This is the first in a series of blogs focusing on the insights from the State of the Industry Report on Mobile Money 2019.

Blog #2 | Blog #3 | Blog #4 | Blog #5 | Blog #6 | Blog #7

Last week, we published the much-anticipated State of the Industry Report on Mobile Money. This 8th edition of the report celebrates many exciting trends, key milestones and industry firsts. The most notable one, which marks a major milestone for the industry, is on the number of mobile money accounts surpassing one billion. Reaching the one billion mark is a tremendous achievement for an industry that is just over a decade old. The one billion milestone also demonstrates that the industry has evolved from its early days to significantly move the dial on customer expectations.

The mobile money industry of today has a host of seasoned providers with a broad set of operational capabilities, a full suite of products and a global reach. With 290 live services in 95 countries and 372 million active accounts, mobile money is entering the mainstream and becoming the path to financial inclusion in most low-income countries. Mobile money services are available in 96 per cent of countries where less than a third of the population have an account at a formal financial institution.

Overall growth in transaction values has been impressive in 2019. Total transaction values grew by 20 per cent, reaching $690 billion in 2019, which means the industry is now processing close to $2 billion a day (over $1.9 billion). The GSMA forecasts that this strong growth in transaction values will endure, and by 2023 over $1 trillion will be transacted via mobile money platforms on an annual basis, translating to over $2.8 billion a day. This growth and scale is a positive signal for the industry as it demonstrates higher levels of customer trust, greater relevance for users and the capacity of mobile money to digitise an increasing amount of capital.

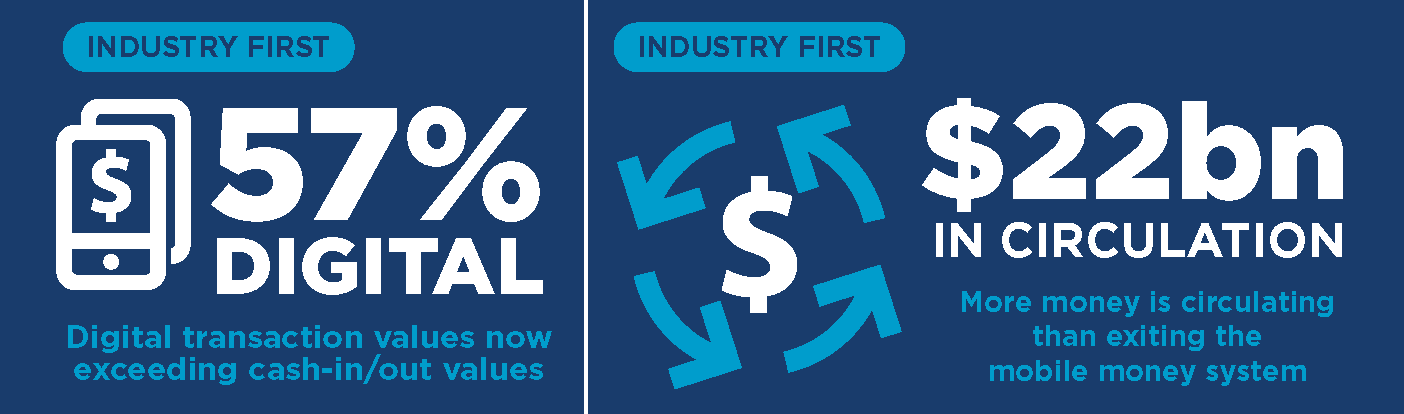

For the first time, digital transactions represent the majority of mobile money flows (57 per cent). A larger proportion of money is entering and leaving the system in digital form, rather than through a cash conversion. This is primarily due to the industry becoming a more integral part of the financial ecosystem (i.e. interoperability) and lower barriers to third-party integration (i.e. APIs). This is a clear signal that providers have taken major steps to ensure digital transactions become a part of their customers’ everyday lives.

More value is circulating in the mobile money system than exiting – another industry first. The total value in circulation (P2P and merchant payments) reached $22 billion in December 2019, more than doubling over the past two years and significantly surpassing the total value of outgoing transactions ($18 billion). The industry has clearly zeroed in on what keeps value circulating. For example, by creating more compelling value propositions for MSMEs with business management tools like customer analytics and inventory management, and offering credit lines to agents and merchants.

What is not captured in the big one billion headline figure is the empowerment that comes with owning a mobile money account and the ability to access new, life-enhancing products and services through the mobile money ecosystem. From closing the financial inclusion gender gap to unlocking access to essential utility services, delivering urgent humanitarian cash assistance and digitising payments for smallholder farmers, mobile money is helping millions meet their basic daily needs and improve their livelihoods over the long term. All of this ultimately unlocks new solutions to some of the world’s most intractable development challenges and plays a catalytic role in achieving the UN Sustainable Development Goals (SDGs).

As we enter a new decade, the industry faces new challenges, especially sector-specific taxation, data localisation requirements and government-led interoperability solutions that do not take operational and commercial mobile money models into account. All these threaten to stifle innovation and affect the ability of the industry to contribute to digital financial inclusion and the SDGs. However, a collective, cooperative effort across the mobile money ecosystem would help tackle these challenges.

Please join us in celebrating a phenomenal year for the industry and recognising the achievements of the mobile money providers globally in driving financial inclusion and accelerating progress towards the SDGs.

Stay posted with the next blogs in this series and more insights by registering for our monthly Mobile Money Insights here.