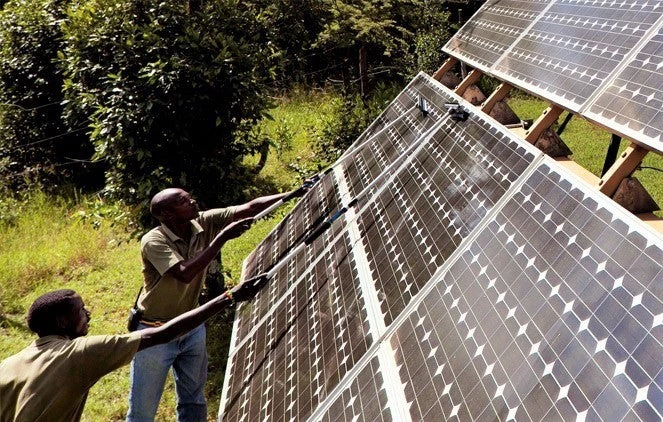

Photo: Scaling Solar project in Zambia

What is a common thread between Argentina, Maldives, and Zambia? In each of these countries, the World Bank provided guarantees to support transparent auctions for renewable energy. Through these, I have seen how the Bank’s involvement helped increase private investors’ confidence, attract world-class developers, and ultimately reduce tariffs.

Drawing on 10 years of diverse experience in the power sector in both public and private organizations, my role is to help bridge the divide between public and private parties and help each side better understand the other. The World Bank is ideally positioned for this. Both sides understand the World Bank carries out a detailed due diligence and ensures the auction meets international standards. Both sides appreciate the World Bank will be an honest broker if issues arise. Because of its long term and continuous involvement in our client countries, the World Bank can help identify and solve issues early on. As such, no World Bank project-based guarantee has ever been called.

In Zambia, despite financial and political risks, the World Bank Group’s Scaling Solar initiative brought in top developers at very competitive prices (6.0 and 7.8 USc/kWh in round 1). The program makes it easier for governments to procure solar power quickly and at low cost through competitive auctions. It includes pre-set financing and risk mitigation products such as World Bank guarantees.

In Maldives, an International Development Association (IDA) guarantee helped conclude the country’s first private solar rooftop project.

In Argentina, the RenovAr renewable auctions, supported by International Bank for Reconstruction and Development (IBRD) guarantees, are bringing back private investors at competitive prices (about 4 to 6 USc/kWh). This is lower than the average cost of generation (about 7 USc/kWh in 2015) and decreasing with each round.

Even some investors who did not choose the guarantee in the above auctions (it was always optional) told me they would not have bid if the World Bank was not involved.

Based on these experiences, I have found these aspects are key for governments to obtain the best outcomes from renewable auctions :

- Government commitment and qualified advisors are critical. Without true government commitment, nothing moves. If the government is committed, it needs qualified transaction advisors to help with preparation of complex technical, financial, and legal matters. Development partners can usually help fund such advisors.

- Competitive, predictable, and transparent processes lead to better outcomes. Unfortunately, the reality is still often that many private developers sign non-transparent agreements with relatively high prices and low chances of materialization. Governments spend an awful lot of time dealing with these unsolicited proposals. Instead, they can run one single process and ask all developers to follow it. This reduces the risk of corruption and improves outcomes. The process needs to be predictable and address the key concerns of the private sector. Contrary to some claims, a competitive process is usually much faster overall. In particular, when contracts are shared during the bid period, the scope for post-award negotiations is very limited. In Argentina, in only two-and-a-half years, the Government developed a fully new renewable auction program and awarded 4.4GW of renewable power.

- Reducing risks ahead of the auction lowers prices. Key risks for a private investor—such as land, environmental and social (E&S) aspects, or regulatory risks—can be significantly reduced. The more due diligence and preparation the government and its transaction advisors can do and share with all bidders, the better. For instance, in Scaling Solar, the land is usually secured and acquired by the government before the bid, along with preliminary E&S studies. Private investors don’t have to worry about this. Stapled financing and guarantees also give certainty the project is bankable.

- The government needs to allocate remaining risks to the party best able to handle them. There is no free lunch. Providing favorable conditions to private investors will result in more competition and better prices. It does not mean the public side should take all risks, of course. However, governments must recognize that each aspect will have an influence on the success of the auction and how much citizens will pay for their electricity. Governments should also consider what instruments would help mitigate the remaining risks, including the possibility of World Bank guarantees.

Supporting efficient private sector solutions is part of the role the World Bank plays to favor the move to clean and affordable energy.

This is the third in a series of posts about the World Bank’s Guarantee Program.

Related Posts

Maximizing concessional resources with guarantees—a perspective on sovereigns and sub-nationals

Scaling up World Bank guarantees to move the needle on infrastructure finance

More than a technicality: The engineering foundation of Scaling Solar

Why Zambia’s 6 cents is more significant than Dubai’s 3 cents

Join the Conversation