From WEEE towards CEEE: Circular Electrical & Electronic Equipment

“The Circular Economy and the UN Sustainable Development Goals will radically change the way we operate our businesses. We can, in the very near future, expect legislative frameworks requiring design for disassembly, design for recyclability, deposit and return systems, extended producer responsibility, tracking and marking systems for traceability, and perhaps even requirements of using mono-polymers, instead of mixing different types of polymers, which currently poses a barrier for recyclability.” – Plastix A/S.

What if the above quote by Plastix A/S was to become a reality in 10 years? How would it change the way your company designs, manufactures and sells electrical and electronic products?

Designing Plastics Circulation report by the Nordic Council of Ministers introduces the concept of circular design and and takes a step beyond Design for Recycling (DFR) as a way to improve plastics recycling and reduce the environmental impact. The ultimate goal should be designing and setting up a system that enables circulation – in other words, taking products back and reprocessing material back to the same product over and over again.

The below text is a summary of the report.

What is the challenge?

Design is the key to move towards a circular economy from the linear take-make-waste economic model; according to the European Parliament, 80% of environmental pollution and 90% of manufacturing costs are the result of decisions made at the product design stage. However, presently most electrical/electronic products (EEE) are not designed for recycling, let alone for circulation.

Globally the amount of e-waste is estimated to grow rapidly; by 2021 there will be 52 million tonnes of e-waste (including PCs, laptops, smartphones, tablets and monitors but excluding a wide range of other electrical equipment such as fridges, lighting, measuring devices etc.). By 2040 carbon emissions and use of the above electronics will reach 14% of total global emissions. It is estimated that globally all plastic production and plastic waste incineration generate 400 million tonnes of CO2 emissions. The annual plastic demand in Europe is 52 million tonnes, of which plastics used in electrical and electronic products counts for 6,2%. Combined with automotive industry these two sectors need plastics nearly 16,3% which equals 8,5 million tonnes per year. The quantity of plastic waste from EEE sources in the EU is around 1.2 million tonnes per year. According to estimates, reuse of PCR plastics in EEE is estimated below 1% (RDC Environment 2017).

Circular economy = a restorative and regenerative industrial system, where waste and emissions are designed out through slowing, closing, and narrowing material and energy loops (Adapted from: Ellen MacArthur Foundation & Martin Geissdoerfer et al. in Journal of Cleaner Production: The Circular Economy - a new sustainability paradigm?, 2017).

Circular design = Based on lifecycle approach covering the whole internal process consisting of 1) R&D 2) design 3) circular business model development.

Proposed solutions

- Circular Design Principles

Embedding a circular economy vision and approach into the company’s strategy is a first step every company could and should take. Developing and implementing circular design principles is a concrete way to execute the strategy, and it also ensures that the company is future-fit in a changing and resource-scarce business environment.

2. Roundtable for Plastics Circulation

Circular design can and should play an important role at each stage of the lifecycle. A roundtable – a high-level platform bringing together companies and value chain actors to create sector-wide Circular Design Principles – is crucial in order to capture economic value that is currently lost due to linear design. Taking a broader view; a great many current challenges and linear practices could be addressed through a closer value chain collaboration. Brands could learn from recyclers and take these learnings into their circular design processes and vice versa; recyclers could tailor their offerings based on the specific needs of each customer.

In addition, there are currently a number of different ways of handling and recycling plastics; there is a need to set up bigger clusters for side stream management to drive up volumes and economic viability. Various networks exist, such as WEEE Forum and Next Wave and many others, that could join forces and take the lead on this. Producer responsibility organisations in the EU member states could also be catalysts of change; for example, ESR has created an ecosystem around the WEEE industry to develop more efficient and effective collection and treatment systems in France.

3. Material identification & circular material choices

A prerequisite for the highest possible value capture is material identification. Incorrect markings on plastics have resulted in a situation whereby recyclers don’t trust the markings and therefore different types of plastics are not separated even if it were technologically possible.

Coupled with the issue of identification is the opportunity to harmonise plastics use. Going through different polymer types used in production and shifting to the most commonly used polymers is an effective way to contribute to recycling. However, this inventory should be done in collaboration with the sector, as it has a direct impact on recyclers. If recyclers knew what polymer types were coming in, they could make necessary investments in novel technologies, thus resulting in a more consistent quality of material. Furthermore, designing out chemicals and additives improves circulation opportunities significantly.

4. Legislation

A requirement for using recycled content would speed up the market transition towards circularity. In addition, requirements for circular design principles, especially reparability, modularity, upgradability, and ease of disassembly could be first encouraged in the form of sector-wide principles and gradually formulated into requirements. Removing existing barriers, such as transporting e-waste across borders within the EU, is equally important. Nordic countries are well positioned to build a Nordic Cluster of harmonisation for a take-back recycling system to support scalability.

5. Embedding environmental calculations into the decision-making process

To operate within planetary boundaries it is necessary to ensure that products are designed, manufactured and circulated in such a way as truly takes us closer to a circular economy. Calculating avoided environmental costs provides a good business case and foundation for decision-making when starting a circular journey.

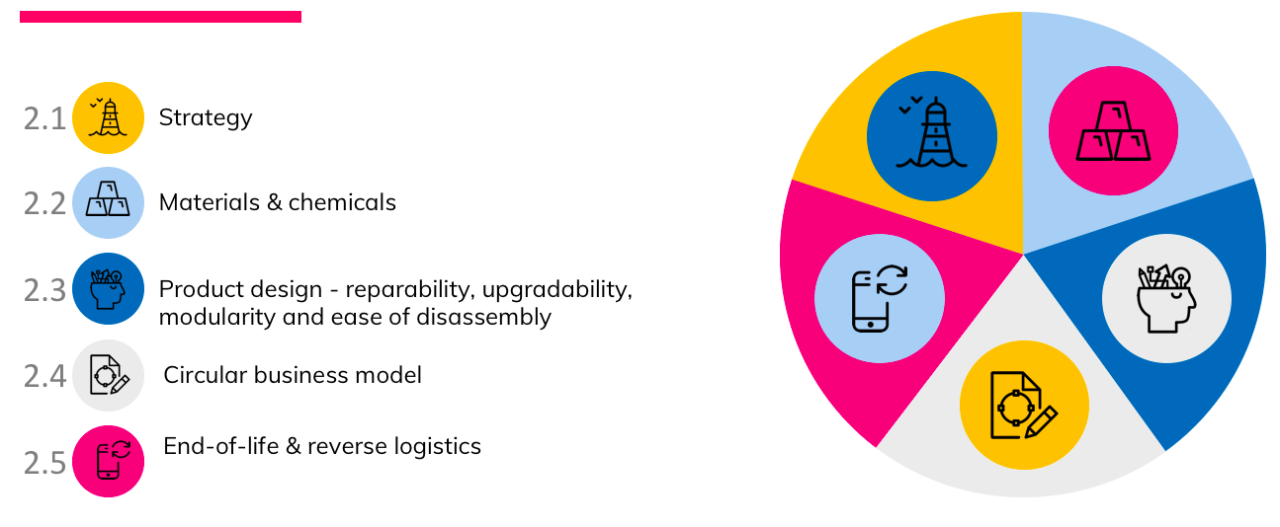

For those of you who want to further explore the report content, I'll summarise the five lifecycle stages with some case-examples below.

Lifecycle stage: Strategy

Many forerunner companies have already embedded circular economy into their strategies. This is reflected directly in the company’s R&D, as the whole approach and many internal processes need to change when transitioning from a linear take-make- waste to a circular way of thinking, operating and doing business.

Traditionally, design based on linear-economy thinking mainly focuses on the manufacturing and use phase through, for example, optimal material choices, energy efficiency, functionality and aesthetics, and it is based on the linear business model of ‘selling more & selling faster’. Circular design, instead, takes a lifecycle view covering materials & chemicals, manufacturing, logistics, business model, use, and end-of-life (or second life) stages. It aims for long-term value maintenance through circulating products and materials endlessly in biological (renewable materials) or technical (non-renewable) cycles using only clean energy. Why is business model development regarded as part of the circular design process? Because the product needs to be designed in a way that enables, for example, maintenance and repair services, selling the product as a service, the use of sharing platforms, and eventually taking the product back for disassembly and remanufacturing purposes.

Accordingly, circular design is much more than just design; it becomes a strategic tool steering the way business is conducted. It is necessary, therefore, to establish circular economy as a strategy at company level to maximise the business benefits of the circular design approach.

For example, Philips has developed an EcoDesign process with six key Green Focal Areas for improved environmental performance – Energy, Packaging, Substances, Weight and Materials, Circularity, and Lifetime. The Circularity focal area is about recovery, reuse and increasing recycled materials in the products as well as designing for easy disassembly, upgradability, recyclability and product-as-a- service business model.

Lifecycle stage: Materials & Chemicals

Proposed solutions: 1) Harmonising plastic use 2) Material identification 3) Phasing out chemicals & additives 4) Using recycled plastic 5) Plastic replacing other materials

Presently there is no focus on the variety of components composition. The biggest material use in both weight and CO2 impact is steel and the second one is plastic. One of the current barriers for recyclers to processing plastics coming from electrical/electronic products is the sheer amount of different polymers.

“There are roughly around 500 000 different polymers in the world; 470 000 of them are used in technical products. This is the reason we don’t process WEEE plastics.” (Fortum)

One feasible solution to reduce the huge variety would be that manufacturers agree on the types of plastics and different polymers they use in their products, this would scale up more pure material stream volumes and make it financially more viable to invest in new recycling technologies.

For example, Novo Nordisk decided to use as few types of plastics in their insulin pens as possible. For one of the prefilled devices (insulin pens that are disposed of when empty), only PP and POM plastic materials were used.

Another opportunity is to harness the platform design approach, which means that parts are standardised so that they can be used in several products. The production volume of the platform is much larger than the volume of the single product. This means that there is better economy in planning circularity, a longer lifetime, more options for repair, etc.

According to our interviewees, using recycled plastic requires a different design approach and different processing than virgin plastic and can be challenging in the beginning. However, interviewed brands regarded this as only one R&D challenge amongst others; when there is a company level commitment to using recycled plastics, required know-how can be built along with required changes in the processes to ensure a high quality of plastic.

Another challenge to overcome is the chicken and egg problem; a situation whereby recyclers do not process plastics if there is no market for them and brands cannot buy recycled plastics because there is no supply. Big brands can take the lead on this and start working with plastic recyclers to find the right quality and make a commitment to buy the processed plastics as the car-maker Volvo has done:

“We encountered a catch 22, where we wanted reused plastics but the providers didn’t have it in the right quality. Then there’s the reuse business that doesn’t process it as they don’t think there’s a market for it. Therefore we wanted to set that ambit ion [at least 25% recycled plastic in each new car] to show that there’s a market, we want this.” - Volvo

Lifecycle stage: Product design: reparability, upgradability, modularity and ease of disassembly

Reparability, upgradability, modularity and ease of disassembly (RUMED) are circular design strategies which play a vital part in the following:

- Extending the life-span of the product

- Enabling worn-out/broken parts to be replaced instead of replacing the entire product

- Enabling software to be upgraded without having to buy a new product

- Enabling remanufacturing through easy disassembly, thus being able to recover components without destroying them

There are many business benefits for applying these RUMED strategies; from the customer perspective it creates loyalty and trust towards the brand. The overall customer experience is improved when the product is durable, spare parts and upgrades are available and repair service works seamlessly.

“The overall experience of a product that unfortunately breaks but then is quickly repaired often creates a bigger customer satisfaction than just replacing the broken product. Many customers really value the fact that the product is possible to repair and not wasted. So there’s real a business advantage to provide this service.” - Electrolux

Fujitsu follows 3R design principles that focus on reduce, reuse, and recycle. Fujitsu is making efforts to improve resource efficiency, which is made possible by designing products to be lighter and smaller, using recycled plastics, reducing the number of parts, enhancing ease of disassembly and improving recyclability. In addition, Fujitsu's own 3-D Virtual Product Simulator (VPS), is used during the product design process, to test the steps involved and the convenience of product assembly and disassembly before creating prototypes.

Lifecycle stage: Circular business models

Circular business models (CBM) refer to ways of doing and developing business through decoupling growth from the increasing use of virgin raw materials and natural resources. Unlike the linear business model which is based on selling high volumes with faster purchase cycles (“sell more, sell faster”) and consequently exhausting our natural ecosystems and material reserves, CBM ideally aims for one planet business logic, i.e. sustainable growth that operates within the planetary boundaries.

Circular business models can be classified in the following way (Nancy M.P. Bocken et al. (2016): Product design and business model strategies for a circular economy in Journal of Industrial and Production Engineering):

- 1) Access and performance model: in this model, the user can access and use the product without owning it, also called a ‘product-service system’.

- 2) Extending product value: a business model whereby the manufacturer reuses or remanufactures old products through take-back programmes.

- 3) Classic long-life model and encourage sufficiency: focus is on long-lasting and durable products and offering maintenance/repair services to support the user’s ability and willingness to keep the product in use as long as possible.

- 4) Extending resource value: this business model refers to turning waste into useful raw material and decreasing or replacing virgin material altogether.

- 5) Industrial symbiosis: this model refers to close physical proximity and collaboration between companies.

Although CBMs are often presented in the form of the above list, in reality they overlap and complement each other, thus forming ‘hybrid’ CBMs. For example, designing and manufacturing high-quality products (No 3: Classic long life model and encourage sufficiency) is a prerequisite for access and performance model (No 1). For the company, it is always important to explore all CBM opportunities to maximise the circularity of operations.

MatKon Group consists of MatKon Refurbish, MatKon ProService and MatKon Data, and specialises in dealing with manufacturers, re-sellers and operators of electronic products (e.g. IT/IP equipment, vacuum robots, coffee machines). They offer services for the telecom industry by repairing and refurbishing used routers and TV boxes. MatKon collaborates with Kirppu ( specialised flea markets, 13 stores in Denmark), where you can buy a refurbished PC with a 15% buy-back price, if returned at end-of-life. The recycle and resell concept extends the lifetime and the value of the product.

Philips wants to move from the ownership and selling the product to access and performance model, which enables them to retain the material ownership for reuse and remanufacturing purposes.

Lifecycle stage: End-of-life & reverse logistics

Considering the product’s end-of-life as part of the design process is a crucial element of making circulation happen. For example, removing glues makes it easier to recover components.

In a linear economy companies have optimised their production lines and logistics as a one-way street being efficient in transporting products out to be sold, but taking products or materials back for reprocessing requires a different structuring of operations.

Getting products back (so called take-back programme) for reuse, remanufacturing and finally for recycling requires reverse logistics, facilities for disassembly and designing and setting up a system for remanufacturing. These operations can be performed through either by the company itself or through setting up partnerships.

For example, Fujitsu has set up recycling centres across Japan to take-back old ICT products, where products are disassembled, sorted and recycled. Materials recognition equipment has been introduced for plastics that are difficult to discriminate between, so as to allow the complete segregation of different types of plastic. Plastics are sorted into 20 different streams for remanufacturing and recycling purposes.

Dell set up a closed-loop plastic recycling process already in 2014. To date Dell has used nearly 50 million kg of recycled plastic in their products.In addition to long-term value maintenance, a closed-loop system generates significant environmental benefits. In 2015 Dell conducted a study which found that closed- loop ABS plastic resulted in avoided environmental costs of $1.3 million annually compared to the use of virgin ABS plastic. Accordingly, the natural capital net benefit of closed-loop ABS vs. virgin ABS was 44% (natural capital calculations include a range of environmental metrics, such as climate change, ecotoxicity, water pollution, respiratory effects, fossil fuel depletion, smog, air pollution and human health). According to the same study, avoided environmental costs would be $700 millions/per year if the entire computer sector would use recycled ABS instead of virgin ABS plastic.

What will the future look like?

It is evident that a quantum leap towards better design and material management is needed quickly. Given the important and manifold role of plastic in electronic/electrical products and the automotive industry, plastic use is not going to decrease. Fossil fuel-based plastic will gradually be phased out in parallel with increasing R&D and testing on bio- based plastic.

The first EU plastic strategy was implemented in early 2018, requiring 50% recycled plastic content in packaging material by 2025 and 55% by 2030. There could be a similar target for CEEE, which would speed up the market transition significantly.

In addition to a huge market potential, many interviewees mentioned customer demand as an important driver. No doubt this demand will only grow in the future.

“In the future there will be more demand from the consumers to have a circular economy in place for products. It will be a big movement in society.” – BODY BIKE International A/S.

Whilst the case studies in this report show enormous potential for developing design practices according to circular principles, the fact is that consumers, too, need to rethink their own consumption.

“If we want to move towards a circular economy, we need to radically think about our own consumption. It has been said that this is a materialistic era – on the contrary; our relationship with material is twisted. We don’t care to fix and if we don’t like the product we think that we can always do KonMari (a trend of getting rid of “stuff” at home). Back in the 70s we still repaired products. Recycling is not a solution, it is a last resort before incineration.” – Energy Authority.

In a similar vein, the rise of a sharing economy contributes to the consumer’s role: on one hand, sharing electrical/electronic equipment increases the use rate of a single product; on the other, increased use by multiple users calls for more durable products.

I'm happy to hear your thoughts on the text and how to take circular design in E&E forward in addition to the proposals we've suggested in the report.

You can access the full report here or read the concise version in ppt format below.

Writer: Anne Raudaskoski, Head of Consulting & Co-Founder of Ethica. Other Nordic team members in the report project are: Torben Lenau (Co-Author), Anna Velander Gisslén, Tapani Jokinen and Anna-Luise Metze.