new leg higher and an approach to the 125.00 level.

Support levels: 123.70 123.30 122.90

Resistance levels: 124.10 124.45 124.90

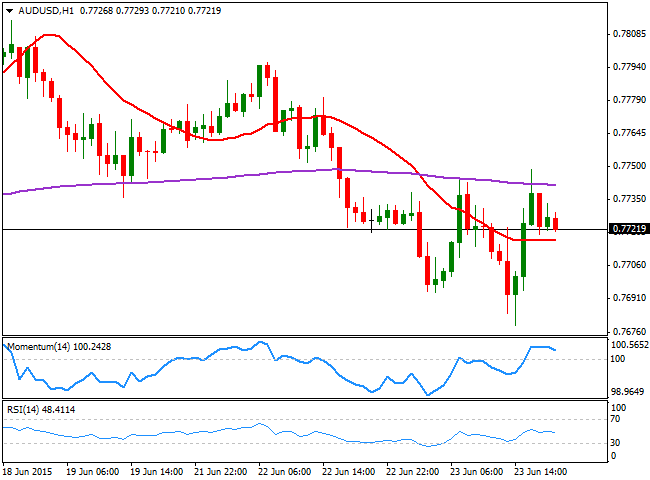

AUD/USD Current price: 0.7722

View Live Chart for the AUD/USD

Aussie was hit during the past Asian session by worse-than-expected Chinese and Australian data. In Australia, the first quarter House Price Index rose less than expected, reaching 1.6% against expectations of 2% advance, increasing possibilities of another rate cut in Australia. In Chine, June Manufacturing PMI printed 49.6, slightly above expected, but still in contraction territory, for the fourth straight month. The AUD/USD pair fell down to 0.7679, but managed to bounce during the American afternoon, despite general dollar strength, ending the day flat in the 0.7720 region. The technical picture is neutral in the short term, as the price stands above a horizontal 20 SMA, whilst the technical indicators lack directional strength, but hold in positive territory. In the 4 hours chart, the latest advance stalled around a bearish 20 SMA, now offering an immediate intraday resistance around 0.7750, whilst the technical indicators hold flat below their mid-lines.

Support levels: 0.7680 0.7640 0.7600

Resistance levels: 0.7750 0.7785 0.7820

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.