Jillane Mignon just needed cash to pay for day care.

Her job with the City of Winnipeg’s 311 program covered the bills, but not the $1,000 a month it cost to care for her son while she was at work.

So it started with a small loan from a payday lender. That took care of that month.

“And then when you get your paycheque, half your paycheque is already gone to pay the lender. So then you have to borrow again.”

At one point, she said, she owed money to four different payday loan outlets – all the money taken out to pay existing loans, plus their rapidly accumulating interest, and get her through to the next paycheque, which was quickly swallowed up in more loan payments.

When Mignon decided to dig herself out of payday loan debt once and for all, she did so “painfully.”

- Life in the forest: How Stanley Park’s longest resident survived a changing landscape

- Bird flu risk to humans an ‘enormous concern,’ WHO says. Here’s what to know

- Mental health support still lacking 4 years after mass shooting: Nova Scotia mayor

- Buzz kill? Gen Z less interested in coffee than older Canadians, survey shows

“Food banks. Salvation Army. Swallow your pride.”

Read the series

- Instability trap: When you’re income rich, but asset-poor

- Canadians want work. Why have so many stopped looking?

- Life in the temp work lane

- Feb. 23: Retirement lost

Government response: What the feds had to say about Canadians’ labour instability trap

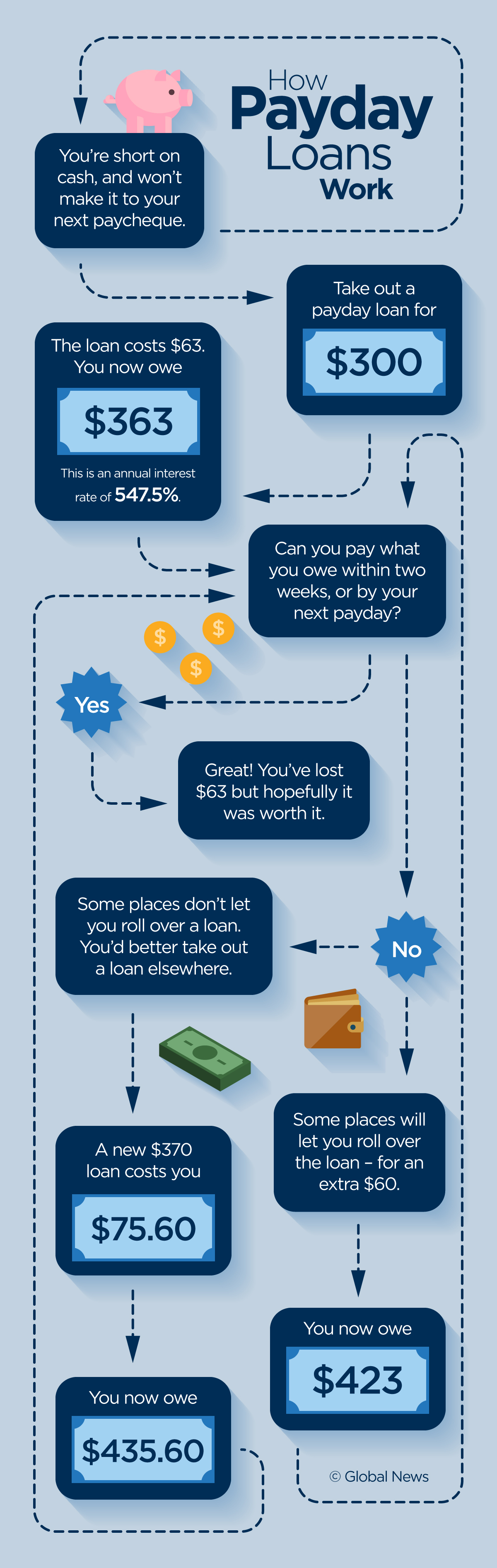

Graphic by Janet Cordahi

Fringe finances by postal code

It’s a familiar predicament for many – one that’s earned payday lenders and cheque-cashing outlets a reputation for exploiting people who need cash quickly and have no other option.

Money Mart came under fire shortly before Christmas for its practice of exchanging gift cards for half their value in cash. At the time, Money Mart said it was “offering customers a convenient, value-added product though this service.” It eventually suspended the practice.

Neither Money Mart nor the Cash Store would speak with Global News for this article.

But Stan Keyes, a former Minister and Liberal MP for Hamilton, Ont., and head of Canada’s Payday Loan Association, argues these businesses – licensed and regulated by provinces, he notes – are filling a need no one else is meeting.

“What alternative do borrowers have?” he asked.

Squash or regulate the industry out of existence, he warns, and you leave people who need small cash infusions quickly without other options.

“If licensed payday lenders were forced to close their doors, say due to overregulation, the demand for the small sum short term loan does not dry up,” he said. “So I suppose those who claim to speak for payday loan borrowers, some of them often misinformed, don’t mind forcing those who need the small sum financing to, what? Take their television off the wall and take it to a pawn shop?”

Keyes said the fees and interest rates (about $21 for $100 at Money Mart, for example), often criticized as high, are necessary because of the risk taken on by lenders who don’t do credit checks. He also thinks citing annual interest rates of several hundred per cent is misleading because these are short-term loans.

There are about 1,500 payday lender outlets across the country. They skyrocketed in growth in the early 2000s, then levelled off. A 2005 Financial Consumer Agency of Canada survey found about 7 per cent of Canadians say they’d used the services.

A Global News analysis has found payday lenders overwhelmingly concentrated in low-income neighbourhoods and neighbourhoods with a high proportion of people receiving social assistance.

(Keyes, for his part, argues they’re simply located where the commerce is.)

Global News used tax data obtained from Statistics Canada and business location information from Red Lion Data to map payday loan locations against income and social assistance.

Interactive: Explore the map below to see how payday lending locations correlate with social assistance levels in your neighbourhood. Click a circle or coloured shape for more information; click and drag to move around.

Most payday loan customers are lower middle class, says Jerry Buckland, a University of Winnipeg and Menno Simons College professor who’s written a book about the practices of these “fringe” financial institutions.

But the heaviest users – the ones who get trapped in a cycle of high-interest debt – are the poorest borrowers.

“It’s those people closer to the edge who aren’t able to pay that payday loan off.”

So maybe they take out another payday loan to fill the gap. And then they’re stuck.

The problem, Buckland argues, is that payday lenders fill a need that traditional banks aren’t.

“Mainstream banks have, over the course of 30 years, shut down more branches in lower-income neighbourhoods,” he said.

“A big thing right now that I see the feds pushing is this financial literacy. And while on the one hand I think financial literacy is important, it certainly doesn’t solve the problem of financial exclusion.”

Maura Drew-Lytle, spokesperson for the Canadian Bankers Association, says banks have done a lot to make themselves more accessible, including offering low-cost accounts for about $4 a month. And as of January, 2015, she said, they’re offering basic, no-cost accounts for low-income seniors, people on disability assistance, students and youth.

She also notes the number of bank branches in Canada “has actually been increasing.”

“Banks have been very focused on customer service over the last decade or so. You’ve seen big changes in branches. … It’s not just a line of tellers any more.”

But Tamara Griffith, Financial Advocacy and Problem Solving Program Coordinator at Toronto’s West Neighbourhood House, says there are still barriers in place – including something as basic as photo ID, the lack of which can limit what a person can do with a bank account.

She and her colleagues will often accompany people when helping them open an account, she said, to help demystify the process and ensure they get what they need.

“Because we know once you walk in, you’re being sold a whole bunch of things,” she said.

“You just want a bank account: You don’t need an overdraft, you don’t need a line of credit, you don’t need a credit card. And every time, it’s the same pitch. And we say, ‘Okay, no we just need a bank account.’”

Many of the people Griffith works with are using credit cards to supplement their income, she said – not for luxuries, but just to get by. They pay the minimum payment as long as they can until the accruing interest becomes financially ruinous.

Vancouver’s Vancity credit union took matters into its own hands a couple of years ago, says Linda Morris, the bank’s Senior Vice President of Business Development, Member and Community Engagement.

“We’d been seeing studies coming out of the States, but also Canada, about people who’d be underserved, or not served at all, by conventional banking,” she said.

So they did their own research – and found even some of the credit union’s own members reported using payday lenders of cheque-cashing facilities.

“That concerned us greatly, because we know the cycle of debt people can get into. … We have people come in who have three different payday lenders they owe money to.”

At the same time,” she added, “when you take a loan with a payday loan, you’re really not developing a credit history. And that’s really important also.”

Last April, VanCity launched its Fair and Fast loan program – essentially, small-scale loans, available within an hour. In July, they added a cheque-cashing component.

“We’re seeing very little delinquency. So far, people are paying back their loans. It seems to be working.

“The larger question, of course, is will we break the cycle.”

San Francisco is asking itself the same question.

In 2005, the city enacted a moratorium on new cheque-cashers and payday lenders.

“We felt at the time we were pretty saturated with those types of organizations,” said Leigh Phillips, director of the city’s Office of Financial Empowerment.

“Our regulatory authority is very, very limited – these are companies that are regulated by the states,” She said. But “we wanted to do something.”

Other cities followed suit with legislation of their own, she said – Los Angeles, San Diego and San Jose among them.

That tackled one part of the problem. It’s still trying to measure how it’s doing on the other half – meeting the need that was driving the growth of these types of businesses in the first place.

The city also launched a Bank on San Francisco program, partnering with existing financial institutions to offer accessible, low-cost accounts.

In many cases, Phillips said, these were “second chance” banking products – for people with poor credit histories or who’d had bad experiences with banks in the past. They also addressed barriers ranging from identification requirements to often-incapacitating overdraft fees.

But while they surpassed their initial goal of getting accounts for 10,000 people in their first year, the program has been tougher to track since then. Phillips said it “looked like” about 80 per cent of those new clients kept their accounts open, which is good.

Just as importantly, she adds, “it’s made financial management a more concrete part of the anti-poverty conversation.”

‘That endless cycle … will drive you insane’

Among the many things on Mignon’s to-do list once she graduates from her community economic development program at Toronto’s Centennial College is work with micro-loans.

“I like the model of microloans because it opens the lending market ot people who are normally shut out,” she said. “People who normally go to these, I call them loan sharks, these payday loan places these pawn shops, to get these monies and then they get caught in these ridiculous circles of high interest rates. …

“I know that endless cycle. It will drive you insane.”

Tell us your story: Have you been trapped in a payday loan cycle?

Note: We may use what you send us in this or future stories. We definitely won’t publish your contact info.

Comments